Everything You Need to Know About Machinery Loans: Equipment Finance Solutions with Fast Approval

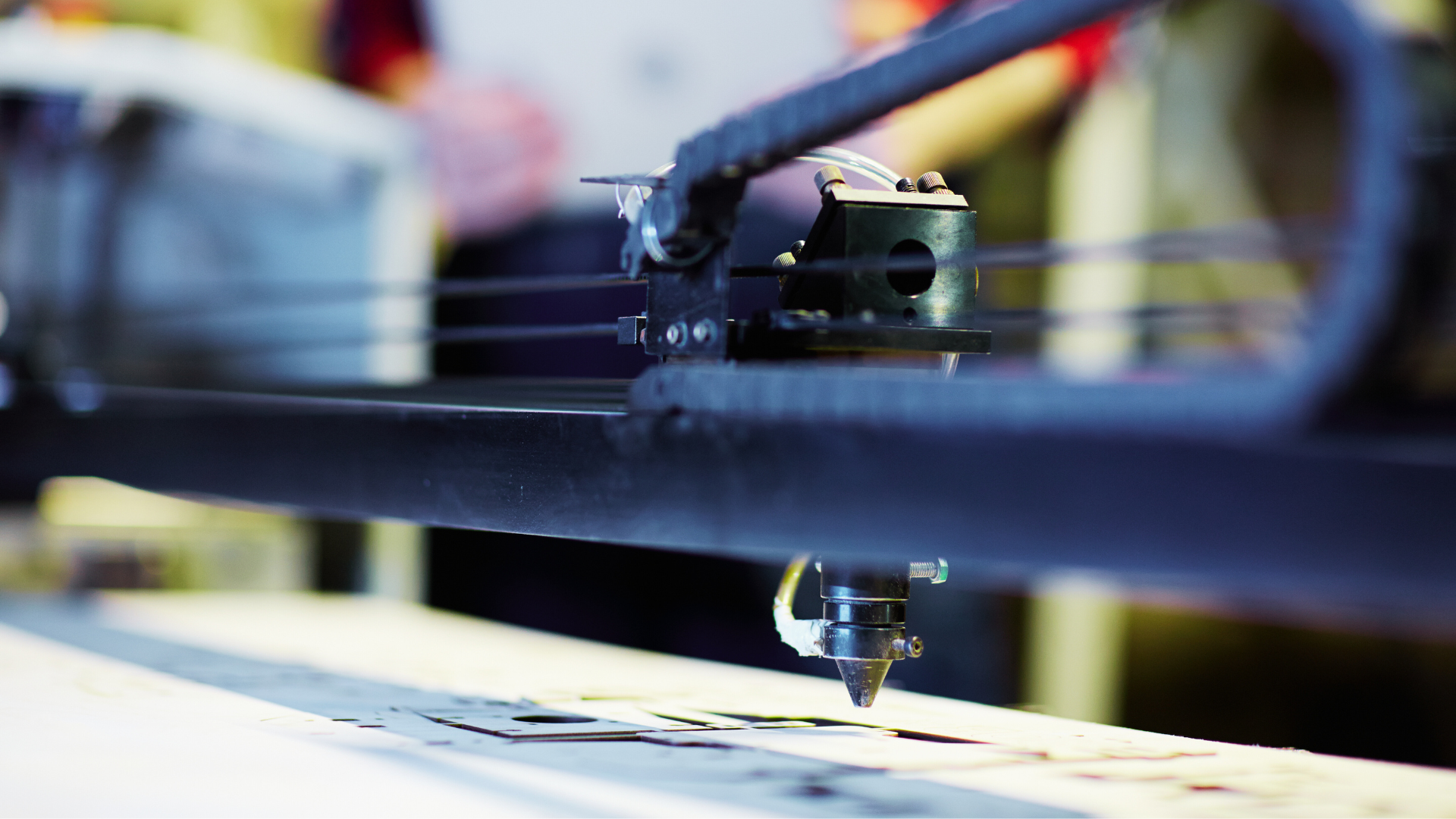

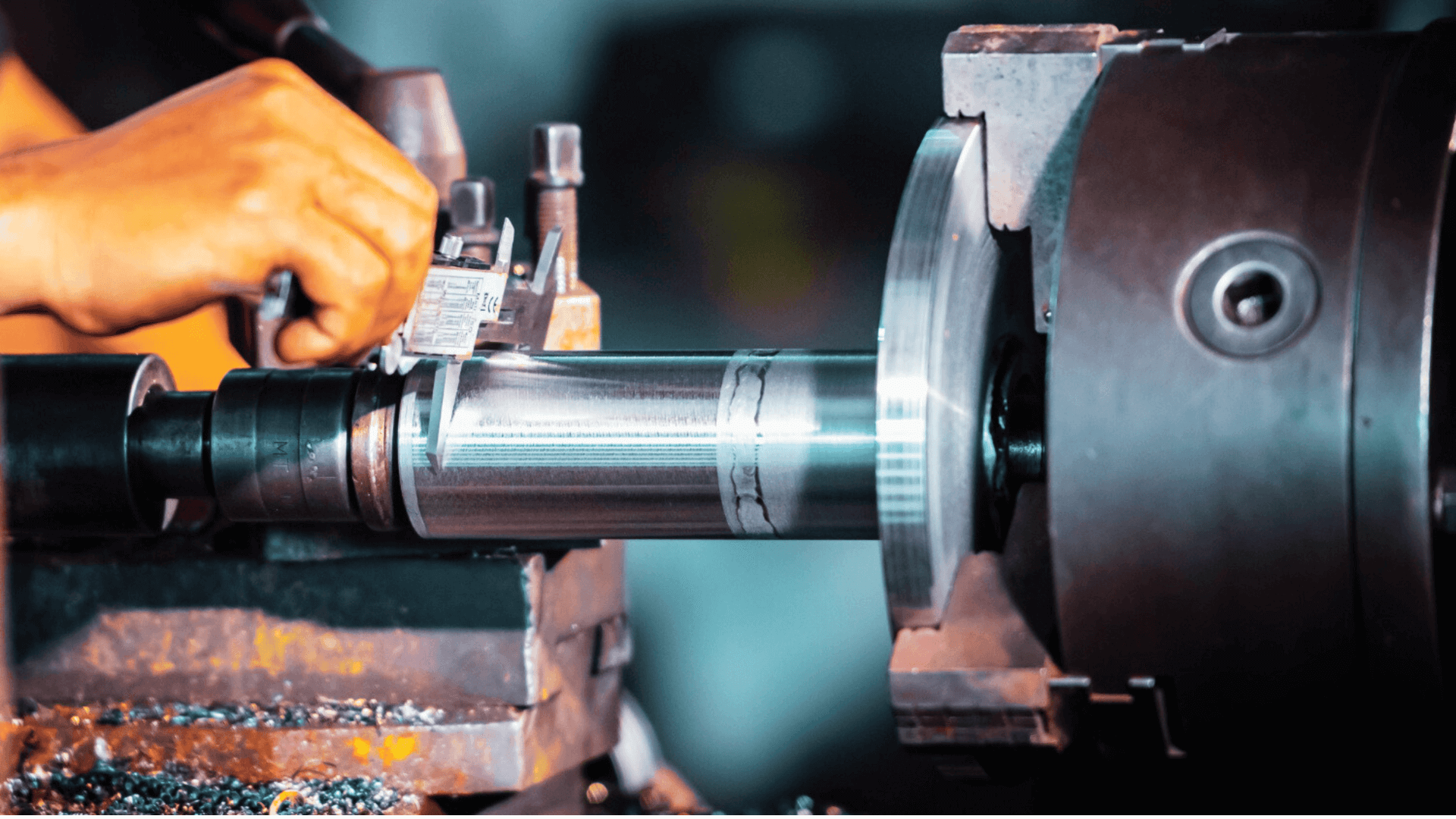

For MSMEs and growing manufacturing businesses, the ability to rapidly secure equipment can be a game-changer. Whether you operate in construction, food processing, packaging, or textiles, access to quick machinery loans can directly impact your operational agility and productivity.

From small enterprises to large-scale production units, industries across India are increasingly relying on machinery and equipment upgrades to stay competitive. Fast approvals for machinery finance allow companies to maintain project timelines, expand capacity, and capitalise on time-sensitive opportunities without being slowed down by lengthy approval processes.

In this blog, we’ll break down what a machinery loan is, why quick approval matters, and how you can qualify and apply successfully. We’ll also highlight what to watch out for, helping you make a confident and informed choice.

What Is a Machinery Loan?

A machinery loan is a type of business loan designed to help businesses upgrade machinery and equipment critical to their operations. These loans fall under the broader category of equipment finance and are tailored to provide the funds you need to scale, automate, or modernise your enterprise.

Who typically requires machinery loans?

- Manufacturing businesses upgrading or replacing outdated machinery

- Businesses looking to acquire essential tools to begin operations

- Contractors or construction firms purchasing heavy equipment

- Small and Medium Enterprises (SMEs) scaling production to meet growing demand

- Food and packaging units investing in automation

Features and Benefits of Fast-Approved Machinery Finance

A fast-approved machinery loan gives your enterprise the ability to respond swiftly to market changes, project deadlines, and seasonal demands. Here’s why this is crucial:

- Allows for prompt reaction to vendor discounts or time-limited offerings

- Safeguards project delivery timelines, especially in contract-based businesses

- Offers a competitive edge through fast execution

- Supports cash flow continuity and operational efficiency

- Enables quick response to time-limited offers or vendor discounts

Benefits of Fast Machinery Loan Solutions

1. Immediate Productivity Boost

Acquiring new or better machines instantly elevates your production capacity, minimises downtime, and maximises efficiency.

2. Avoids Costly Delays

Quick financing can mean the difference between securing and losing a project. Delays in loan approval can lead to contractual penalties or loss of business.

3. Takes Advantage of Deals

Vendors often offer discounts on equipment for a limited time. Fast loan disbursal helps you avail these offers.

4. Improves ROI

As long as the repayment schedules are convenient to your business cycle, the faster you install your machine, the quicker you begin generating returns.

5. Access to Capital Without Disruption

With minimal disruption to ongoing processes, you can fund expansion without freezing existing operations or draining internal reserves.

How to Apply for a Machinery Loan: Eligibility Criteria

The process to apply for a machinery loan online is straightforward if you follow the right steps and prepare beforehand. Let’s go over the prerequisites, necessary paperwork, and the overall application procedure.

Eligibility Criteria

To qualify for machinery finance, you typically need to meet the following:

- Business vintage of at least three years

- At least one premise owned by the business

- 700+ credit score

- Positive cash flows and repayment history

Documents Required

Minimal documentation is one of the key features of fast-approval loans. However, the following are still commonly required:

- 3 years’ balance sheet and ITR

- 12 months’ bank statements of all bank accounts

- GST returns for the current year

- KYC – Aadhar & PAN

- Residence and factory ownership proof

- Proforma invoice/quotation

- 12 months’ electricity bills

How to Apply: Step-by-Step

1) Check Your Eligibility

Use an online eligibility calculator or consult with a relationship manager to understand the applicable eligibility.

2) Get a Quotation

Obtain a detailed quote provided for a wide range of machinery purchases from an authorised dealer.

3) Prepare the Documents

To prevent any delays, collect and confirm all necessary documents, making sure they are accurate and up-to-date.

4) Submit Application

You can apply via a branch or register and submit documents online. Use the EFL Clik App to apply for a machinery loan online in a convenient, efficient, and accessible way.

5) Assessment and Sanction

Lenders perform a credit assessment, verify the documents, and then approve and sanction the loan amount.

6) Disbursal

Funds are typically disbursed within 48-72 hours for pre-approved customers and within 5-7 days for new applicants.

What to Watch Out for in Fast-Approval Loans

While fast machinery loans offer flexibility and speed, it’s vital to conduct due diligence. Keep these in mind:

1. Higher Interest Rates

Lenders offering instant approval may charge a slightly higher interest rate due to the quick turnaround.

2. Hidden Charges

Always read the fine print for hidden charges, processing fees, or penal interest on defaults.

3. Prepayment Terms

Some lenders levy prepayment or part-prepayment penalties. Clarify these before signing the loan agreement.

4. EMIs and Tenure

Understand the loan tenure, EMI structure, and whether you can opt for flexible or structured repayment schedules.

5. Loan-to-Value Ratio (LTV)

Check for high loan-to-value ratios offered by lenders. A higher LTV means less upfront investment from your side.

Choosing the Right Machinery Loan

When selecting a machinery loan online or offline, it’s not just about how fast you can get the funds. It’s also about making sure the loan fits your business goals. Here’s how to simplify your decision:

- Align your loan with business objectives: Decide whether the loan is to expand, upgrade, or enter a new market.

- Ensure transparency: Ask for a breakdown of all fees, tax implications, and stamp duty if applicable.

- Don’t compromise diligence: Always assess the lender, compare offers, and review the documents required.

- Think ROI, not just interest rate: The overall value of your machine investment matters more than the nominal interest.

- Apply smart: If possible, apply for a machinery loan online for a smoother process and quicker disbursal.

Whether you have a small business or a seasoned enterprise, a fast-approval machinery loan can be a crucial factor in helping you grow your business efficiently.

Frequently Asked Questions

Can I get a machinery loan without collateral?

Yes, many lenders offer unsecured machinery loans depending on your eligibility, repayment history, and business profile. However, the interest rate may be slightly higher.

What’s the average interest rate for machinery loans?

The interest rate typically ranges between 9% to 18% per annum, depending on your creditworthiness, loan tenure, and the type of lender (bank/NBFC/fintech).

How quickly can the loan be approved and disbursed?

For eligible customers, pre-approved loans may be sanctioned within 24-48 hours, while new applications usually take 5-7 working days, subject to document collection and verification.