Key Takeaways

No Cash Strain: You don’t have to pay the full cost of an expensive CNC/VMC machine upfront. Use a machinery loan to acquire the equipment and preserve your existing working capital for daily operations.

Two Main Paths – Loans vs. Leases: The decision is primarily between two options: a Machinery Loan (for immediate ownership) or a Machine Lease (for lower initial cost and flexibility).

Opt for Immediate Ownership: A machinery loan allows you to own the machine from day one, making it an immediate business asset. You repay the cost via EMIs.

Choose Flexibility and Low Initial Cost: A machine lease is ideal for businesses prioritising cash flow or looking to test new technology.

Prepare Your Finances: To secure financing quickly, ensure you have a healthy credit score. You will need comprehensive documentation.

Smart Business Loan Options to Finance a VMC or CNC Machine in India

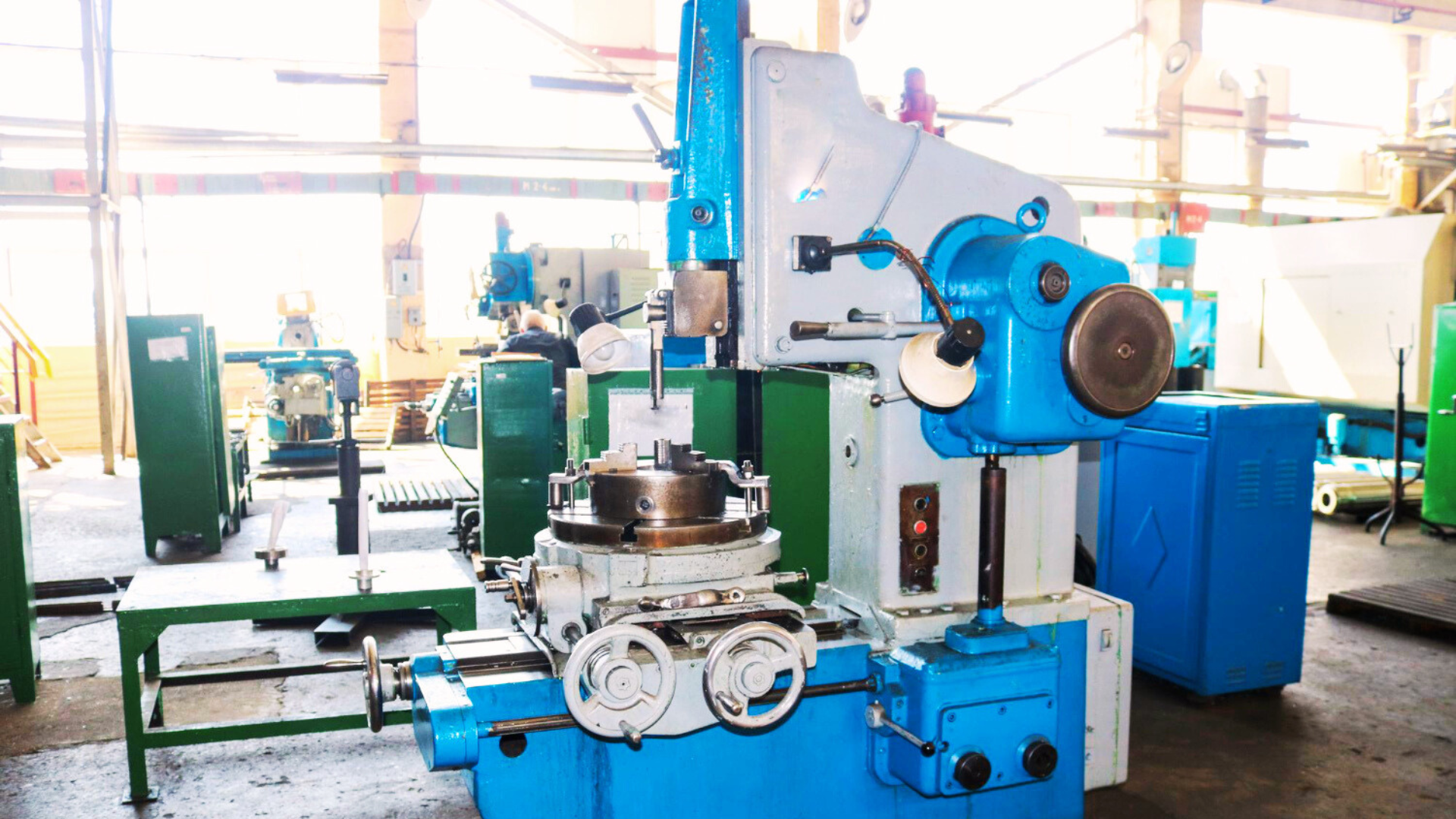

For many small and mid-sized manufacturers, expanding capacity or upgrading to advanced equipment like CNC (Computer Numerical Control) or VMC (Vertical Machining Centre) machines can feel overwhelming. You need modern machinery to stay competitive, but the upfront cost can easily run into lakhs, locking up working capital and delaying growth.

That’s where flexible machinery loan and leasing options are transforming how Indian businesses invest in technology to deliver efficiency. Instead of saving up for years or straining cash flow, you can now access the latest CNC technology without a heavy capital outlay through structured financing or lease-to-own models. Let’s explore why this approach is smarter, especially for MSMEs looking to modernise without compromising liquidity.

Why are CNC and VMC Machines Really Expensive Upfront

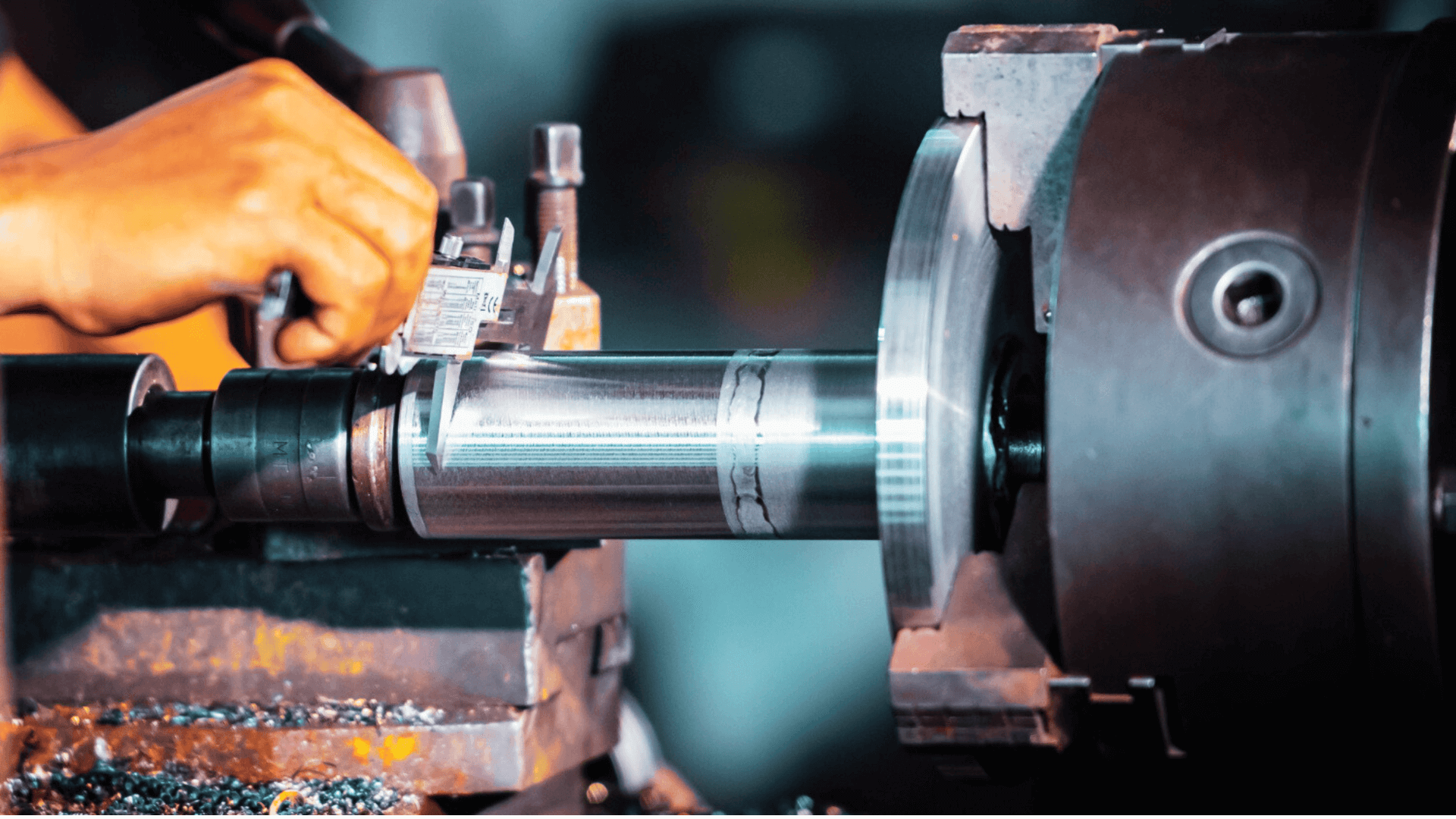

CNC and VMC machines have become indispensable in precision manufacturing, and their cost reflects their sophistication.

- Technology investment: Advanced automation, precision tooling, and digital interfaces drive up costs

- Import dependency: Many high-performance CNC and VMC units are imported, making pricing sensitive to exchange rates and duties

- High setup expenses: Installation, calibration, and operator training for the tech often add to the total cost of ownership

- Working capital strain: Paying for machinery outright can deplete reserves meant for raw materials, staff salaries, or other operating costs.

For many growing manufacturers, this creates a dilemma – whether to delay expansion of their workshops or compromise on technology. However, with solutions like CNC machine financing, that trade-off is no longer necessary.

Flexible Financing Options to Own a CNC or VMC Machine

Modern financing options make acquiring state-of-the-art equipment far more practical and cash-efficient.

1. Machinery Loan

A machinery loan allows you to purchase equipment outright while paying back the cost in easy instalments. You retain ownership from day one, and the machine becomes a long-term business asset.

With Electronica Finance Limited (EFL), businesses can avail quick machine loans with minimal documentation and flexible repayment options. You can align the EMIs with your cash flow cycles. This ensures you don’t disrupt working capital while scaling production capacity.

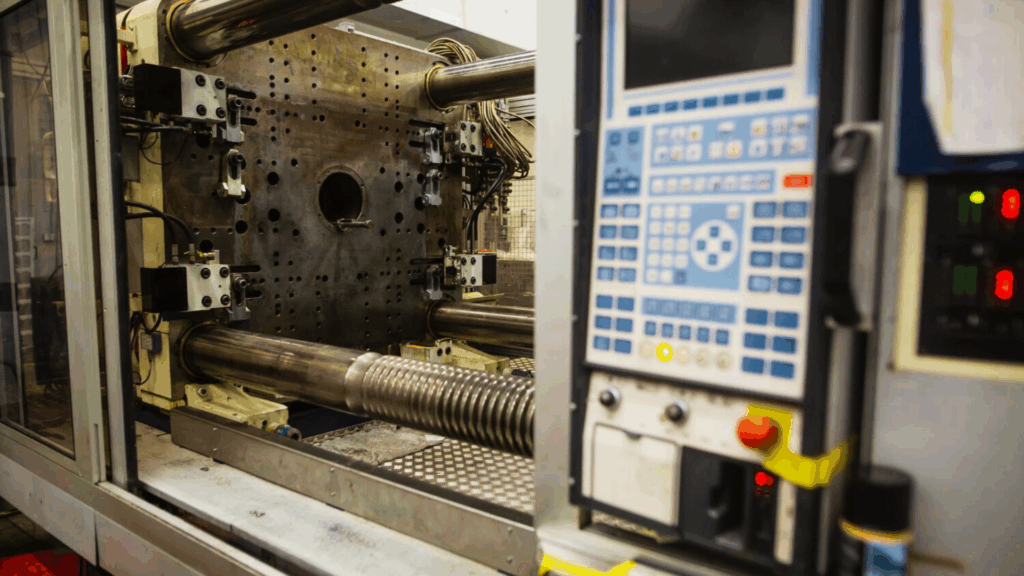

2. CNC or VMC Machine Financing

For those who prefer structured financing specific to manufacturing technology, CNC machine financing or VMC machine financing solutions help fund up to 75–90% of the equipment value. You get ownership gradually, while EFL’s tailored EMI plans help balance your capital expenses with operational growth.

These plans are especially valuable for MSMEs aiming to automate production or replace ageing equipment without a large upfront payment.

3. CNC or VMC Machine Lease

Another increasingly popular option is a CNC machine lease or VMC machine lease. Instead of purchasing, you lease the machine for a defined period, which is usually 3 to 5 years, paying regular instalments.

At the end of the lease term, you can either upgrade to a newer model, extend the lease, or opt for a lease-to-own CNC or VMC programme, transitioning ownership after the final instalment.

This approach offers flexibility, easier upgrades, and predictable budgeting, which is ideal for businesses seeking to keep pace with rapidly evolving technology.

How to Choose the Right Option for Your Business

Selecting between financing and leasing depends on your business’s financial strategy and long-term goals. If your priority is long-term asset building, a machinery loan or CNC machine financing plan works best. But if you’re testing new technology or prefer lower initial costs, CNC or VMC machine lease options offer practical flexibility.

Here’s how to evaluate:

| Criteria | Machinery Loan | CNC/VMC Lease |

| Ownership | Immediate ownership | Ownership only at the end of the lease (in case of lease-to-own) |

| Upfront Cost | Higher (usually requires a down payment) | Lower or zero down payment |

| Tax Benefits | Depreciation benefits | Lease rentals may be tax-deductible |

| Flexibility | Limited, once purchased | Easier to upgrade or replace |

| Ideal For | Businesses seeking asset ownership | Businesses prioritising cash flow and flexibility |

How to Secure a Machine Loan?

To start with, assess your requirements. Your accuracy in ascertaining the optimal equipment for your business needs will help you financially. From there, you can follow these simple steps and keep the required documents ready.

Need to get new cutting-edge machinery?

–>

Ensure your credit score is healthy

–>

Apply for an easy and reliable machinery loan from EFL

–>

Collect and keep the required documents ready

–>

Receive the approved loan within three working days

Documents Required

- Three years’ balance sheet and ITR

- 12 months’ bank statements of all bank accounts

- GST returns for the current year

- KYC – Aadhar & PAN

- Residence and factory ownership proof

- Proforma invoice/quotation

- 12 months’ electricity bills

With easy machine loans from EFL, you get higher output, quicker delivery timelines, and stronger profitability, without compromising liquidity.

Conclusion

In today’s manufacturing landscape, agility matters as much as capability. With options like CNC machines, VMC machines, and machinery loans, Indian MSMEs can upgrade equipment, boost efficiency, and stay future-ready—all without a heavy capital burden.

If you’re considering your next machinery investment, explore flexible financing options through Electronica Finance Limited’s tailor-made solutions.

Get started easily with the EFL Clik App today!

FAQs

1. What financing options are available for CNC or VMC machines?

You can opt for a machinery loan, CNC or VMC machine financing, or a CNC/VMC machine lease. Each offers flexible repayment terms, quick approvals, and minimal documentation through lenders like EFL.

2. How does a CNC machine lease differ from a traditional purchase?

In a lease, you pay for machine usage over a fixed term rather than buying it outright. It often includes maintenance support and allows for upgrades, making it ideal for businesses that want flexibility without locking capital.

3. Are there government subsidies or MSME schemes for machinery purchase in India?

Yes. MSMEs may be eligible for government-backed credit guarantee schemes or subsidised interest loans under initiatives like the CGTMSE or PMEGP, depending on eligibility. Always check the latest policies or consult with your lender for updated options.