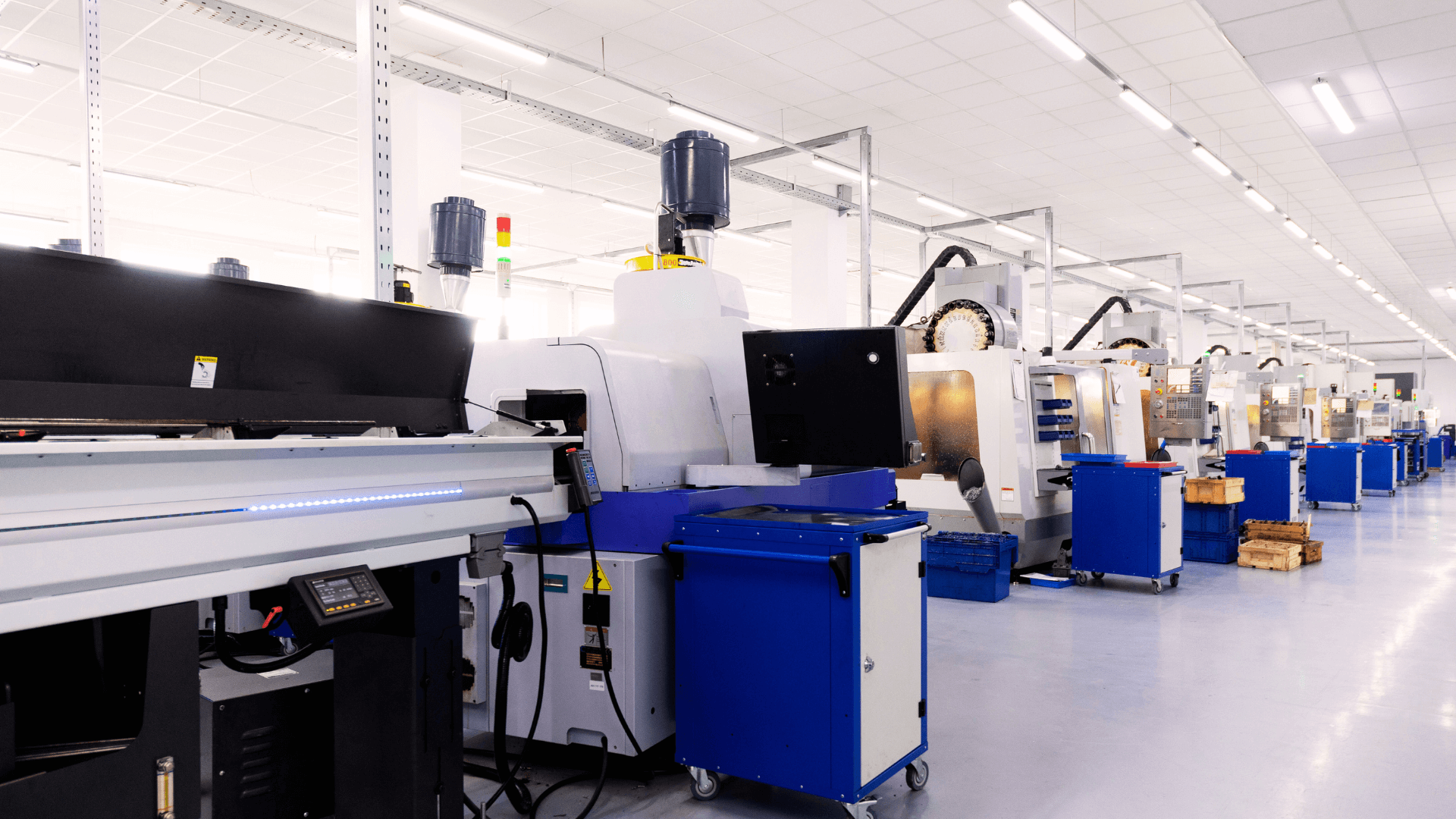

As a small business in manufacturing, your machinery plays a critical role in your business growth, productivity, safety, and long-term success. Over time, however, older equipment can hinder your operations rather than help them. In this blog, we’ll explore five clear signs that it’s time to upgrade your machines. Here is some actionable advice on how a machinery loan, with minimal collateral required, can be your best option to maintain healthy cash flow while making the upgrade.

Table of Contents

- Frequent Breakdowns and Repair Costs Are Adding Up

- Declining Productivity and Output Quality

- Compatibility Issues with New Technologies

- Rising Energy Consumption and Operating Costs

- Safety Concerns and Compliance Risks

- The Business Benefits of Upgrading Your Machines

- How to Afford New Equipment Without Breaking the Bank

- Machinery Loans

- Leasing vs. Buying

- Government Grants and Tax Incentives

- Trade-in Programs

- Final Thoughts

- FAQs

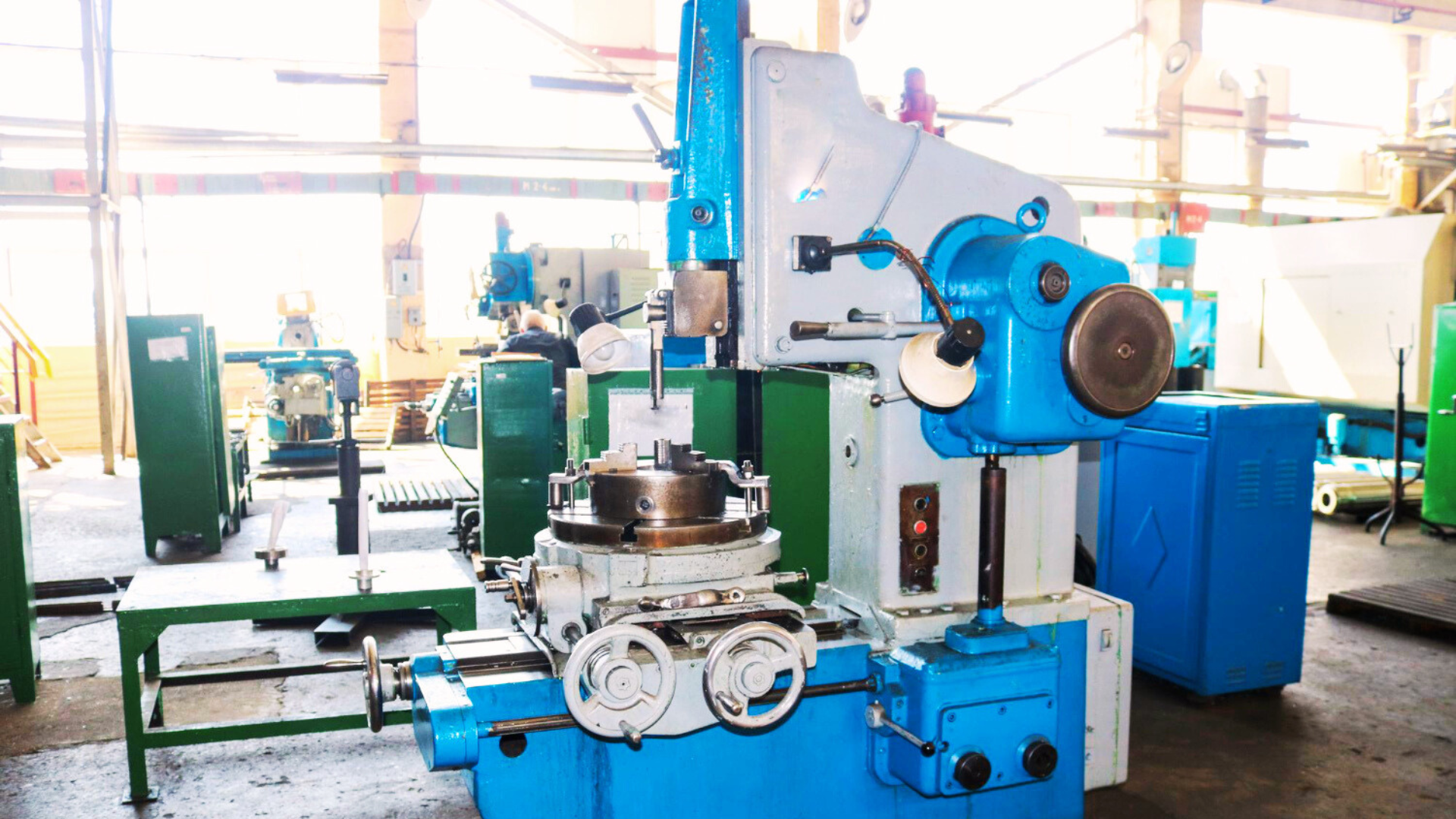

Frequent Breakdowns and Repair Costs Are Adding Up

If your machines are constantly breaking down or requiring repairs, it’s a strong indicator that they are no longer operating effectively. While repair costs might seem manageable at first, they quickly add up, affecting your bottom line. If maintenance bills exceed 5-6% of the machine’s value annually, it’s time to consider a replacement. New machinery experiences fewer breakdowns. This minimises costly downtimes, ensures more efficient operations, and directly supports your business requirements.

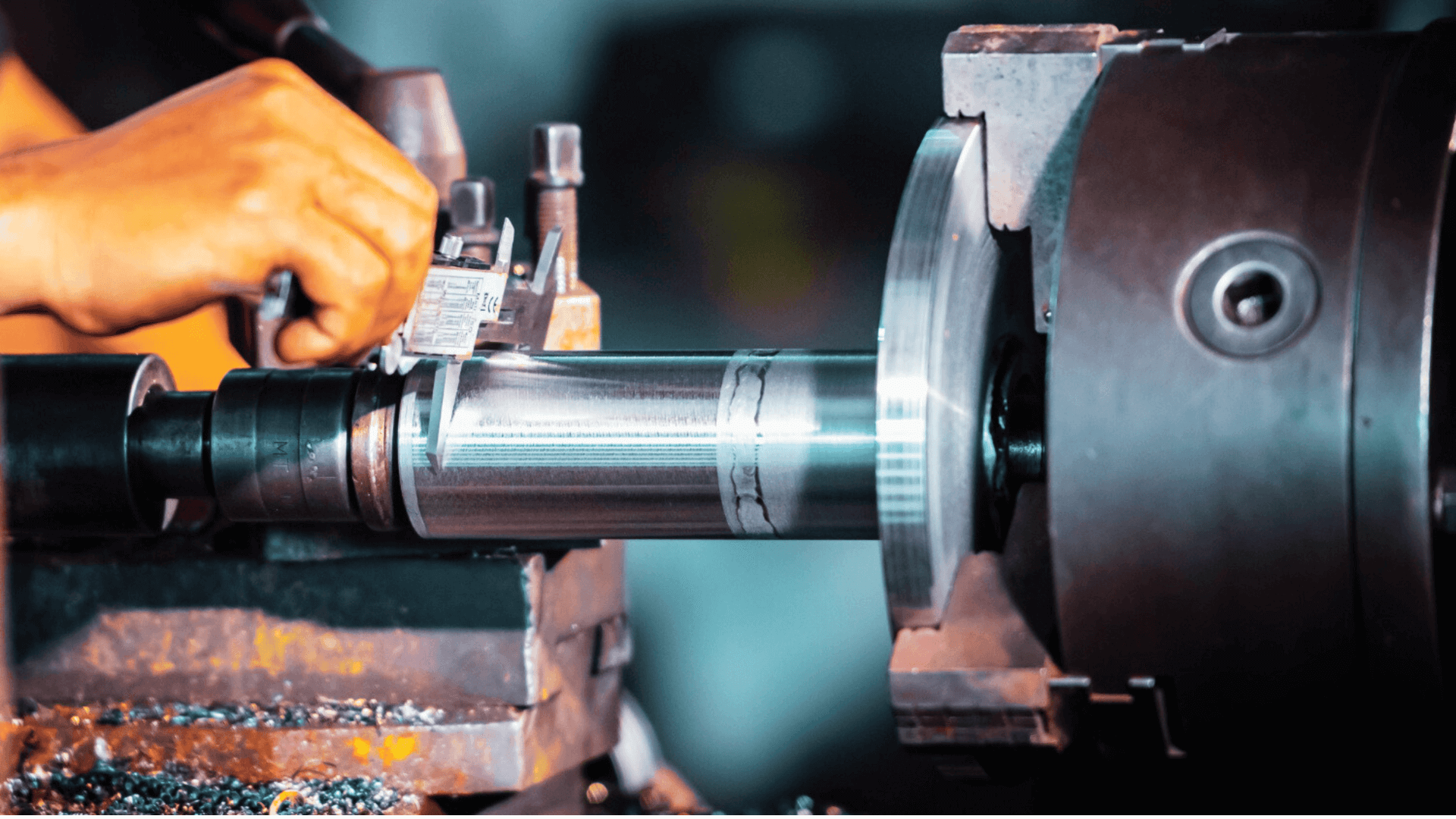

Declining Productivity and Output Quality

Ageing machinery often slows down production speed, which directly impacts business growth and your ability to meet customer demand. The decline is even more pronounced if the equipment is not maintained properly. Additionally, older equipment can lead to inconsistencies in product quality, which can lead to defects and customer dissatisfaction. If you’re noticing a decrease in speed, accuracy, or consistency, upgrading to better machinery can help. Upgrading machinery with a machine loan helps maintain high standards and supports business growth.

Compatibility Issues with New Technologies

Staying up-to-date with technological advancements is crucial for a successful business. Older machines may no longer meet business needs, as they can’t integrate with newer software or automation tools. Choosing the right machinery ensures better compatibility with modern systems and makes it easier to meet evolving business needs. Upgrading to new equipment improves your business assets and helps you stay competitive with smooth, efficient business operations.

Rising Energy Consumption and Operating Costs

Older machinery is often less energy-efficient, and it causes higher operating costs. With rising energy prices, running outdated equipment can significantly impact your profits. In contrast, modern machines, in most domains, are designed with energy efficiency in mind. Investing in equipment that meets current industry standards ensures better performance and sustainability. By opting to purchase new machinery, you can lower energy costs, improve your small business’s sustainability, and maintain healthy working capital.

Safety Concerns and Compliance Risks

Old machinery may no longer meet updated safety standards or regulations and eventually put your employees and your business at risk. Non-compliant equipment can result in workplace accidents or legal issues.

Newer machines are built with safety features that help protect workers and ensure your business adheres to the latest safety regulations. Investing in upgraded equipment is an investment in both your employees’ well-being and your company’s future. Business owners can apply for a machine loan to cover the costs of upgrading to safer, more efficient machinery and ensure compliance with modern regulations.

The Business Benefits of Upgrading Your Machines

Upgrading your machinery brings several key business benefits that can positively impact your operations. The most important of these is Return on Investment (ROI). While the initial cost of new machinery can seem daunting, the long-term benefits far outweigh the upfront expense.

Increased Output: Contemporary machines are faster and more efficient. This means your business can meet growing customer demands without increasing labour costs.

Efficiency Gains: New equipment is typically more reliable and requires less maintenance. The faster turnaround times it provides can help you scale operations more effectively and result in greater productivity at lower costs.

Staying Competitive: By investing in advanced machinery, you’re positioning your business ahead of competitors who are using outdated equipment. Offering higher-quality products and faster delivery times ensures you can retain customers and attract new ones.

How to Afford New Equipment Without Breaking the Bank

Upgrading your machinery might seem like a major financial hurdle, but it doesn’t have to be. Here are some effective ways to finance your new equipment:

Machinery Loans

Machinery loans are designed to help businesses finance new equipment. These loans often offer flexible repayment terms and competitive interest rates, making it easier to upgrade without draining your cash reserves. Business owners can easily avail a machinery loan by meeting the eligibility criteria set by lenders.

Flexible Repayment Period: 3-5 Years

Leasing vs. Buying

If purchasing new equipment outright isn’t feasible, consider leasing. Leasing allows you to use the machinery for a fixed term while making smaller, manageable payments. It’s a great way to access high-quality equipment without committing to the full purchase price.

Government Grants and Tax Incentives

Many governments offer grants or tax incentives for businesses that invest in energy-efficient machinery. Check if you’re eligible for any such programs that could reduce your upfront costs.

Trade-in Programs

Some equipment suppliers offer trade-in programs where you can exchange your old machinery for a discount on new equipment. This can significantly reduce the amount you need to finance.

For business owners, applying for a machinery loan or a business loan can be expedited by maintaining a strong credit history and credit score. A solid financial track record ensures better terms for the loan amount and supports overall financial health, making it easier to secure favourable financing.

Final Thoughts: Invest in Efficiency, Safety, and Future Growth with a Machinery Loan

Upgrading your machinery is an investment in your business. With enhanced productivity, reduced maintenance costs, and improved safety standards, the benefits of upgrading will pay off in the long run. Don’t let outdated machines hold you back. Use financing options like equipment loans, leasing, and government incentives to make the process more affordable.

The loan application process with EFL is simple, and the EFL Clik app streamlines your journey, helping you meet eligibility requirements for quick loan approval. By taking action now, you’ll boost your business and secure its future, staying competitive in an ever-evolving market.

FAQs

Why is it important to upgrade equipment?

Upgrading your equipment is crucial to match current industry standards and ensure your business remains competitive. By investing in equipment to increase productivity, you improve efficiency, reduce maintenance costs, and enhance product quality. When it comes to machinery, upgrading ensures you have the latest technology.

What three things can you do regularly to keep the machines working well?

To ensure your machinery runs efficiently, here are three key practices:

- Perform routine maintenance and cleaning

- Check for wear and tear, and fix issues early

Calibrate and update software to maintain accuracy