How Machinery Loans Can Boost Manufacturing Efficiency for MSMEs

In today’s manufacturing landscape, efficiency is vital. It directly decides margins, delivery timelines, and how competitive a business can remain when input costs are rising and customers expect faster turnaround. Many manufacturers know their productivity is being held back, but large capital requirements often delay equipment upgrades. Structured financing options, such as a well-planned machinery loan, allow manufacturers to modernise without draining cash reserves, helping productivity improve steadily rather than in disruptive bursts. When financing supports machinery upgrades, efficiency gains become achievable and sustainable instead of aspirational.

Why MSME Manufacturing Efficiency Depends on Modern Machinery

Impact of Outdated Equipment

Outdated machinery slows production in ways that are not always obvious at first to MSMEs (micro, small and medium enterprises). Frequent breakdowns disrupt schedules. Manual adjustments increase errors. Maintenance costs quietly rise month after month. Over time, manufacturers end up spending more to produce less. These inefficiencies affect order fulfilment, workforce utilisation, competitiveness, and customer trust.

Benefits of Advanced Machinery

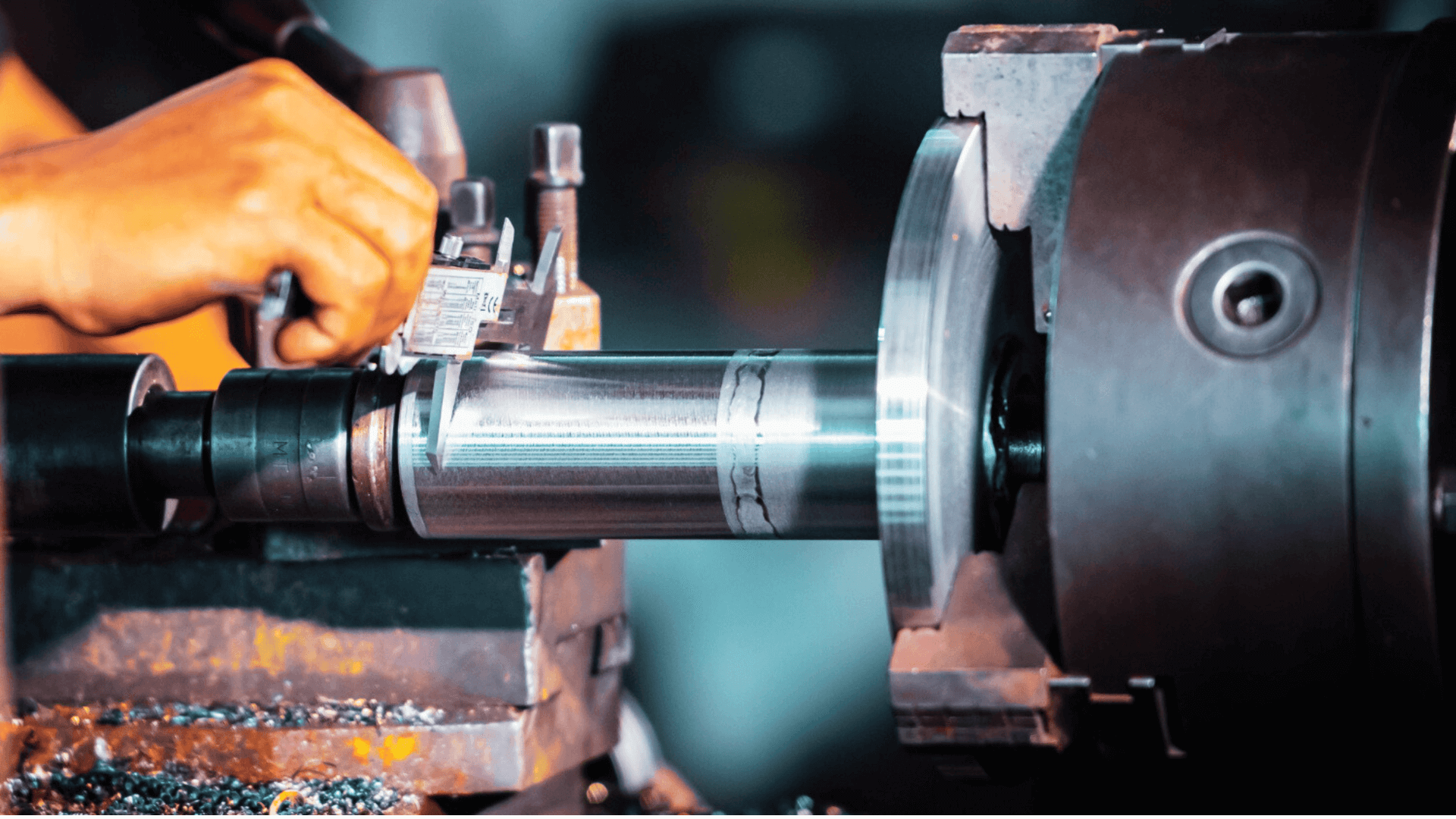

Modern machinery changes this equation. Automated processes reduce dependency on manual intervention. Precision controls deliver consistent output. Advanced machines also integrate better with digital systems, improving monitoring and quality checks. This is why manufacturers investing in CNC machine financing or VMC machine financing often see immediate improvements in throughput and product uniformity.

How Machinery Loans and Equipment Loans Help in Upgrading Manufacturing Efficiency

Increased Production Capacity

A machinery loan enables businesses to scale capacity without waiting years to accumulate capital. Instead of turning down orders or running machines beyond optimal limits, manufacturers can add capacity when demand rises. This approach allows growth to happen in real time, not retrospectively.

Reduced Operational Downtime

New machines break down less frequently and are easier to maintain. With CNC machine lease or VMC machine lease options, businesses can even upgrade periodically, ensuring technology remains current. Reduced downtime keeps production schedules predictable and reduces the hidden cost of idle labour.

Improved Product Quality and Consistency

Precision-driven equipment improves tolerances and repeatability. This reduces rework, scrap, and customer complaints. Manufacturers using CNC machine financing often report better batch consistency, which strengthens long-term client relationships and lowers quality-control expenses.

Cost Optimisation Over Time

Although modern machines cost more upfront, they save money over time. Energy efficiency lowers utility bills. Automation reduces overtime expenses. Fewer breakdowns mean lower repair costs. With the right machinery loan, these savings start offsetting EMIs far sooner than many manufacturers expect.

Financial Advantages of Using Machinery Loans to Improve Manufacturing Technology

Preserves Working Capital for Business Operations

Using internal funds for large equipment purchases can strain daily operations. A machinery loan keeps liquidity intact, ensuring funds remain available for raw materials, payroll, and logistics. This balance is especially important for manufacturers managing seasonal demand cycles.

Flexible Repayment and Tenure Options

Machinery financing structures allow EMIs to align with production cycles. This flexibility makes manufacturing equipment financing far more manageable than lump-sum purchases. When repayments match cash inflows, financial stress reduces significantly.

Tax Benefits on Machinery Financing

Interest paid on equipment loans and depreciation on machinery are generally treated as business expenses. These benefits improve net profitability while supporting long-term asset growth. This makes equipment loans for manufacturers a financially efficient route to expansion.

Machinery Loans vs Using Internal Funds As Financing Options for MSMEs

When manufacturers plan a machinery upgrade, the real decision is not about whether to invest, but how to fund it without putting operational stability at risk. Comparing machinery loans with internal funding highlights how each approach affects cash flow, risk exposure, and the pace at which productivity gains are realised.

| Decision Factor | Using Internal Funds | Using a Machinery Loan |

| Working Capital Availability | Significant upfront cash outflow limits day-to-day operations | Working capital is preserved for materials, payroll, and growth needs |

| Financial Risk | Higher vulnerability to delays in payments or unexpected expenses | Risk is spread over time through structured repayments |

| Speed of Machinery Upgrade | Often delayed until surplus is available | Enables immediate upgrade and faster productivity gains |

| Impact on Cash Flow | One-time outflow can disrupt monthly stability | Predictable EMIs aligned with business cash flow |

| Ability to Scale Production | Expansion is gradual and constrained by cash reserves | Capacity scales faster as machines start generating revenue |

| Return on Investment (ROI) | ROI begins only after full capital deployment | ROI starts while repayments are ongoing |

Conclusion

Manufacturing efficiency improves when equipment, finances, and strategy work together. Modern machinery reduces downtime, enhances quality, and lowers long-term costs, but financing determines how quickly these benefits can be realised. A structured machinery loan transforms upgrades into a planned investment rather than a financial burden. Manufacturers willing to align machinery upgrades with smart financing decisions position themselves for steady productivity gains and stronger margins.

To explore structured financing options designed for manufacturers, visit the Machine Loan page or access quick solutions through the EFL Clik App.

FAQs

How do machinery loans help improve manufacturing efficiency?

Machinery loans enable manufacturers to upgrade equipment without delaying investments, leading to higher output, fewer breakdowns, and improved product consistency.

Are machinery loans suitable for small manufacturing businesses?

Yes. Many lenders offer machine finance options for MSMEs, making upgrades accessible even for smaller operations.

Can machinery loans be used for automation and technology upgrades?

Absolutely. Financing supports automation, precision tooling, and energy-efficient machinery that improves overall productivity.

Do machinery loans offer tax benefits for manufacturers?

Interest expenses and depreciation on financed machinery are generally tax-deductible, improving cost efficiency over the loan tenure.