When a business grows, it often hits a point where manual processes or ageing equipment can no longer keep up with rising demand. Efficiency depends heavily on the quality of your machines. Yet, buying modern equipment outright is no small expense, as it can tie up working capital and slow down day-to-day operations.

In situations like these, machinery loans are the answer. Businesses can invest in modern equipment without disrupting cash flow. This can give them the technological edge to stay competitive. In fact, for many enterprises, the availability of equipment financing solutions from reliable machinery loan providers is the difference between stagnation and sustainable growth.

What is a Machinery Loan?

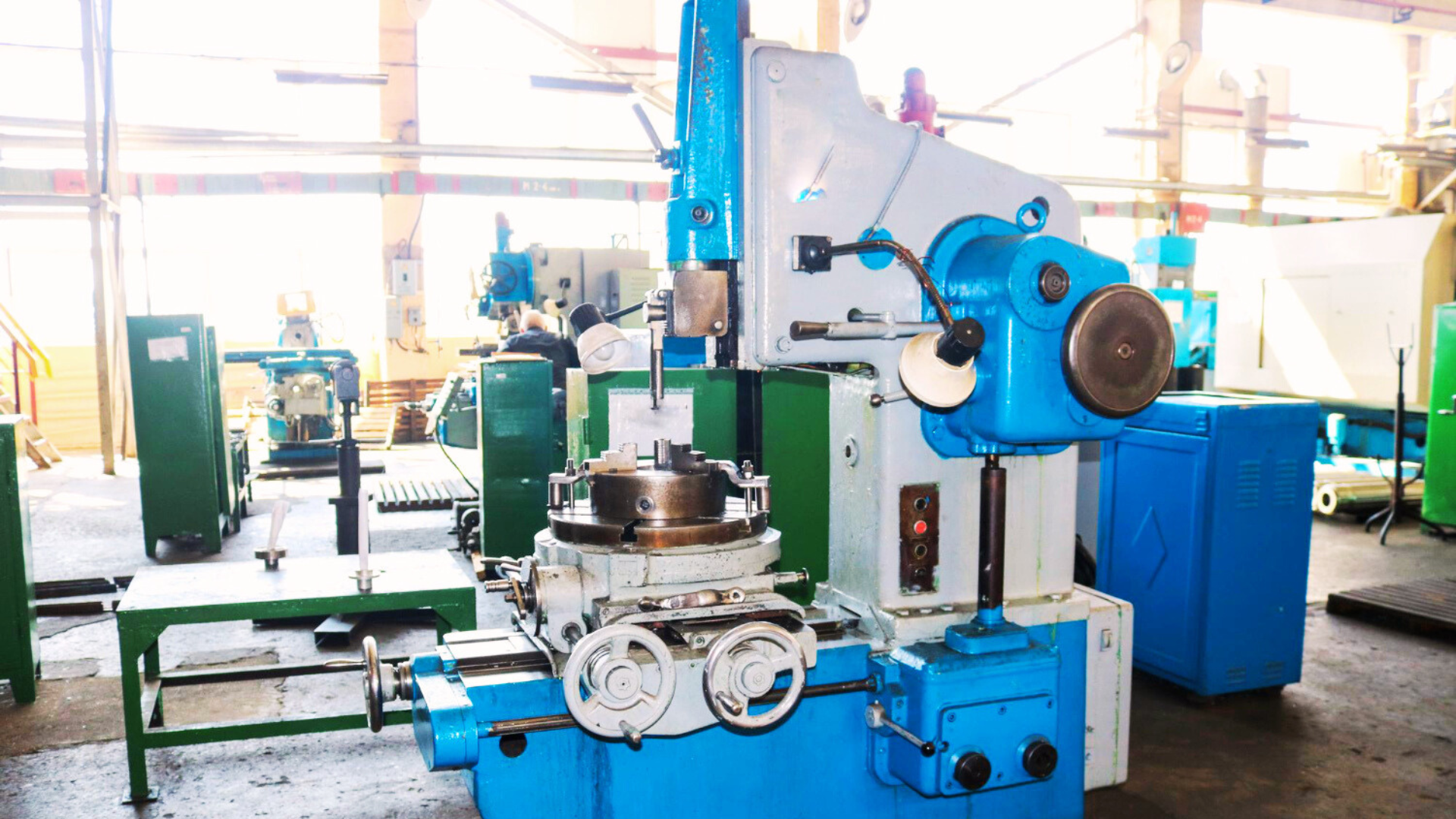

A machinery loan is a type of business financing designed specifically for the purchase, upgrade, or repair of machinery. Unlike a general business loan, it focuses on capital investment in equipment, whether it’s CNC precision machines, industrial mixers, injection moulding equipment, or printing presses.

With Electronica Finance Limited (EFL), these loans are structured to help businesses acquire machines without exhausting working capital. Loan amounts typically cover a large portion of the machine cost, allowing enterprises to spread repayments over flexible tenures. This ensures that businesses can align repayments with revenue generated from the use of the equipment.

A machine loan can help you pay for machinery as it starts generating returns for your business – a practical way to grow without overburdening cash reserves.

Why Do Businesses Need Equipment Loans?

Indian industries are diverse, but they face similar challenges when it comes to machinery. Outdated equipment often means slower production, higher wastage, and lower product quality, all of which erode competitiveness.

- Staying competitive and increasing productivity – Newer machines often deliver better output, reduced cycle times, and superior accuracy. A loan helps businesses acquire them quickly.

- Reducing downtime and maintenance costs – Old machines often break down, leading to production delays. A timely upgrade avoids hidden costs.

- Meeting bulk orders with ease – If you receive a large order from a client, the ability to scale up quickly through machine upgrades can make or break the deal.

- Complying with quality standards – Sectors like pharmaceuticals and food processing are governed by strict quality norms. Investing in advanced machinery ensures compliance and reduces the risk of rejection.

- Freeing up working capital – Opting for a loan instead of paying upfront can help businesses keep cash available for salaries, raw materials, and day-to-day operations. Instead of exhausting reserves on a one-time payment, loans allow businesses to allocate funds smartly.

- Customised financing – Based on the eligibility criteria, loan amounts and tenures can be tailored to suit the machine cost and business cash flows.

- Tax benefits – Interest paid on machinery loans for business is often tax-deductible, which adds to the financial advantages.

For many SMEs in India, a machinery loan is more a necessity than a luxury to keep the business relevant in a competitive landscape.

Use Cases Across Industries for Machinery Finance

One of the strongest reasons to consider equipment finance to purchase new machinery is its versatility across sectors. Different industries have different machinery needs, but the role of finance remains the same – bridging the gap between business objectives and affordability.

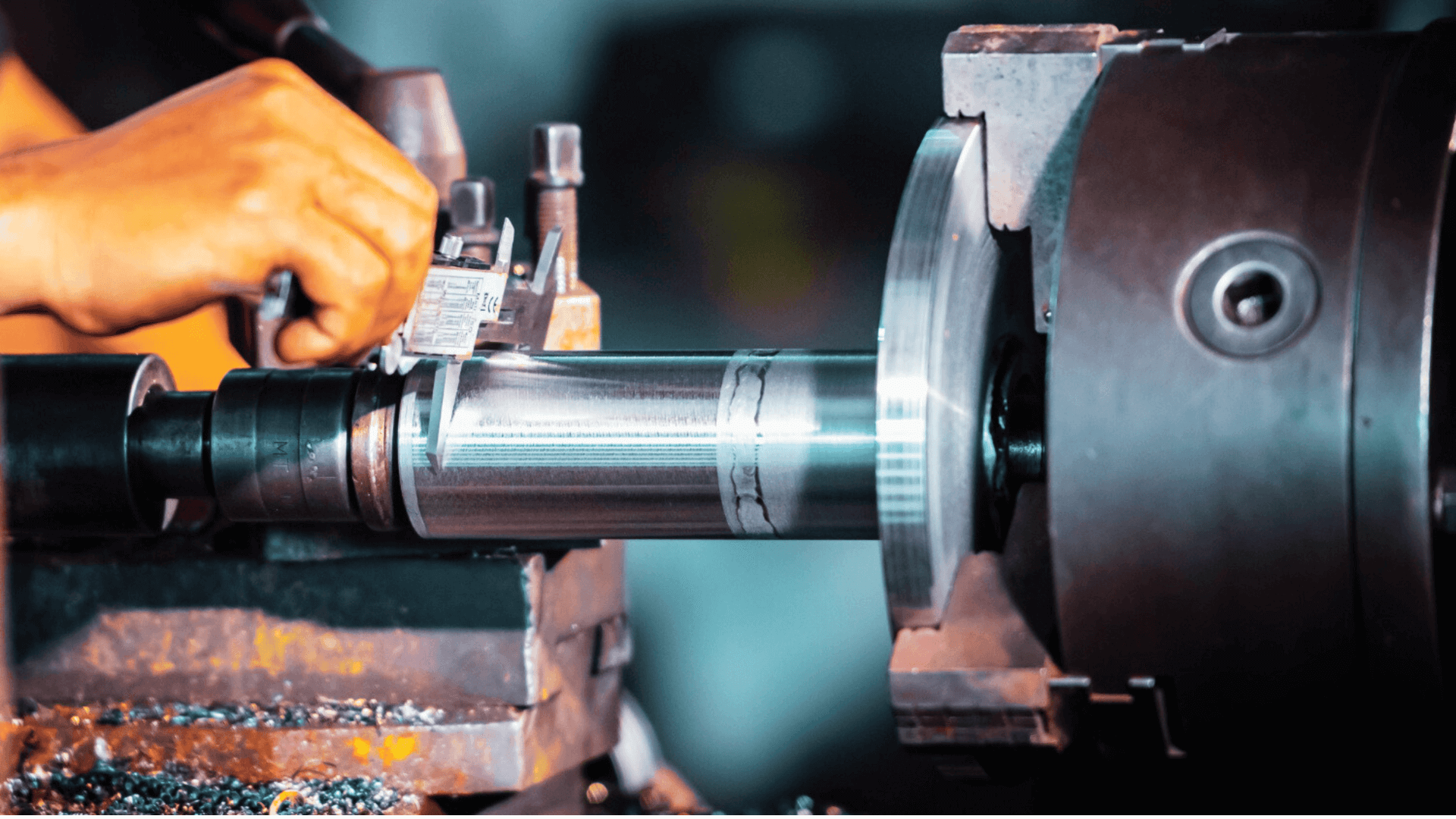

- Manufacturing – Manufacturing companies use CNC machines, lathe machines, welding equipment, and fabrication units. For example, an auto-component manufacturer may use machinery finance to add new CNC units and double its production speed.

- Textiles and Garments – This sector includes power looms, embroidery machines, and stitching units. For a growing apparel exporter, quick access to machine loans can mean scaling production ahead of festive or export seasons.

- Food Processing – Food processing companies use grinders, mixers, and packaging machines to scale operations. With India’s food industry booming, upgrading to modern and hygienic machinery helps businesses meet safety and export standards.

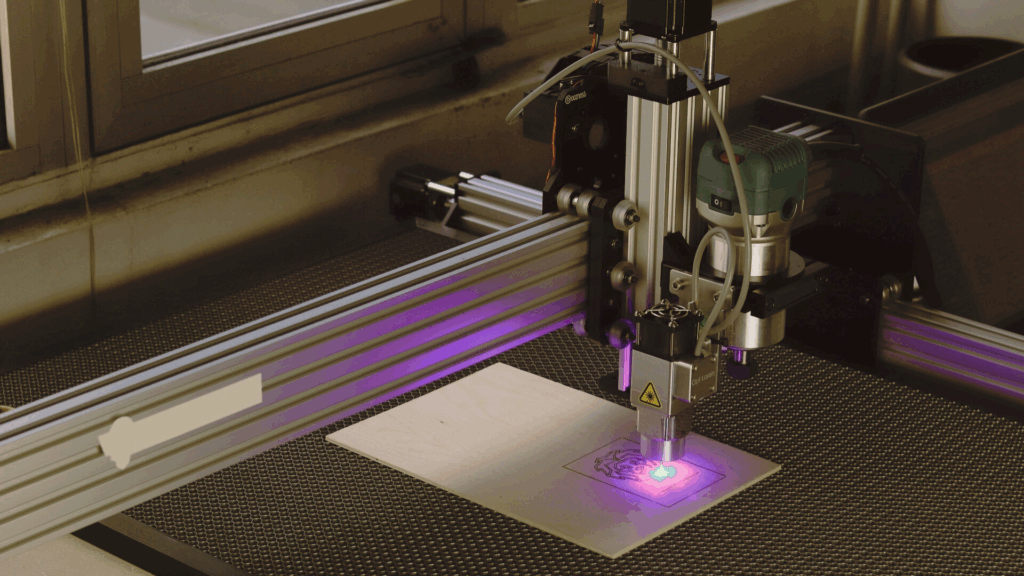

- Printing and Packaging – The industry commonly requires offset printing machines, digital printers, and packaging lines. A printer may invest in new digital printers to fulfil both bulk and custom orders profitably.

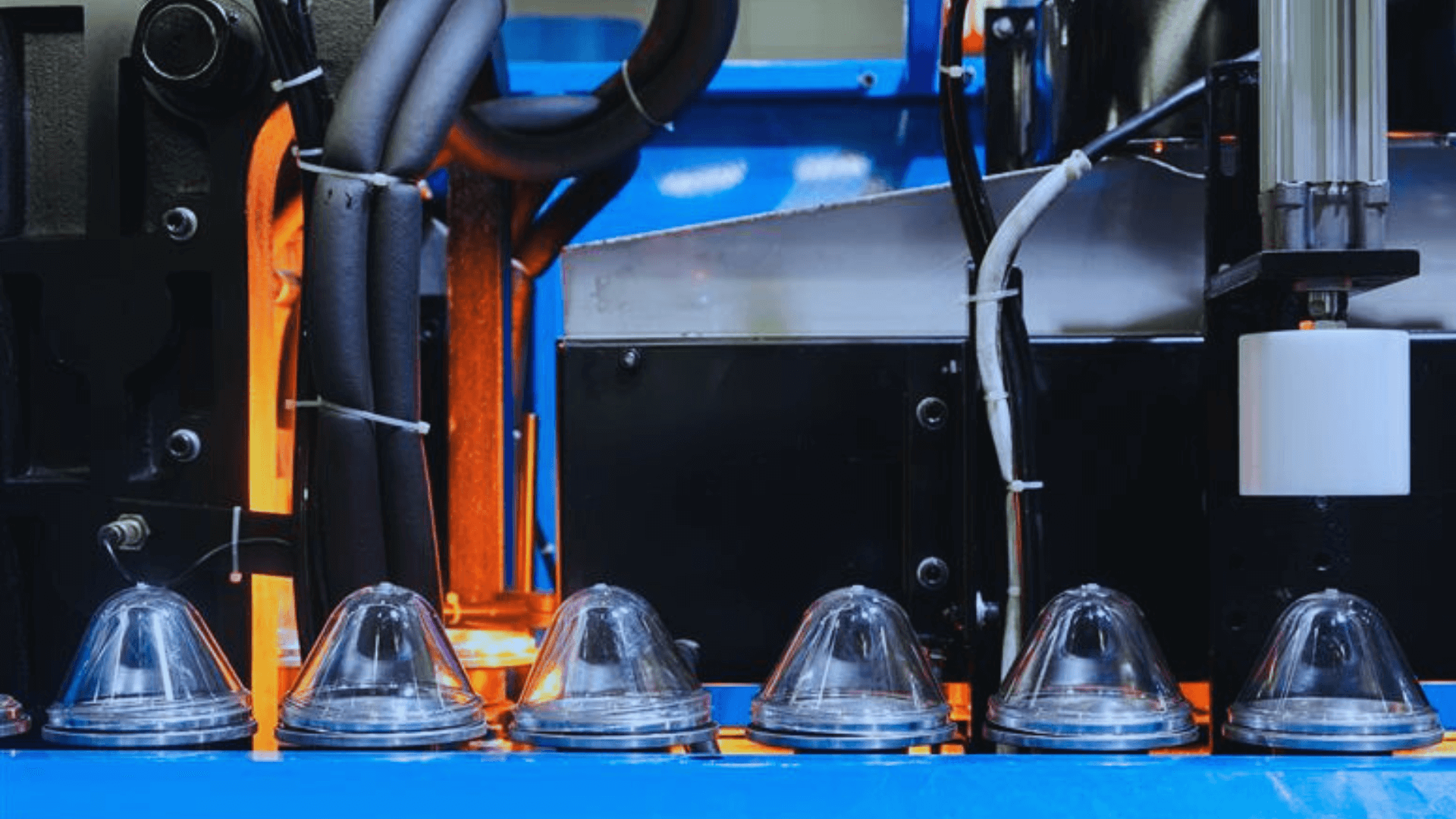

- Plastics and Moulding – Equipment like injection moulding and blow moulding machines is a staple of the plastics industry. Entrepreneurs in this sector often rely on loans to install advanced, energy-efficient models that cut down electricity costs.

These scenarios show that whether you’re in a traditional sector like textiles or a modern one like plastics, the need for finance is universal.

Machinery Loan vs Equipment Leasing

At first glance, new equipment leasing may seem like a cheaper alternative to machinery loans. However, both have their place, and the choice depends on business goals.

· Ownership – A machinery loan gives you complete ownership once repayments are done, turning the machine into a lasting business asset. Leasing only gives you temporary access, with no asset to show at the end.

· Long-term value – Buying with a loan helps you create equity in your business. Leasing suits companies that need equipment only for a short project or industries where technology changes too quickly.

· Cost of financing – Leasing might feel lighter in the beginning, but monthly instalments can add up over time. Loans are typically more economical if the machine will be in use for several years, since you eventually own it outright.

· Flexibility – Leasing contracts often come with restrictions on how the machine can be used, customised, or maintained. A loan-funded purchase allows complete control, giving businesses the freedom to use and adapt the equipment to their exact needs.

· Tax treatment – Lease rentals are usually fully deductible as business expenses, offering short-term tax relief. With loans, you can claim depreciation on the asset plus interest deductions, which may deliver stronger tax benefits over the asset’s life.

· Balance sheet impact – A loan adds liability but also creates an owned asset, which strengthens the balance sheet and can improve creditworthiness. Leasing typically keeps the asset off your balance sheet, which may look lighter in the short term but does not build net worth.

· End-of-term outcome – At the end of a loan, you have an asset with resale value. At the end of a lease, you return the machine and have to start over with new financing if you still need it.

· Maintenance responsibility – In some leases, maintenance is bundled, reducing hassle. With loans, upkeep is your responsibility, but this also allows you to choose cost-effective service options.

For most SMEs in India, loans to upgrade machinery tend to be the preferred choice because they help build long-term value.

Conclusion

As the Indian MSME industry expands, technology and efficiency determine business growth in all sectors. But advanced machinery is not cheap. This is why businesses – from small manufacturers to mid-sized exporters – explore financing options with providers like EFL to fuel their business operations.

EFL enables enterprises to modernise, scale, and stay competitive without draining working capital by offering tailored machinery finance solutions.

For business owners who want access to the latest machinery and to invest in the future, applying for a machine loan through the EFL Clik App is a smart, practical step forward.

FAQs

Why do we need to take machine loans?

Businesses often cannot afford the high upfront cost of machinery. A machine loan is ideal as it spreads the cost over manageable instalments, making it easier to invest in advanced equipment without blocking working capital.

What is the time period for machinery loans?

The tenure varies depending on the machinery loan provider and the business profile. At EFL, flexible repayment options are offered so that instalments align with cash flows.

What are the interest rates and repayment terms?

Interest rates and repayment structures differ based on loan amount, machine type, and borrower profile. Providers like EFL offer competitive rates and repayment terms tailored to each business, ensuring affordability while supporting growth.