Key Takeaways

- Machinery loans allow you to acquire high-value equipment without exhausting your working capital, keeping your daily operations smooth.

- Leverage GST Input Tax Credit and Depreciation benefits to lower your overall tax liability.

- While banks often require property as security, NBFCs offer unsecured (collateral-free) options.

- NBFCs and FinTech lenders generally provide faster approvals and more personalized support.

- Choose a loan with an EMI structure that aligns with your machine’s output.

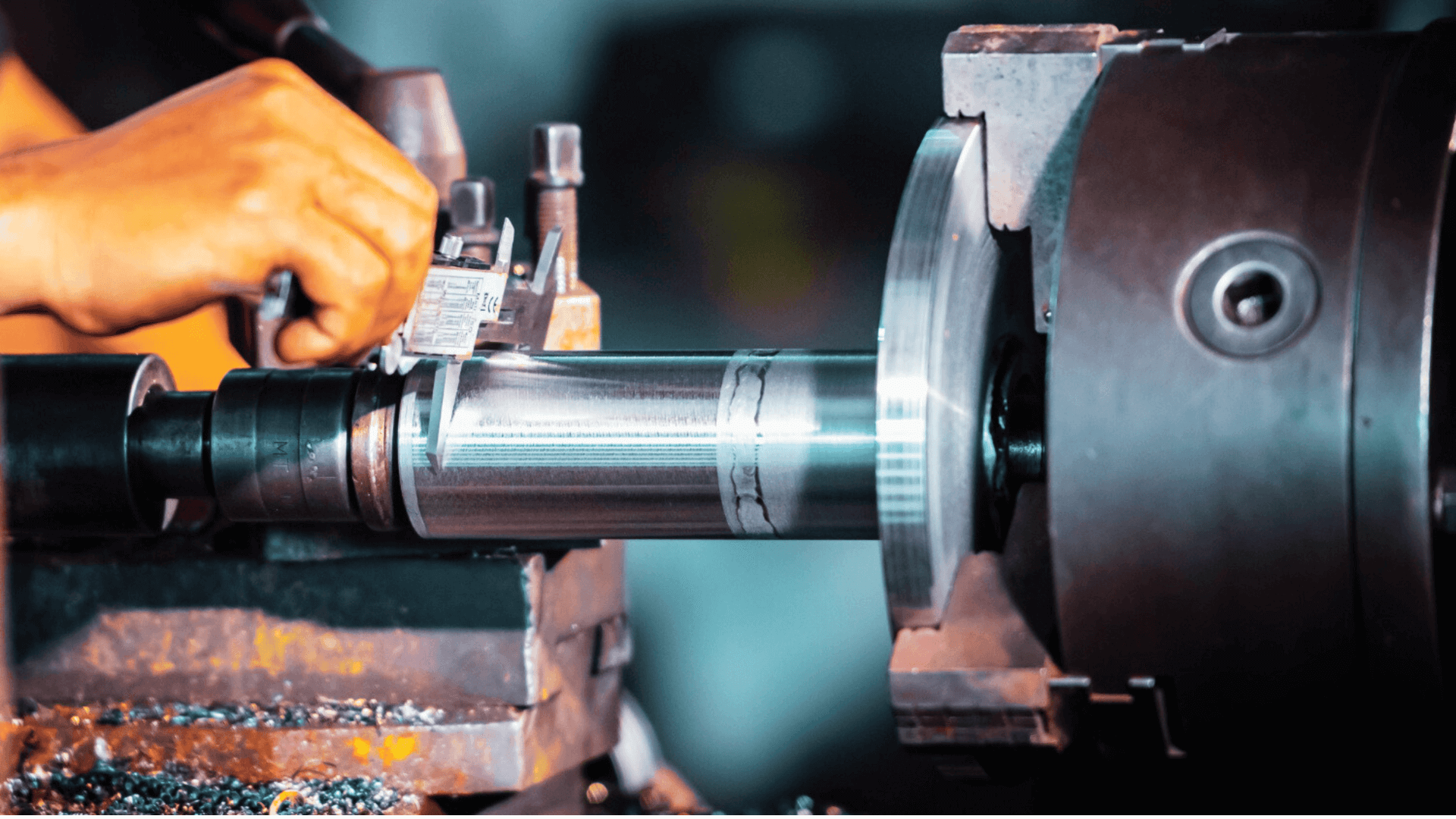

First-Time Machine Buyer? Discover Loan Options You Can Apply for Today

Purchasing your first machine is a significant investment decision for any business. However, high upfront costs and limited access to funds often make financing essential. A well-structured machinery loan helps first-time buyers manage cash flow and invest in equipment that supports long-term productivity and business growth.

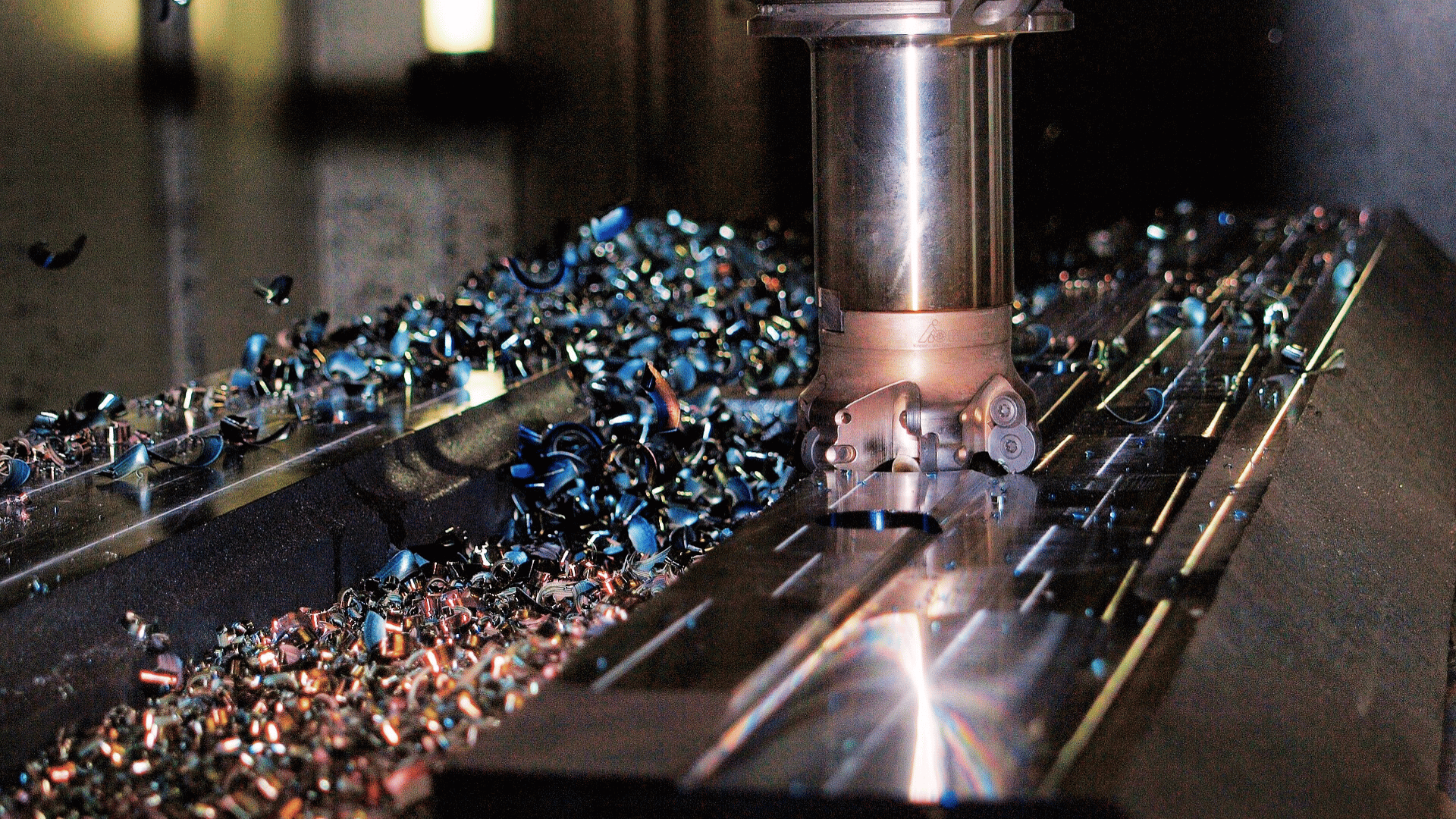

Challenges in Machine Purchases for First-Time Borrowers

Machine purchases involve significant capital commitments, which can be difficult for first-time borrowers to manage. Limited credit history often limits access to larger loan amounts or more favourable terms. Uncertainty around repayment tenure, interest rates, and monthly EMIs can delay decision-making for first-time borrowers.

There is also a lack of general information around equipment financing options. Many businesses are unsure whether working capital, asset purchase loans, or machinery loans are better suited to their financial situation. Understanding the equipment lifecycle and productivity ROI is essential before evaluating financing options.

Businesses often compare machinery loans with personal loans or term loans. However, these options typically fund short-term needs, such as medical expenses, rather than capital investment. Machinery loans differ in loan eligibility criteria, repayment tenure, and monthly instalments, helping borrowers assess the amount of money, credit limit, and repayment terms and choose financing within their budget.

Machinery Loan Options for First-Time Borrowers

First-time buyers can choose from several financing routes, depending on eligibility, repayment flexibility, and approval process.

Equipment Loans from Banks

Banks offer structured loans with fixed interest rates and defined repayment terms. These usually require a formal loan application, KYC documents, and detailed financial records. Collateral, such as a piece of land or commercial property, may be necessary. Processing timelines are typically longer, but terms are predictable.

Machinery Loans from NBFCs and FinTechs

NBFCs such as Electronica Finance Limited, an RBI-registered lender, offer machinery loans designed specially for equipment financing for SMEs. These options often include faster loan approval, competitive interest rates, and flexible repayment options. Many loans are unsecured, reducing the need to pledge an existing home or other assets. Borrowers also benefit from professional advice and personalised support throughout the application process.

Government-Backed MSME Loans

Government-backed MSME loan programmes provide financial help through collateral-free or low-interest structures. These schemes are designed to offer favourable repayment tenure and support first-time borrowers who may have limited access to traditional credit.

Vendor or Supplier Financing

Some equipment suppliers offer EMI-based plans or deferred payment options. These arrangements allow businesses quick access to machinery, with predefined monthly payments and, in some cases, flexible pre-payment terms.

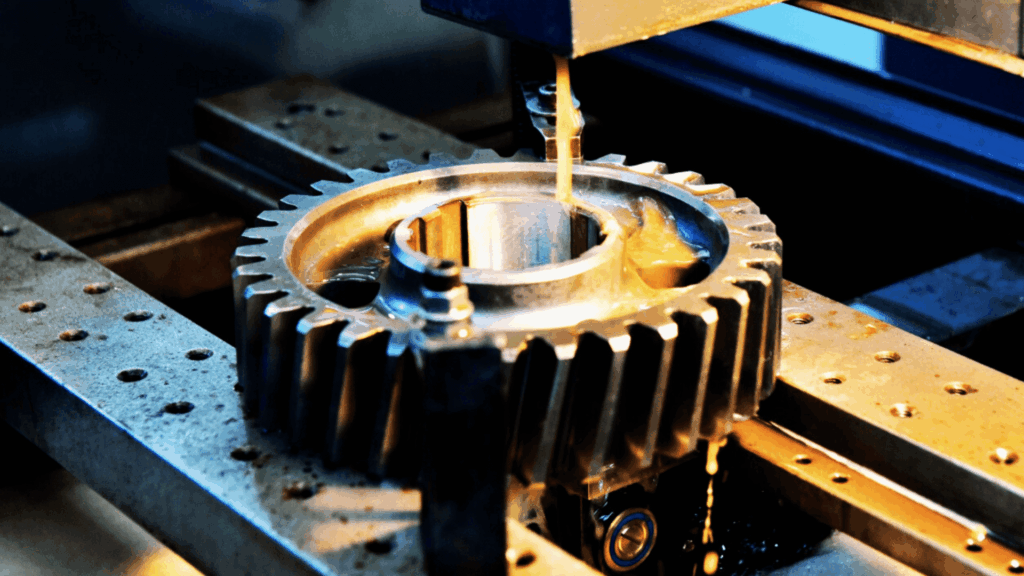

Machinery Loan Benefits for First-Time Borrowers

A machinery loan for first-time buyers offers multiple advantages:

- Preserves working capital by reducing upfront expenditure

- Affordable EMIs make repayment manageable

- Tax benefits like GST Input Tax Credit and accelerated depreciation

- Faster ROI through improved efficiency and upgraded equipment

- Supports the ability to scale operations without financial strain

Note: Machinery loans allow businesses to claim depreciation, reducing taxable income. This regulation can be leveraged by MSMEs to aid their growth.

How to Choose the Right Machinery Loan

Selecting the right loan requires careful financial planning. Businesses should compare loan interest rates, processing fees, and repayment tenure to ensure EMIs remain within budget. Evaluating collateral requirements, lender credibility, and transparency in terms and conditions is equally important. Reviewing indicative loan amounts and seeking professional advice can help borrowers make informed decisions aligned with their operational needs.

During the application process, lenders review an application form, KYC documents, and business details with professional discretion. A machinery loan application is assessed by an experienced advisor who can advise on repayment structures and help borrowers plan comfortably.

Explore faster machinery loans with the EFL Clik App.

Conclusion

For first-time buyers, a machine loan helps manage upfront costs while maintaining cash flow. By comparing loan options, repayment tenure, and eligibility criteria, businesses can assess their financing needs strategically and invest in machinery at the right time to support sustainable growth

FAQs

What loan options are available for first-time machine buyers?

Banks, NBFCs, MSME schemes, and supplier financing offer machinery loan options with varying eligibility, repayment tenure, and EMI structures.

Can startups apply for machinery loans?

Yes. Startups and first-time borrowers can apply, as lenders assess business potential and basic financial information.

What documents are required to apply for a machine loan?

KYC documents, GST details, and basic financial statements are typically required during the application process.

Are government-backed loans available for buying machines?

Yes. MSME government-backed loans provide financial support for machinery purchases through favourable terms and lower interest structures.

How much loan amount can a first-time buyer get for machinery?

The loan amount depends on eligibility, with some NBFCs offering machinery loans up to ₹3 crore.