Margins for MSMEs (Micro, Small, and Medium Enterprises) in India’s economic scenario are under constant pressure. Input costs fluctuate, labour availability is uneven, and customers expect faster delivery in every sector without paying more. In this market environment, growth doesn’t usually stall because demand disappears, it stalls because operations cannot keep up. Many entrepreneurs and businesses continue to run on ageing equipment, stretching machines beyond their intended life and quietly absorbing losses through inefficiency and lack of technical innovations.

This is where modern machinery for MSMEs becomes a profit lever rather than a cost burden. The initiative to upgrade equipment directly impacts productivity, quality, energy usage, and turnaround times. When done strategically and supported by the right machinery loan, upgrades can translate into measurable gains (nearly 30 percent or more), often pushing profit margins significantly higher over time. Let’s understand how and why this happens.

The Challenges MSMEs Face with Outdated Machinery

Older machines don’t fail all at once. It happens slowly, bleeding profits. Frequent breakdowns lead to unexpected downtime. Maintenance schedules become reactive rather than planned, and spare parts grow harder to source. This directly affects manufacturing efficiency for MSMEs, as production schedules remain unpredictable.

Capacity is another constraint. Outdated equipment limits output per shift, making it difficult to fulfil larger or repeat orders. Businesses often decline opportunities simply because existing machines cannot scale.

Quality inconsistency is the third challenge. Manual calibration and worn components increase rejection rates and rework. Over time, this erodes customer confidence and margins simultaneously.

What Is Modern Machinery?

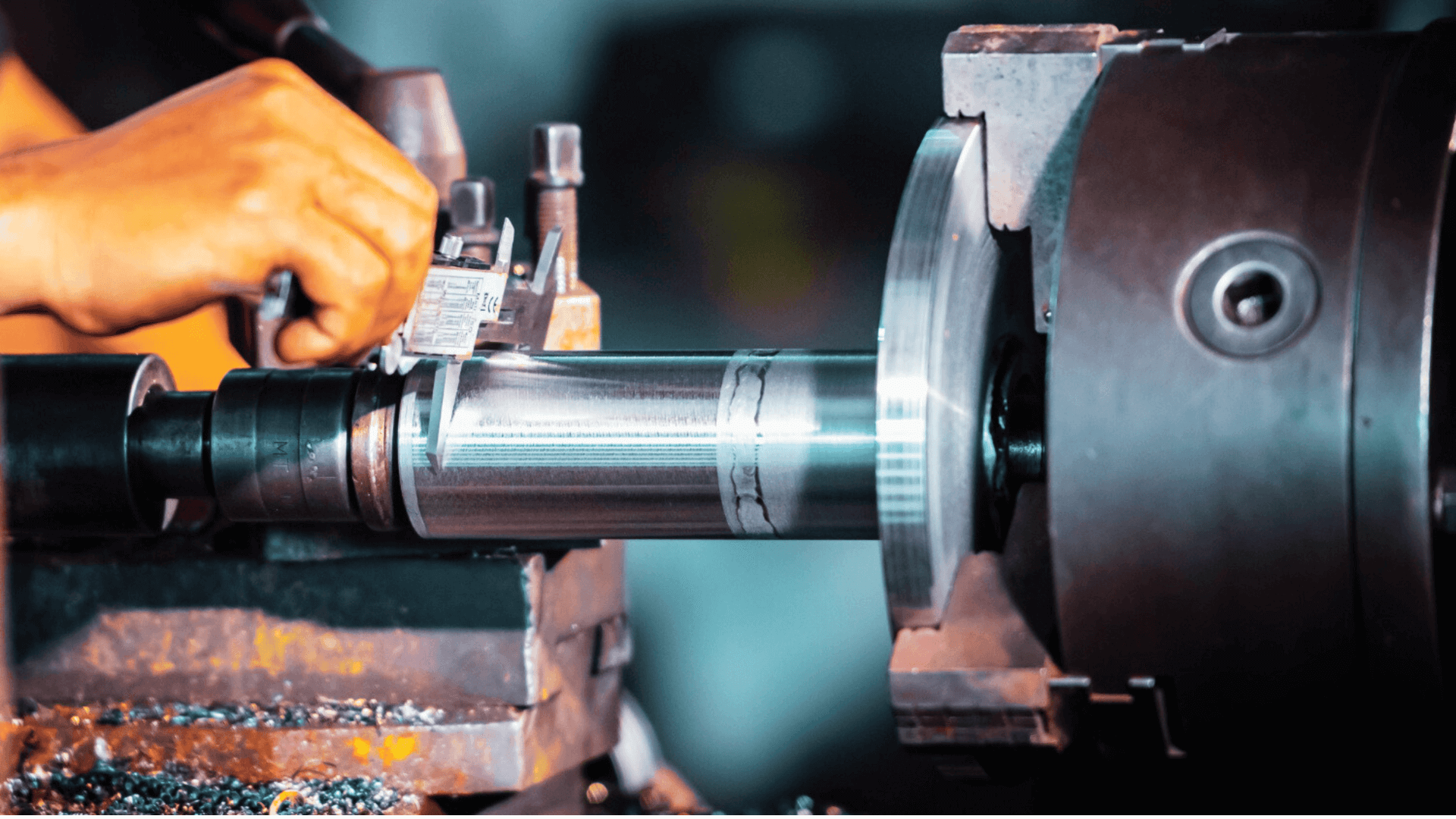

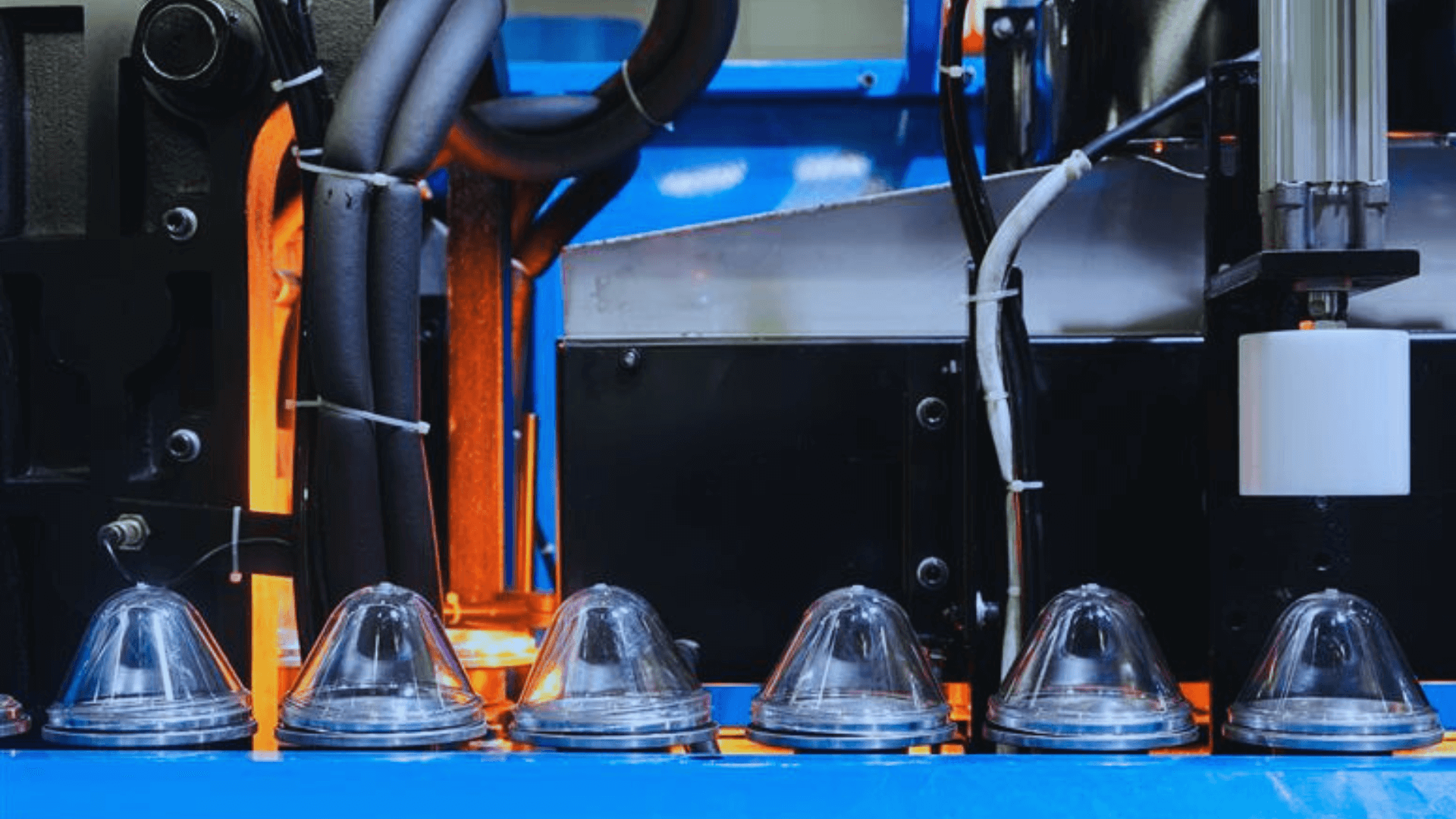

Modern machinery is defined less by age and more by capability. Newer, automation-enabled machines reduce manual intervention and ensure consistent output. Energy-efficient designs lower power consumption per unit produced. Technology-driven systems also allow better monitoring, predictive maintenance, and faster changeovers.

Importantly, modern machines are built for scalability. Through CNC machine financing or VMC machine financing, MSMEs can invest in equipment that supports current demand while remaining ready for future expansion.

How Technology Upgradation Directly Impacts MSME Profitability

The impact of updated machines on profitability is immediate and structural. Higher output per hour improves capacity utilisation without increasing labour costs. Automation reduces dependency on manual skill availability and lowers error rates. These improvements form the core of machinery upgrade benefits.

Better precision improves product consistency, reducing wastage and customer complaints. Faster turnaround times allow businesses to take on urgent orders without disrupting existing schedules.

Focused on MSME profit growth strategies, these operational gains compound month after month.

Cost Savings That Drive Profit Growth in India

Profit growth is as much about saving costs as it is about earning more. New machines demand fewer repairs and less downtime, cutting maintenance expenses. Energy-efficient motors and systems reduce electricity bills, which adds up significantly over time.

Optimised raw material usage further improves margins. Precision equipment ensures tighter tolerances and fewer rejects. This is critical for businesses working on thin spreads.

These savings collectively strengthen the case for machinery investment for small businesses looking to stabilise cash flows.

Revenue Growth Opportunities with Machinery Upgrades

Modern equipment protects margins and unlocks growth. Higher capacity allows MSMEs to accept larger orders and commit to repeat contracts confidently. Automation also makes it possible to diversify product lines without proportionally increasing costs.

Improved quality leads to stronger customer retention and referrals. Over time, businesses become competitive not on price alone, but on reliability and consistency – key drivers of long-term revenue growth.

Financing Machinery Upgrades for MSMEs

The biggest hesitation around upgrades is capital outlay. This is where structured financing plays a critical role.

A machinery loan or equipment loan for SMEs allows businesses to invest in productivity while preserving working capital. EMIs can be aligned with projected cash flows, ensuring repayments don’t strain daily operations.

Options such as CNC machine lease or VMC machine lease offer flexibility for businesses testing new capabilities without committing to full ownership upfront. For many, this balance between access and affordability is what enables timely upgrades.

You can explore tailored financing options through the machine loan solutions designed specifically for MSMEs.

When Should MSMEs Consider Upgrading Machinery?

Timing matters. If maintenance costs are rising faster than revenue, that’s a warning sign. When demand consistently exceeds current capacity, or manual processes slow delivery commitments, upgrades should move higher on the priority list. Plans for automation, quality improvement, or expansion also indicate readiness. In these situations, delaying investment often costs more than acting decisively.

Conclusion

Upgrading machinery should be viewed as a strategic move and not as an expense line item. The right equipment improves efficiency, quality, and scalability – all of which directly influence profitability.

When combined with well-planned financing, machinery upgrades support sustainable growth without destabilising cash flows. For MSMEs focused on long-term competitiveness, modernisation remains one of the most reliable paths to stronger margins.

Thinking about upgrading your equipment? Explore flexible machinery financing options through the EFL Clik App and find a solution that fits your business growth plans.

FAQs

How does modern machinery increase MSME profitability?

Modern machines improve output, reduce waste, lower energy costs, and minimise downtime. This contributes directly to stronger margins.

Can small MSMEs afford to upgrade to modern machinery?

Yes. Financing options such as business loans for machinery purchase and leasing models spread costs over time and protect working capital.

What types of machinery upgrades deliver the highest ROI?

Automation-enabled CNC machines, VMCs, and energy-efficient production equipment typically offer the fastest returns.

How long does it take to see profit improvement after upgrading machinery?

Many MSMEs see operational improvements within months, with profit impact becoming clearer as utilisation increases and costs stabilise.