Acquiring advanced machinery and equipment can significantly reduce upfront capital expenditure for MSMEs and bring in automation and efficiency. While it is a key ingredient in business growth, limited funds often remain a challenge for many MSMEs.

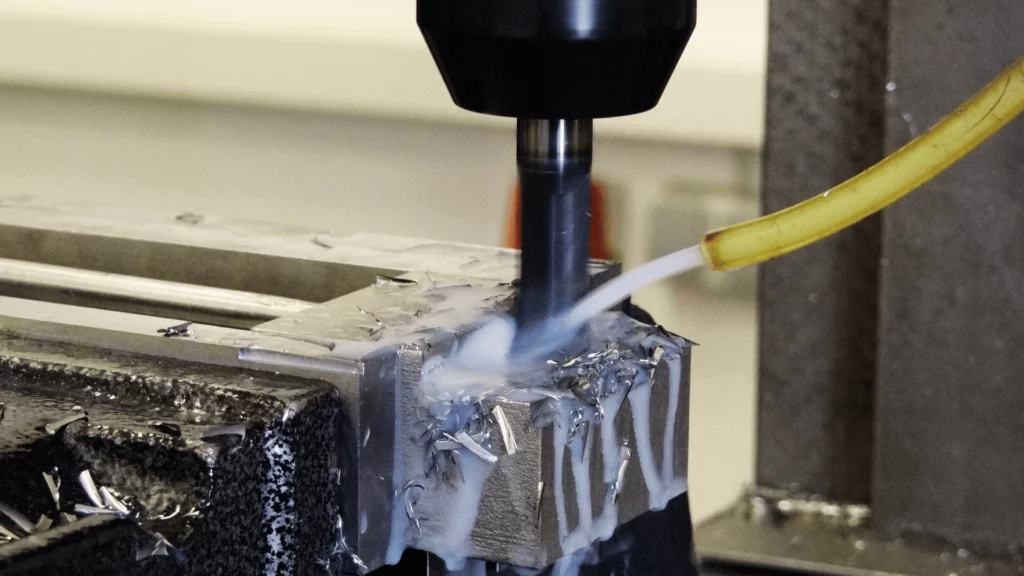

Equipment finance provides a practical way to acquire essential machinery, such as second-hand CNC machines, excavators, or other industrial equipment, without straining working capital. Understanding the available financing options, from equipment loans to lease agreements, helps you compare benefits, eligibility criteria, and repayment terms to choose the solution best suited to your business needs.

Different Types of Equipment Finance and Used Machinery Loan Options

When financing used machinery, you have several options tailored to different financial needs.

Equipment Loan

An equipment loan allows you to purchase machinery by borrowing funds from a lender, with the equipment itself serving as collateral. The convenient repayment terms simplify budgeting. With a tenure of up to five years and loan amounts up to ₹3 Crore, this financing option helps businesses acquire heavy machinery required for construction and manufacturing without depleting working capital.

Lease Agreements

Leasing equipment provides an alternative to purchasing. Leases allow you to use machinery for a set period and return it at lease-end, while hire purchase agreements combine leasing with eventual ownership. Equipment leases typically involve lower monthly payments, preserving cash flow.

Machinery Loan from NBFCs

Non-Banking Financial Companies (NBFCs) offer specialised machinery loan options with fast approvals. You can secure a loan as fast as within three working days. These lenders offer financing terms tailored to industries such as engineering, plastics, textiles, and food packaging.

Business Loan for Equipment

An unsecured business loan offers the flexibility to fund equipment without collateral. This approach proves to be the most comfortable, albeit a little pricey. You can leverage a convenient unsecured business loan even online.

Key Factors to Consider When Choosing Equipment Finance

Before obtaining a loan for used machinery, you should evaluate these critical factors to ensure the financing aligns with your business requirements.

Eligibility Criteria

Lenders assess your creditworthiness. A bureau score above 700 improves approval chances greatly. Most require at least one owned business premises and a minimum business vintage. Startups may face stricter eligibility requirements.

Loan Terms and Repayment

Equipment finance offers repayment terms of 24 to 60 months, allowing you to align loan payments with the new, improved revenue. Interest rates vary by lender, equipment value, equipment age, and the borrower’s credit profile. Compare term loans from multiple financial institutions to secure favourable terms and lower financing costs. Interest rates typically range from 10-18% p.a., although the Loan-to-Value (LTV) ratio is relatively lower for used equipment.

Collateral Requirements

Most equipment financing options use the machinery itself as collateral, eliminating the need for additional security. This hypothecates the purchased equipment to the lender until full repayment. The agreement specifies your debt obligations and the consequences of default.

Equipment Finance vs Business Loan: Which Is Better?

Choosing between equipment finance and a business loan depends on your specific needs and financial situation.

| Factor | Equipment Finance | Business Loan |

| Purpose | Machinery and equipment only | Any business needs |

| Collateral | Equipment itself | May require property/assets |

| Loan Amount | Based on equipment value | Based on business financials |

| Tenure | Up to 5 years | Typically shorter |

| Tax Benefits | Depreciation + GST input credit | Standard deductions |

Equipment finance works best when you need specific machinery to upgrade operations or improve productivity. The equipment serves as security, making approval easier even with moderate credit scores. Business loans offer greater flexibility but may involve higher interest rates and stricter eligibility criteria for unsecured options.

Construction companies and manufacturers typically prefer equipment financing because it preserves working capital while providing favourable terms for essential equipment purchases.

They also leverage the depreciation and GST input tax credit to reduce the effective cost of equipment purchases.

How to Acquire Construction Equipment and Heavy Machinery

Construction businesses needing heavy machinery like excavators, bulldozers, and cranes can streamline acquisition through these steps:

Evaluate Requirements: Assess the age and type of equipment needed and determine whether buying or leasing suits your project duration and utilisation.

Compare Lenders: Research equipment financing options from banks, NBFCs, and other suppliers. Seek competitive rates and flexible repayment. Some manufacturers offer vendor financing as well.

Prepare the Documentation: Gather KYC documents, financial statements, GST returns, and proforma invoices.

Align Finances: Calculate how using the equipment improves efficiency and productivity in your business. Ensure EMIs match project revenue to maintain cash flow and grow your business sustainably.

Conclusion

Understanding different types of equipment finance helps you acquire used machinery without straining working capital. When choosing an NBFC equipment loan, lease, or machinery loan, evaluate eligibility criteria, loan terms, and interest rates to find the right fit. For flexible equipment financing options from Electronica Finance Limited, explore the EFL Click App.

FAQs

Which financing option is best for used machinery?

The best option depends on your specific business priority:

- For Ownership: An equipment loan is ideal, offering up to ₹3 Crore with tenures up to 5 years, using the machinery itself as collateral.

- For Speed: NBFC machinery loans are best for urgent needs, with approvals as fast as three working days.

- For Cash Flow: Lease agreements provide lower monthly payments and preserve working capital.

- For No Collateral: An unsecured business loan is suitable if you prefer not to hypothecate the asset, though interest rates may be higher.

Is a business loan better than equipment financing for used machinery?

It depends on your goal. Equipment Financing is generally better for acquiring machinery because it uses the asset as collateral, offers longer tenures (up to 5 years), and provides specific tax benefits like Depreciation and GST input tax credit.

Does used machinery financing require collateral?

In most cases, no additional collateral is required. Under standard equipment financing, the used machinery itself acts as the security (hypothecation).