Key Takeaways for MSMEs

- Tailored Financing: Machinery loans are designed specifically for production assets (like CNC/VMC machines).

- Speed and Flexibility: They offer faster approvals and customised repayment schedules that align with your manufacturing cash flow and order cycles.

- No Personal Property as Collateral: The machinery itself is often used as security (hypothecation).

- Competitive Edge: Timely financing allows you to quickly acquire new or used equipment.

- Cash Flow Protection: Options like leasing or instalment-based payments help manage the large upfront cost, keeping your working capital free for daily operations.

Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit

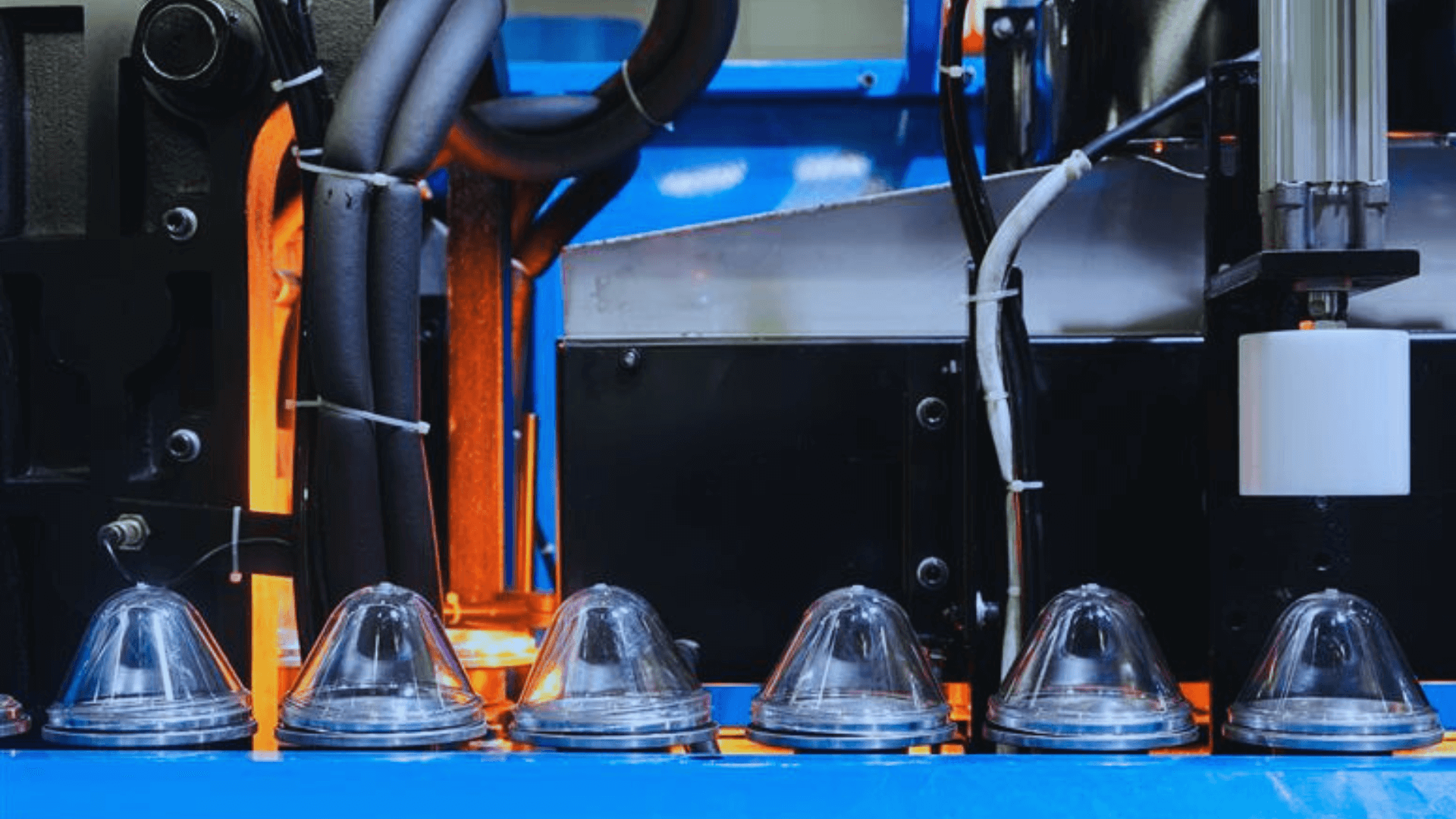

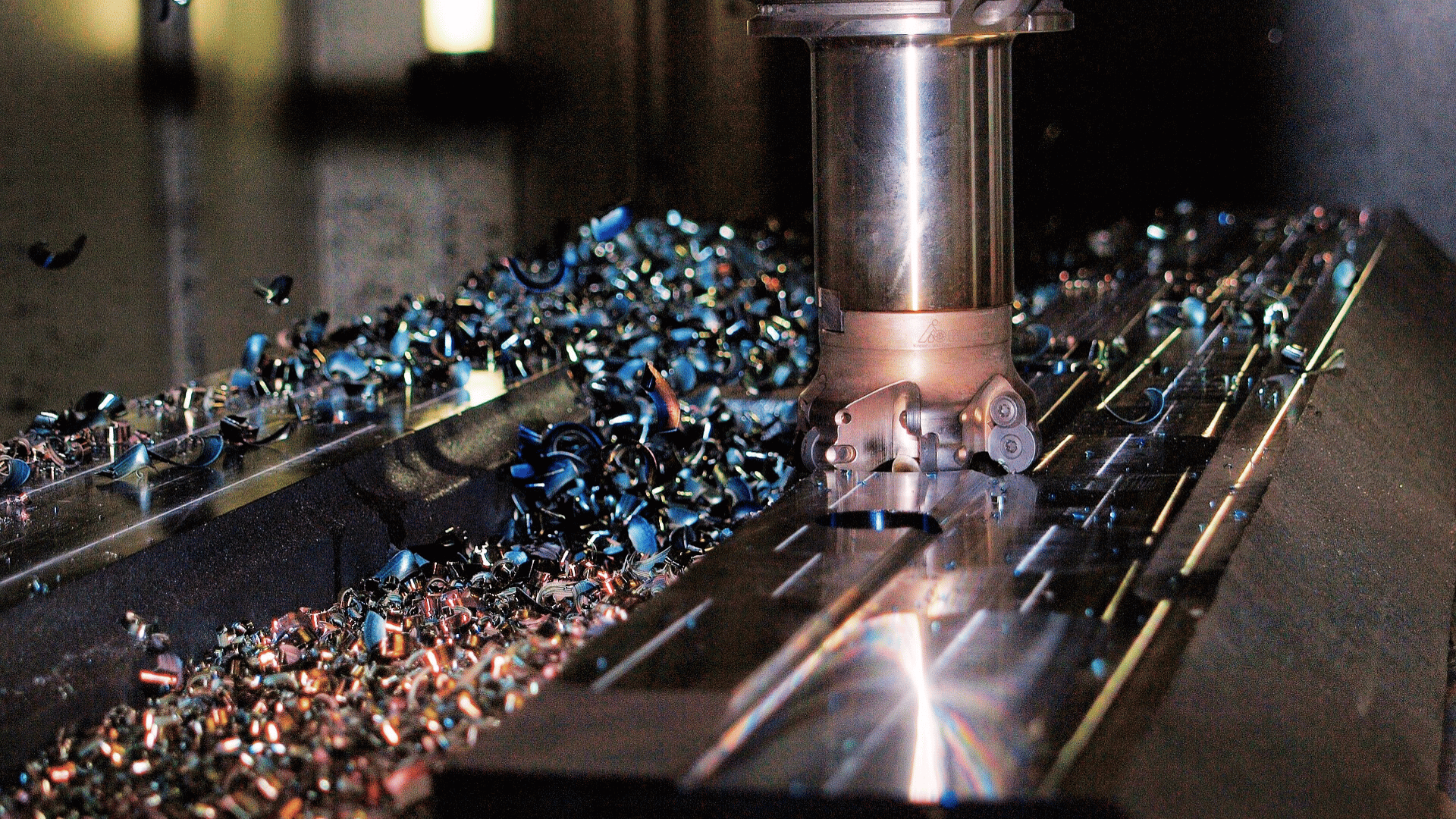

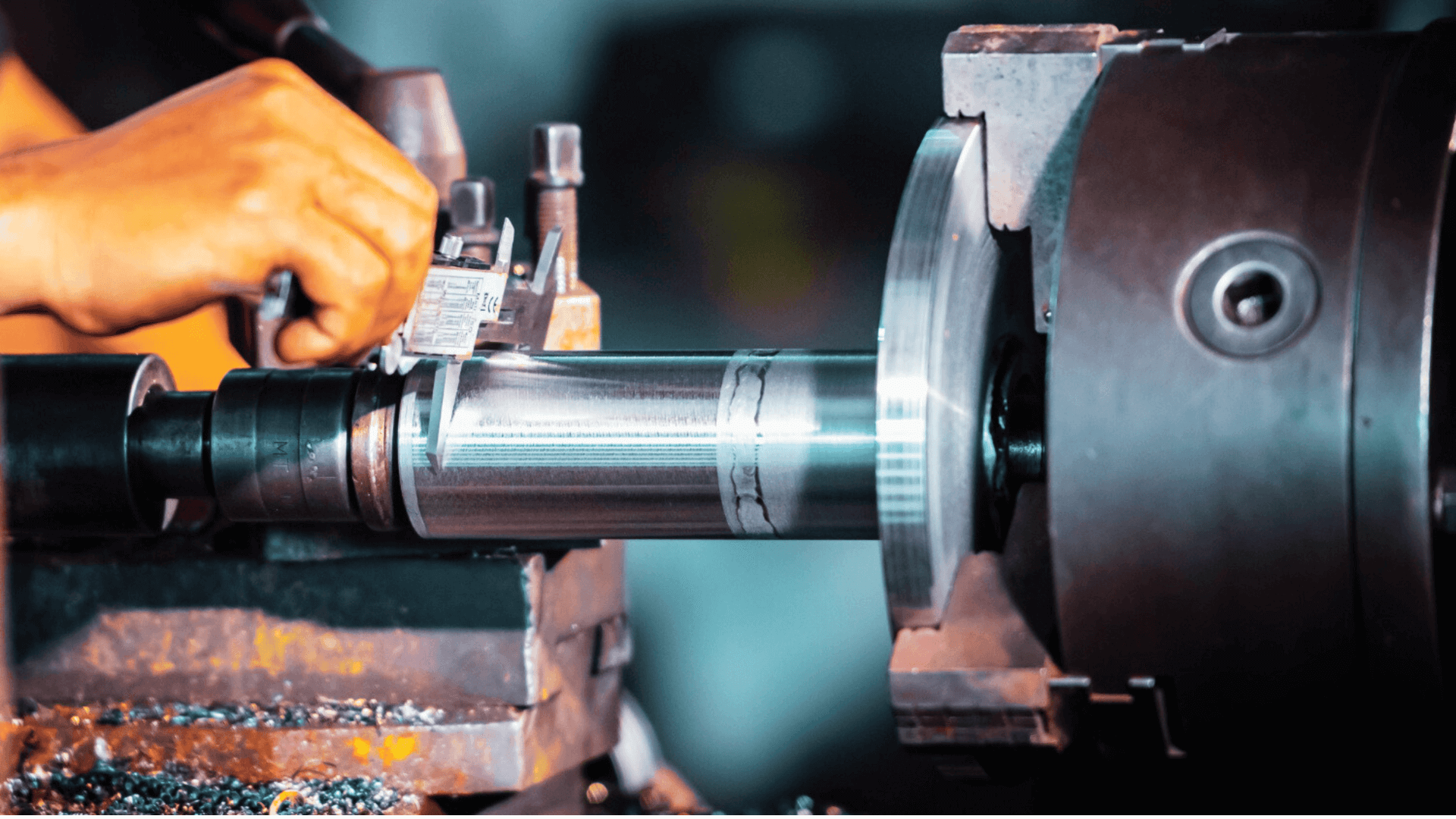

Across the engineering and plastic manufacturing MSME (Micro, Small, and Medium Enterprises) ecosystem, growth often depends on the machinery a business uses. Computer Numerical Control (CNC), Vertical Machining Centre (VMC), injection moulding setups, and fabrication systems are the backbone of daily production. Yet many small business owners face the same bottleneck when they try to avail a loan for machinery – upgrading machinery requires capital, and traditional bank loans are not always structured around real production timelines, order cycles, or upgrade windows.

This has made machine loans increasingly relevant. Instead of a general credit structure, MSMEs are seeking financing that aligns closely with machinery investment cycles, installation timelines, and the operational realities of manufacturing. The choice depends on the business focus – to improve precision, increase output, or diversify into new product categories. Dedicated machinery financing may offer a more flexible and practical route than standard bank credit.

The Unique Financing Needs of the Engineering & Plastic Industries

Engineering and plastic production businesses generally operate on tight delivery schedules and competitive pricing. When demand peaks, the ability to scale quickly by investing in modern machinery matters more than long approval cycles or waiting periods. New machinery purchases are also large-ticket investments that require predictable repayment structures.

Key financial needs typical to this sector include:

- Funds earmarked for expenses that fulfil new business needs

- A repayment schedule aligned with seasonal business cash flow or long-term contract cycles

- Quick access to capital to seize order opportunities without tying up personal assets

- Flexibility to finance new expensive machinery, as well as used machines

These needs rarely align with traditional lending formats that work better for general business expenses, not production assets.

Traditional Bank Credit Vs. Machinery Loans for MSMEs

Banks, as lenders, typically require extensive documentation, longer assessment periods, and collateral-backed applications. For many MSMEs, this creates delays, particularly when production timelines are tight or market demand shifts suddenly.

Common constraints with bank credit include:

- Longer approval processes

- Higher emphasis on external collateral (like property), rather than the machine’s potential to generate income (asset viability)

- Limited customisation for machinery-specific purchases

- Less flexibility when businesses want to upgrade incrementally

A manufacturer needs quick access to modern equipment to remain competitive. Delayed financing from a standard business loan can sometimes cost a large order, compromise product quality, or even lead to losing a client.

The Rise of Machinery Loans for MSME Businesses

This shift in financing preference has led to strong demand for specialised machinery loan solutions designed specifically for production and manufacturing businesses and enterprises. These structured loans consider the value and lifespan of machinery, making them more aligned with real asset usage.

Many MSMEs now adopt CNC machine financing, VMC machine financing, and structured purchase support for injection moulding or processing equipment. Some manufacturers also explore CNC machine lease and VMC machine lease options to avoid large upfront payments and keep working capital free for operations.

This alignment between financing and production is what makes machine loans particularly relevant.

Key Benefits of Machine Loans for Engineering and Plastic MSMEs

Opting for machine loans from NBFCs offers MSMEs in the plastic and engineering industry to focus on growth and stabilise business operations. These easy loans for the purchase of machinery also offer:

1. Faster Access to Capital: Approvals are generally quicker since the financing is tied to a specific machine purchase.

2. Lower Upfront Cost Burden: Businesses can spread payments over manageable instalments instead of blocking capital.

3. Better Cash Flow Management: Repayments are structured in line with operational and revenue cycles.

4. Option to Finance New or Used Machines: Upgrading does not always require purchasing brand-new equipment.

5. Helps Maintain Quality and Productivity: Timely machine upgrades improve accuracy, output, and overall competitiveness.

6. Repayment and Cost Structure: Financial institutions in India typically offer repayment tenures between one and five years for MSMEs, allowing businesses to plan their finances precisely.

How Machine Loans Help MSMEs Stay Ahead of Competitors

Manufacturing technology evolves rapidly. A business still working on outdated machinery will eventually lag – either in speed, precision, or cost efficiency. In competitive industries, the ability to invest at the right time in modern machinery or equipment is often the difference between business growth and stagnation. Machine loans help MSMEs stay updated without straining finances.

They allow manufacturers to:

- Deliver consistent quality

- Take on larger and more demanding orders

- Enter new product categories

- Reduce maintenance downtime

The Future of MSME Financing in Manufacturing

As MSMEs in the engineering and plastic sectors continue to scale, machine loans offer a financing model that respects production timelines, business realities, and long-term growth aspirations. For businesses ready to explore machinery financing or upgrade equipment, the process is now more convenient than ever.

Apply, track, and manage your machine loan applications easily through the EFL Clik App.

FAQs

What makes machine loans more suitable for MSMEs than traditional bank credit?

Machine loans are specifically structured around machinery purchases, making documentation simpler, approvals faster, and repayment more aligned with manufacturing cash flows.

Can engineering and plastic MSMEs get machine loans without collateral?

In many cases, the machine itself can serve as security, reducing the need for external collateral.

How quickly can MSMEs get a machine loan approval compared to a bank loan?

Machine loan approvals are typically faster, since the loan is tied directly to an asset with clear business use.

Are machine loans available for upgrading existing machinery, or only for new purchases?

Machine loans can be used for new machine purchases, used machine acquisitions, and sometimes for refurbishing or upgrading.

What factors should MSMEs consider before choosing a machine loan provider?

MSMEs must check a provider for repayment flexibility, experience in manufacturing financing, application convenience, and post-disbursement support.

What are the typical repayment periods (tenures) for a machine loan?

The repayment tenure is flexible but usually ranges from 12 to 60 months (1 to 5 years), structured to match the machine’s lifespan and the expected return on investment.