For India’s MSMEs, staying competitive depends solely on labour strength or production volume. A lot of their operations hinge on having a technological edge, with CNC (Computer Numerical Control) precision machines offering a powerful solution to meet these evolving demands.

These advanced tools can significantly upgrade a factory’s production capabilities, delivering faster turnarounds, consistent quality, and reduced material wastage. However, CNC machines are expensive, and not every business has the liquidity to invest upfront. This is where a CNC machine loan or a CNC machine financing solution becomes a strategic choice.

This article explores how businesses in India can unlock scale and efficiency through CNC precision machine loans.

What Is Advanced Manufacturing?

Advanced manufacturing integrates cutting-edge technologies like robotics, Computer-Aided Design (CAD), (CNC) systems, real-time data analytics, and automation to improve both efficiency and precision. These systems enable businesses to reduce costs and build a future-ready production ecosystem.

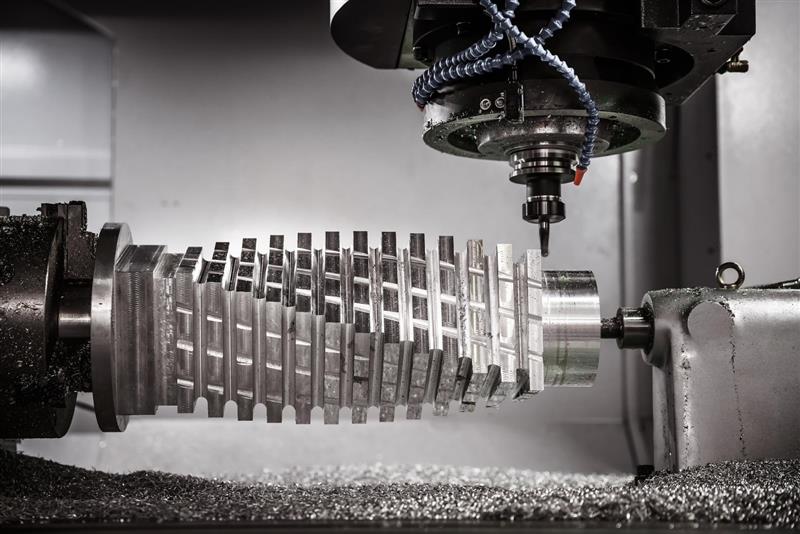

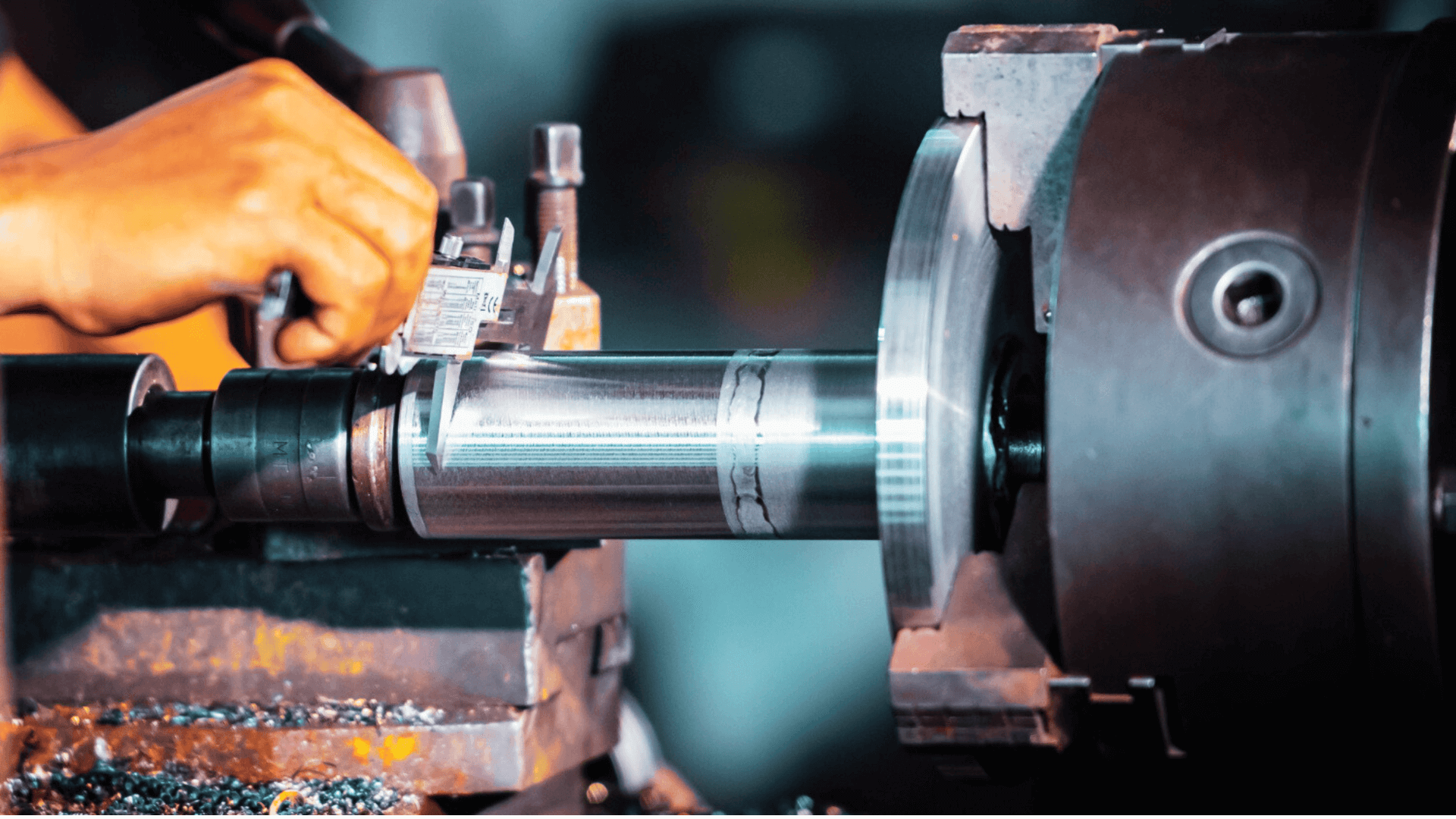

Unlike traditional manufacturing, which often relies on manual labour and standalone processes, advanced manufacturing connects different aspects of production into a seamless workflow. For instance, a CNC machine, apart from just cutting metal, also follows a programmed design with micrometre-level precision. It minimises errors and reduces material wastage.

In India, sectors such as aerospace, automotive, defence, electronics, and high-precision tooling are increasingly shifting toward this model. Small businesses can now leverage the same level of precision with helpful financial products.

How CNC Precision Machines Accelerate Business Growth

Integrating CNC precision machines can completely alter your business trajectory. Here’s how:

Higher productivity: CNC machines can operate 24/7 with minimal supervision, drastically improving production output.

Superior accuracy: Automated control means reduced human error, which results in tighter tolerances and better product consistency.

Reduced material waste: With optimised cutting paths and precision controls, material wastage is minimised.

Scalability: Once a program is created, it can be reused across batches, making it easier to scale production without adding labour.

Faster turnaround times: Automation shortens the production cycle, enabling quicker order fulfilment and better customer satisfaction.

Multi-material compatibility: CNC machines can work across a wide range of materials, including metals, plastics, composites, and even wood, allowing product diversification and tapping new markets, using the same setup.

Easier prototyping and customisation: It becomes possible to rapidly prototype and fine-tune custom components without disrupting ongoing production.

Improved worker safety: Since the machining process is enclosed and automated, the risk of accidents from manual handling, sharp tools, or repetitive strain is significantly reduced.

Data integration and monitoring: The built-in sensors and digital monitoring capabilities allow real-time production tracking, predictive maintenance, and better decision-making based on performance analytics. This is vital for businesses aiming to stay globally competitive.

Challenges Faced by Businesses in Adopting CNC Technology

There’s no doubt that CNC technology can change manufacturing for the better, but making the leap isn’t as simple as purchasing a machine and plugging it in. Businesses must align their existing infrastructure, talent pool, and financial planning with the demands of a precision-driven ecosystem. And in sectors where margins are already tight, this transition can feel overwhelming without structured support.

Here are some of the most common hurdles manufacturers face when stepping into CNC-based production:

High initial investment: CNC machines can cost anywhere from a few lakhs to several crores, depending on the type, axis range, and software. For a small business, this capital outlay can delay other strategic investments.

Skilled labour requirement: Operating CNC machinery isn’t plug-and-play. It requires trained operators and programmers, which means either hiring experienced staff or investing in workforce upskilling, both of which demand time and money.

Space and infrastructure needs: CNC machines often need specific ambient conditions, upgraded electrical systems, and sufficient space for safe and efficient operation. Existing workshops may need significant retrofitting.

Working capital crunch: When funds are diverted towards asset purchase, routine operational expenses, such as raw materials, staff salaries, or utility bills, may take a hit, causing temporary disruptions.

Software and maintenance costs: CNC machines run on software that needs periodic updates and sometimes proprietary licensing. Plus, ongoing maintenance and occasional downtime can affect productivity and cost more than anticipated.

Integration with existing systems: Transitioning from manual or semi-automated systems to CNC means rethinking production workflows. Compatibility issues and training gaps can slow down the ramp-up period.

CNC Precision Machine Loans – A Smart CNC Machine Financing Solution

A machine loan, structured for CNC purchases, allows business owners to acquire advanced machinery without upfront capital strain. Electronica Finance Limited, a specialised NBFC in machinery financing, offers customised loan solutions that cater to this exact need.

Here’s how a CNC machine loan can make all the difference:

Asset-backed funding: The CNC machine itself often acts as collateral, reducing the need for additional security.

Customised repayment options: Choose EMIs that suit your cash flow — monthly, quarterly, or seasonal. Tailor your monthly payment.

Loan tenure flexibility: Repayment periods range from 12 to 60 months, depending on your repayment capacity.

Quick approvals: Electronica Finance offers faster loan approvals by understanding the nuances of machinery procurement.

Competitive interest rates; Since it’s a secured loan, interest rates are typically lower than unsecured alternatives.

These features make CNC machine financing a practical way to adopt industry-leading technology without derailing your finances.

How to Apply for a CNC Machinery Loan

Getting started with a CNC precision machine loan is easier than you might expect. Here’s a basic roadmap:

- Evaluate machine requirements: Choose the make and model you want to purchase. Get a pro forma invoice from the vendor.

- Check eligibility: Most lenders look at business history, health, potential, financial performance, and creditworthiness. A credit score above 700 and at least one owned premise should be enough for most financing partners.

- Documentation:

- 3 years’ balance sheet and ITR

- 12 months’ bank statements of all banks

- GST returns for the current year

- KYC – Aadhar and PAN

- Residence and factory ownership proof

- Proforma invoice/quotation

- 12 months’ electricity bills

4. Get approval and disbursement: Once approved, the loan amount is directly disbursed to the machinery vendor.

Apply online: Use the EFL Clik App for a seamless digital loan application.

The entire process can be completed within a few days, provided documents are in order and the machine specifications are clear.

Whether you’re in die and mould manufacturing, component machining, or precision fabrication, CNC machine financing lets you move with the times, and, sometimes, ahead of them. Beyond the ability to afford cutting-edge machinery, CNC machine loans offer strategic growth advantages.

FAQ

What is a CNC precision machine, and how does it help in manufacturing?

A CNC precision machine is a computer-controlled manufacturing tool that can cut, drill, mill, or shape materials with exceptional accuracy. It helps in reducing manual errors, speeding up production, and delivering consistent quality.

How can a CNC machine contribute to business growth?

CNC machines enable manufacturers to increase production capacity, diversify product lines, reduce operational costs, and expand into new markets. They also allow for mass customisation and reduce dependency on skilled manual labour.

Who is eligible for a CNC precision machine loan?

MSMEs with a minimum operational history (usually three years), consistent turnover, and valid business documentation are generally eligible. Lenders also look at bank statements and credit scores to assess loan viability.