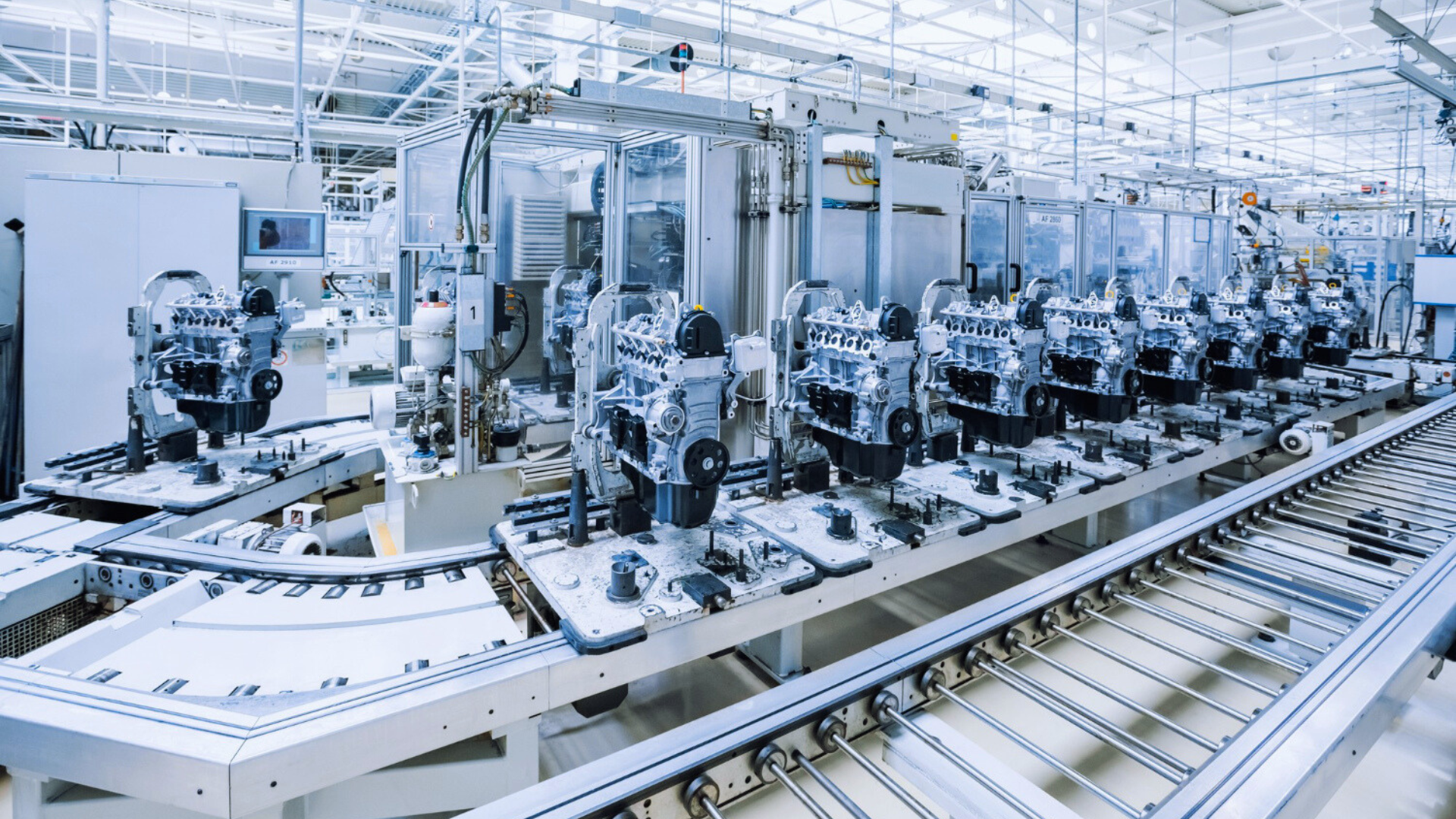

When it comes to scaling up your operations or improving efficiency, investing in the right machinery and equipment is crucial. By acquiring a loan for machinery, MSMEs can simplify their growth efforts without draining cash reserves. These loans are designed to help businesses acquire, upgrade, or replace equipment.

Whether you’re looking to apply for machinery loans to procure new equipment for your specific needs or expand your operations, choosing the right machinery loan supplier is just as important as selecting the right equipment. In this blog, we’ll explore how to find the ideal lender, understand loan terms, and evaluate services that suit your type of business and financial health.

Smart Strategies to Find a Machinery Loan Provider

1. Online Research and Aggregator Platforms

Start with a simple online search using relevant keywords like “machinery loan in India” or “get a loan for your business.” Aggregator websites and fintech platforms offer a comparative overview of different lenders, including NBFCs, which are increasingly popular among MSMEs.

2. Leverage Industry Networks

Talk to peers in your industry or business associations. Business owners who’ve recently secured an equipment loan can give first-hand insights on lenders offering better interest rates or smoother processes.

3. Explore Government-Linked Financing

Consider schemes like CGTMSE and PMMY, which support MSMEs with less stringent collateral requirements.

Don’t Let Cost Be the Only Deciding Factor

Total Loan Cost

Consider not just interest rates but also processing fees, prepayment charges, and penalties.

Flexibility and Repayment Terms

Choose a loan that matches your cash flow and revenue cycle, even if the rate is slightly higher.

Type of Business Loan

Ensure the loan is designed for machinery acquisition — not working capital or general business use.

After-Sales Support and Transparency

Choose a lender with dedicated relationship managers and clear terms post-disbursal.

Loan Disbursal Time

Speed matters. Quick disbursal can help seize equipment deals and avoid business downtime.

Compliance and Documentation

GST Compliance

Ensure timely filing of GST returns to reflect your business turnover and financial discipline.

Financial Statements and Documentation

Prepare your ITRs, bank statements, and balance sheets to strengthen your loan application.

Tailored Financing Solutions

Machinery Loan or Equipment Leasing?

Buying gives ownership; leasing helps you stay current with tech and reduces initial costs.

Asset-Backed Loans

Know what serves as collateral — business assets or the machinery itself — and assess risk accordingly.

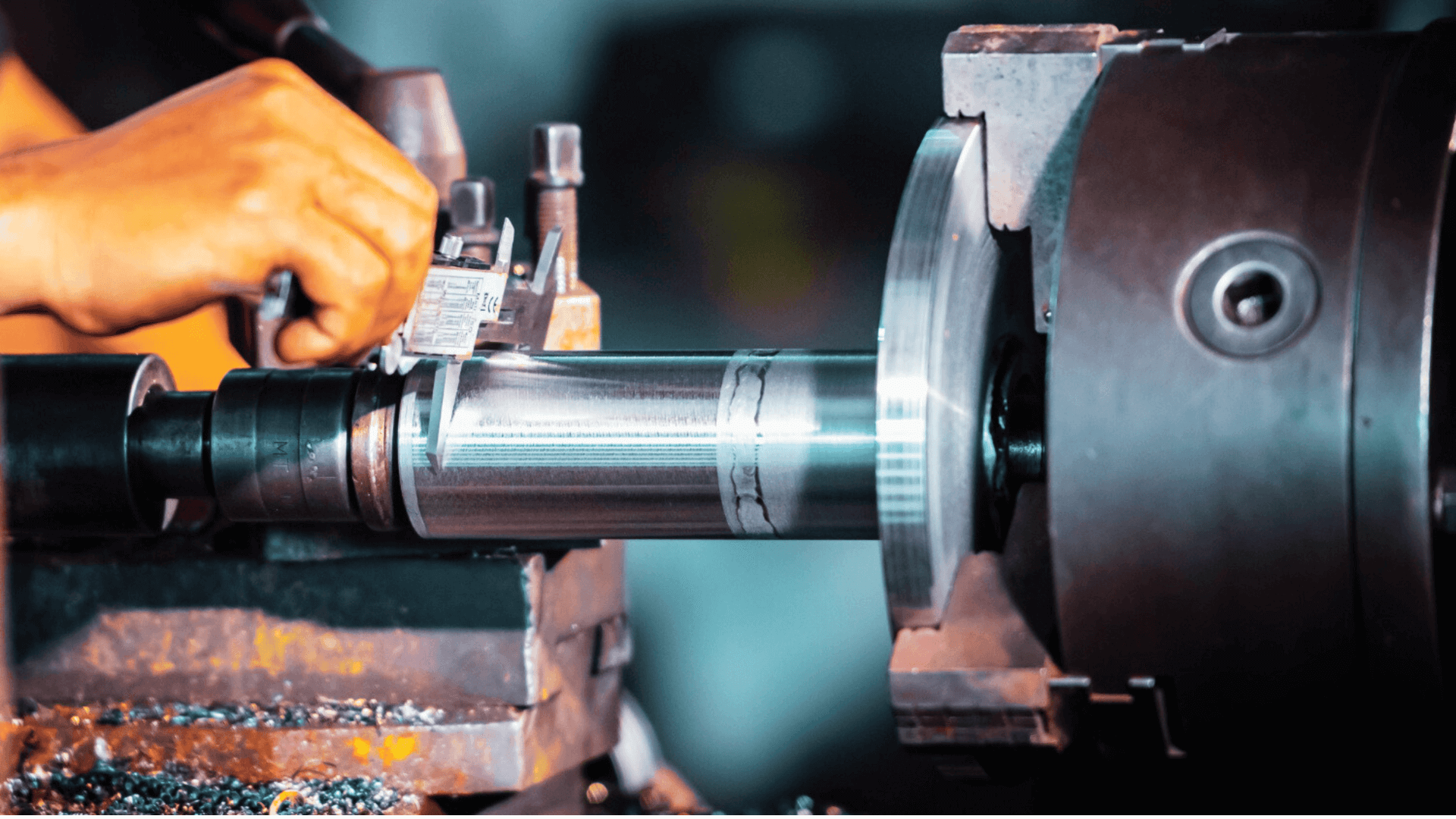

Consider the Type of Equipment

Choose lenders who finance your specific type of machinery, not just heavy or high-value assets.

Empower Your Business Today

With the right equipment and financing partner, your business can enhance productivity, reduce errors, and scale efficiently. Don’t just chase low interest; evaluate transparency, flexibility, and service support.

Ready to Take the Next Step?

If you’re ready to apply for machinery finance or upgrade existing tools, choose a partner that aligns with your long-term goals and provides tailored, reliable financing.

FAQ

What factors should I consider when choosing a machinery loan supplier?

Evaluate interest rate, loan type, repayment terms, lender transparency, and post-sale support.

How do I compare interest rates?

Look beyond just rates — include processing fees, charges, and whether the rate is fixed or floating.

What is the importance of loan tenure?

Long tenures lower EMIs but increase interest. Short tenures save interest but can pressure cash flow.

What documentation is required for a machinery loan?

- 3 years’ balance sheet and ITR

- 12 months’ bank statements

- Current year GST returns

- KYC – Aadhar and PAN

- Proof of residence and factory ownership

- Proforma invoice or quotation

- 12 months’ electricity bills

With the right approach, you can secure a machinery loan that aligns with your vision and drives business growth.