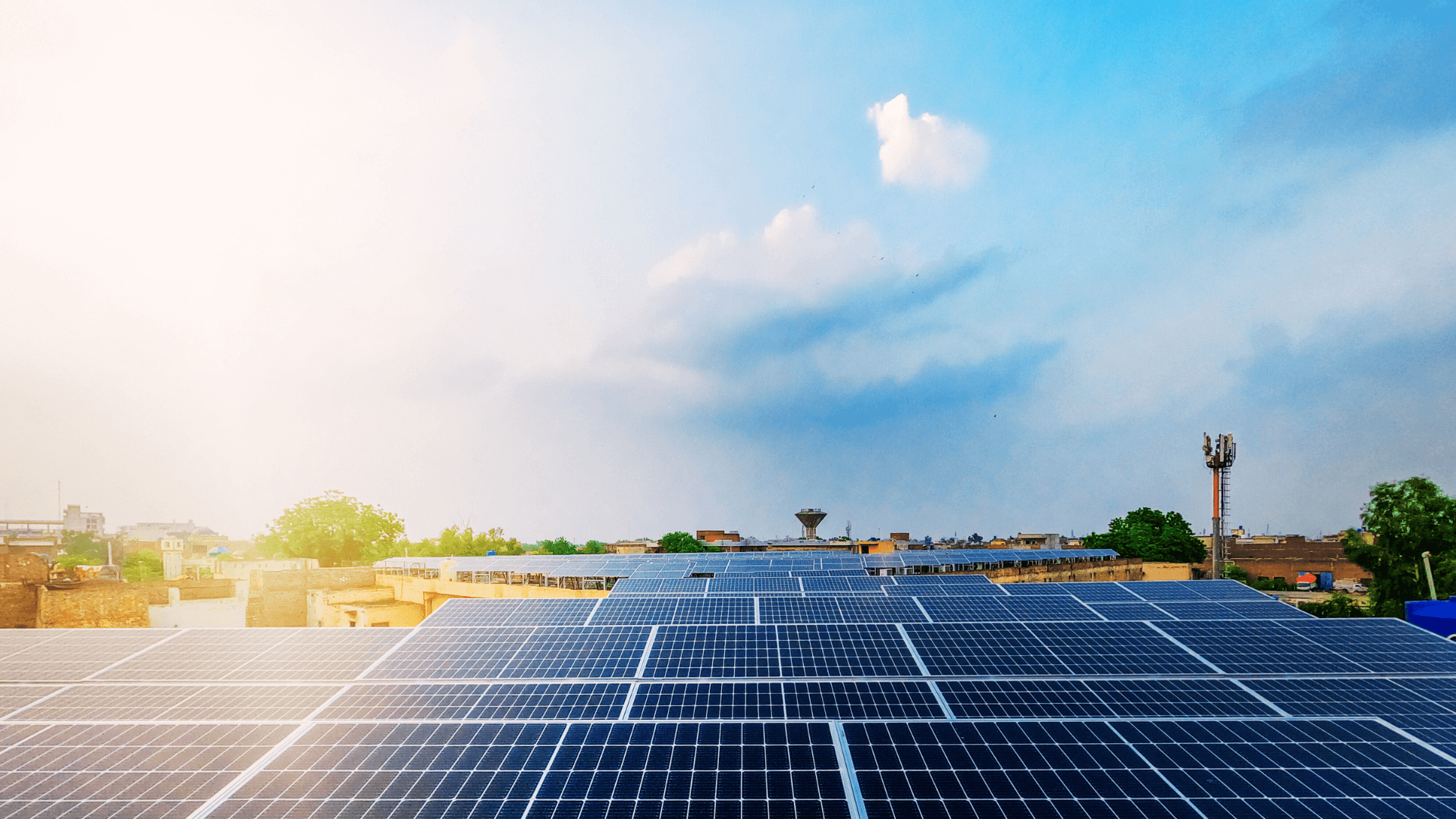

Adopting solar energy for your home is a long-term investment in a greener, more sustainable future. As electricity costs continue to rise and the environmental impact of fossil fuels becomes more evident, homeowners are increasingly making the switch to solar. But before installing solar panels, it is crucial to understand the financial aspects of the process. Solar financing is a key step in ensuring your solar power system is both affordable and effective.

If you’re planning to install solar panels, you’ll need to consider a range of factors, from your creditworthiness to the available incentives, vendor options, and long-term cost savings. This guide walks you through the top 5 things to consider before financing and installing a rooftop solar energy system.