For many businesses, especially Small and Medium Enterprises (SMEs), buying business-critical equipment outright or more than once is not feasible. Equipment financing allows you to purchase equipment through structured equipment loans and leases, preserving cash flow and unlocking growth.

Many organisations, big and small, rely on several types of loans and financing options to keep the business running. Companies in the manufacturing, construction, healthcare, and agriculture sectors can make the best use of equipment loans.

This guide explains how equipment financing empowers business owners to grow without draining capital. Learn about loan vs. lease options, the application journey, pros and cons, and use cases.

Why Equipment Financing Matters for Businesses

Acquiring the necessary equipment and machinery helps businesses expand operations, improve productivity, and remain competitive. To make such a crucial choice about fulfilling your business needs, you must know what exactly you are getting and how it will help. Here are the benefits of machinery loans.

Preserves Working Capital and Cash Flow

For many small businesses in India, cash flow is the lifeblood of daily operations. Machinery loans or equipment financing provide a way to acquire the necessary equipment without a large upfront payment. Instead of spending a significant portion of your working capital on equipment, you can finance the purchase and pay EMIs over a period of time. This helps you maintain healthy cash flow and ensures that the day-to-day operations of your business are not disrupted.

Access to the Latest Technology

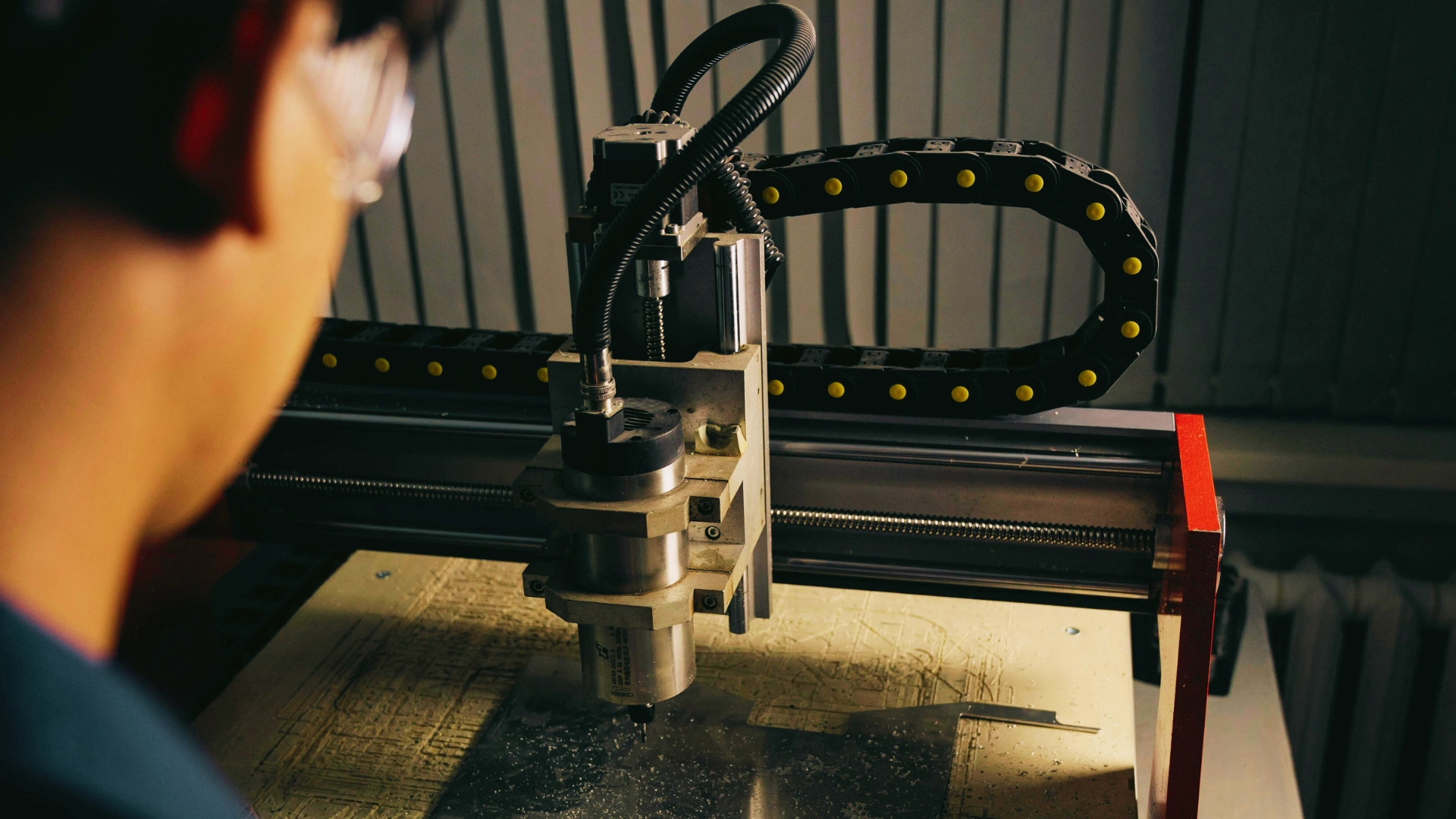

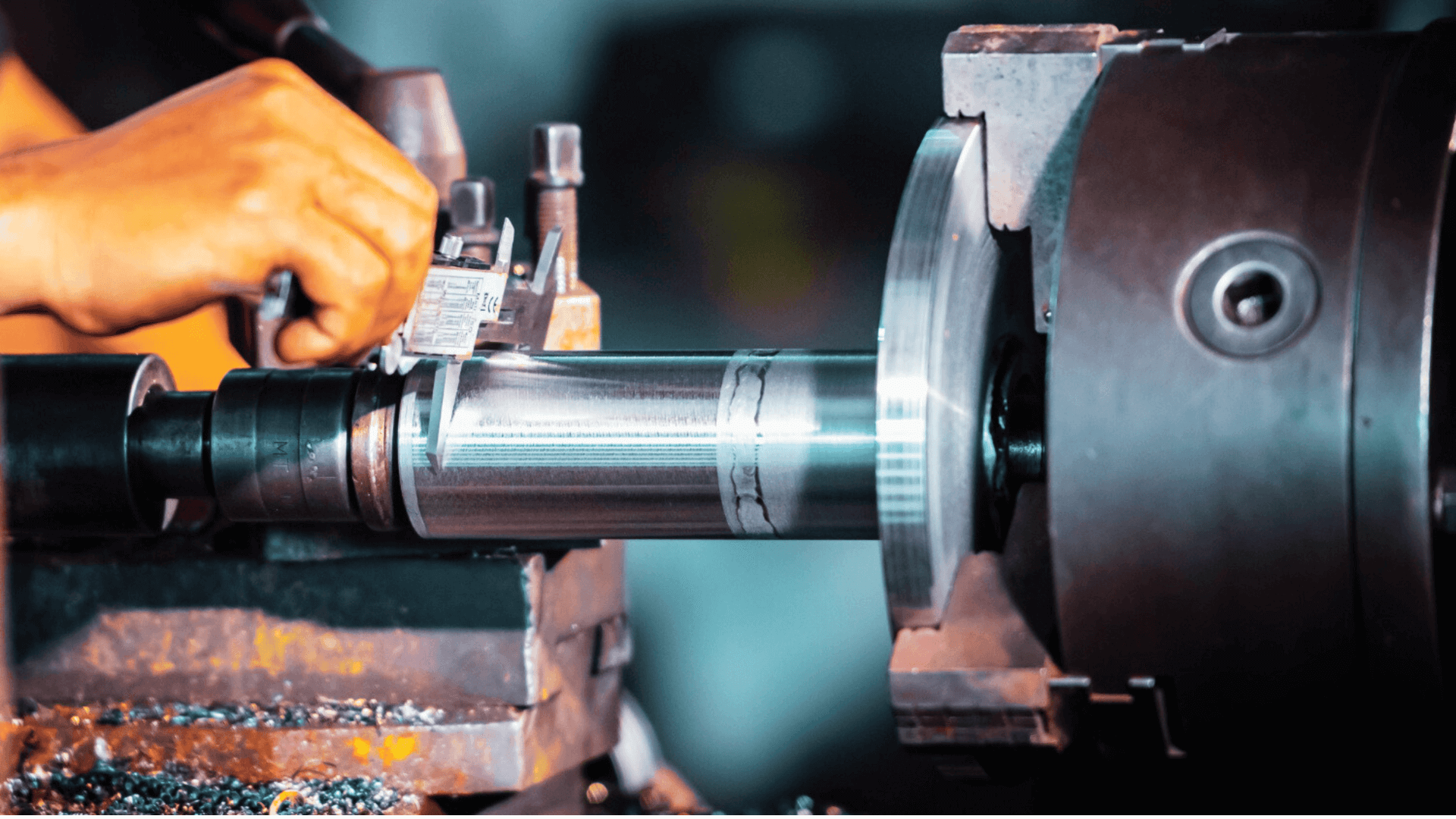

Staying updated with the latest technology is crucial to remaining competitive. This is particularly true for industries such as manufacturing, construction, healthcare, and IT, where outdated equipment can lead to inefficiency, lower productivity, and increased downtime.

With equipment financing, businesses can acquire cutting-edge technology and machinery without waiting for years to save up the funds. By spreading the cost over time, small business owners can stay current with the latest equipment, enabling them to improve product quality, enhance service delivery, and optimise operations.

Tax Benefits and Depreciation Deductions

Businesses can benefit from significant tax deductions when they finance equipment. Both loan repayments and leasing costs may be tax-deductible under Section 37 of the Income Tax Act, 1961. This means that by acquiring machinery through financing, you can lower your taxable income, reducing the overall tax liability of your business.

Moreover, machinery and equipment depreciate over time, and this depreciation can also be claimed as a tax deduction. When you finance machinery through a loan, the equipment becomes an asset on your balance sheet, and its depreciation can be accounted for annually. This allows businesses to claim tax relief on the equipment’s depreciation, further reducing their tax burden.

Flexible Financing Options

Equipment financing is available in multiple forms to cater to different business needs. You can get such a loan from a bank or an NBFC at more convenient terms. Whether you want to own the equipment eventually or prefer using it for a fixed period, there is a suitable financing option for you.

Flexible terms and convenient interest rates help small businesses choose a solution that suits their financial situation, cash flow cycles, and long-term goals. By offering low monthly payments, equipment financing allows businesses to acquire expensive machinery without overburdening their budgets.

Mitigate Risk and Protect Assets

Financing equipment reduces the risk of making large upfront investments in machinery. If, for any reason, the equipment is no longer needed, businesses are not stuck with an underperforming or unnecessary asset.

Types of Equipment Financing Options

One of the significant challenges of purchasing machinery outright is that it ties up your capital for the long term. But there are other ways of dealing with a risk. You could use your latest equipment through different methods. There are four main equipment financing options to explore:

- Equipment loans: Borrow funds to purchase the equipment, with the asset itself serving as collateral. Loan-to-value ratios may reach up to 90% for new gear and 75% for used machines.

- Equipment leasing: Rent a machine under a lease agreement for a fixed period. You can either return it or purchase the equipment at the end of the lease. The equipment leasing method sidesteps ownership without giving up usage.

- Hire-purchase/Lease-to-own: Pay EMIs to lease the equipment, but the title transfers to you at the end. It blends loan and lease advantages.

- Refinancing/upgrade: If you already own equipment, refinance it to get upgraded equipment or free up working capital.

Equipment Loans vs. Equipment Leasing

Choosing between equipment loans and equipment leasing depends on your priorities:

Equipment Loans

- You own the equipment upfront and repay via fixed EMIs over 2–5 years (sometimes longer).

- Equipment itself is collateral for the loan, usually eliminating the need for other assets.

- You build equity and can sell the equipment anytime.

Equipment Leasing

- Ownership remains with the lender or vendor

- Offers a lower upfront cost and flexibility to swap outdated gear

- At the end of the lease term, you can return the equipment or negotiate to buy it

Use leases if you need newer machinery more frequently; use loans if long-term ownership and tax depreciation are your goal.

How to Apply for Equipment Financing

Numerous banks and NBFCs provide loans for new equipment. But your choice must account for the ease of application and eligibility criteria. Electronica Finance has tailored a simple, quick process for machine loans:

Assess your equipment needs: Decide what type of equipment you need, how it fits your business plan, and what ROI you expect.

Check eligibility with the eligibility calculator.

However, generally, these are the eligibility criteria for most financing solutions:

- Credit score of 700+

- Business vintage of 2–3+ years

- Positive cash flow and financial statements

- At least one owned premise

Gather this documentation:

- Three years’ ITR and Balance Sheet

- 12 months’ bank statements

- GST returns

- KYC (PAN, Aadhaar)

- Premises ownership proof

- Proforma invoice or quotation

- 12 months’ electricity bills

Submit your application: Provide all documents plus a business plan detailing machine use, costs, and repayment plan.

Receive evaluation: The lender assesses your credit score, cash flow, and the type and condition of the equipment.

Fast approval and disbursal:

- Loans up to ₹3 crore or 75% of the equipment cost

- No need for additional collateral

- Approval within 3 working days; funds disbursed within 7 days

Pros and Cons of Equipment Financing

Businesses need a clear idea of what they are getting into. You will need to align the repayment schedule with your revenue cycle and make sure you have the EMIs coming in. Let’s weigh the real features of a machinery loan against its drawbacks.

Pros

- Preserves working capital: No need to pay full cost upfront

- Tax advantages: Depreciation and interest costs are deductible

- Access to better gear: Stay competitive by financing modern equipment

- Easy applications: EFL’s streamlined process makes it quick and hassle-free

- No collateral beyond equipment: Hypothecation keeps other assets safe

Cons

- Interest cost: Rates vary from ~7.5% to 30%, depending on equipment and lender

- Obligation for payments: Even if the machine becomes less useful, payments continue

- Equipment ownership limits: Leasing may restrict usage or modifications

- Vendor dependence: Vendor financing (like vendor notes) can bring less favourable terms

Conclusion

Equipment financing, whether through loans, leases, or hire-purchase agreements, is your gateway to acquiring necessary machinery without draining funds or disrupting business operations. It offers multiple advantages: preserving cash flow, gaining tax benefits, accessing modern equipment, and providing flexible financing solutions tailored to your needs.

Explore easy and quick loan application and approval processes with EFL. You can apply for a machinery loan online through the EFL Clik App.

FAQs

What is equipment financing, and why is it important for businesses?

Equipment financing is a loan or lease used to acquire machinery or tools for business operations. It helps preserve cash flow, allowing businesses to acquire necessary equipment without significant upfront costs, ensuring smooth operations and growth.

How do equipment loans work?

Equipment loans provide businesses with funds to purchase machinery, with the equipment serving as collateral. The borrower repays the loan in fixed instalments over a set period, typically 2-5 years, while retaining ownership of the equipment.

How can businesses qualify for equipment financing?

Businesses typically need a good credit score (700+), a solid financial history, at least 2-3 years of operation, and sufficient cash flow. Lenders also evaluate the type of equipment and its projected value to the business.

Which industries typically use equipment financing?

Manufacturing, construction, healthcare, agriculture, IT, and logistics industries commonly use equipment financing to acquire machinery, vehicles, and technology. This helps them scale operations and stay competitive.

What are the risks associated with equipment financing?

Risks include the possibility of defaulting on payments, the equipment losing value, and the equipment becoming obsolete before the loan is repaid. Additionally, leasing may limit control over the equipment’s use.

Can equipment financing help my business get new technology or tools?

Yes, equipment financing allows businesses to acquire new technology, machinery, or tools without upfront capital expenditure. This helps businesses stay updated with the latest advancements and improve efficiency.