Banks Declining Your Business Loans? The Smartest Solution for Small Business Owners

For many Indian business owners, access to timely funding can make or break growth plans. Yet, traditional bank loans often come with rigid requirements, such as high credit scores, multiple years of profitability, and extensive documentation. If a bank declines...

Why Unsecured Business Loans Are a Smart Choice for Growing Retail and Distribution Small Businesses in India

In retail and distribution, maintaining a steady cash flow often determines how smoothly a business runs. Small retailers and distributors constantly juggle inventory restocking, seasonal demand, supplier payments, and customer credit terms, all while keeping daily operations afloat. Traditional bank loans, though familiar, aren’t always the...

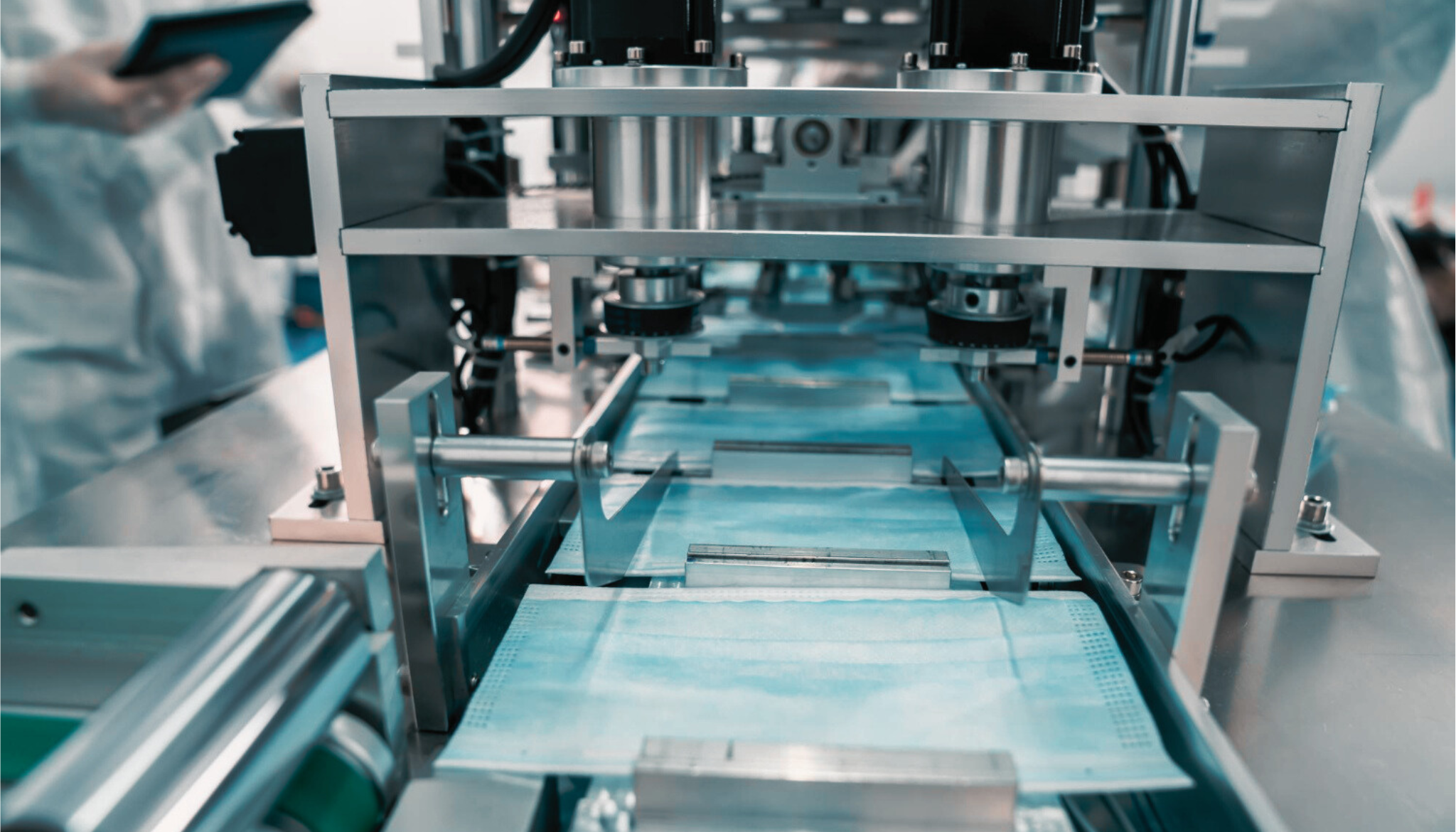

Textile or Plastic Manufacturing Machinery Loans: Equipment Loan Without Collateral

Starting or scaling a small manufacturing enterprise is tough when machinery costs are high and collateral is hard to arrange. A loan is undoubtedly the most convenient option. The question is, which loan, and how to get it? If you’re a first-time founder...

Unlocking Business Growth with Unsecured Business Loans in India

Running a business today is more dynamic than ever. Markets move quickly, customer preferences shift overnight, and opportunities can disappear just as fast as they appear. To keep pace, businesses often need immediate funding to stock up inventory ahead of...

Facing Production Delays? Get a Machinery Loan for Your Business

Facing production delays can be a major setback for any business, especially for smaller manufacturers relying on the efficiency of their machinery. Malfunctioning or outdated machines can halt operations, disrupt cash flow, and delay product deliveries. Fortunately, a machinery loan...

Facing Supplier Pressure? Use BLAP to Settle Dues Without Dipping into Savings

For many MSMEs in India, supplier pressure strains financial stability. Delayed payments, rising credit card debt, and tight cash flow can make businesses vulnerable to legal action or loan default. Traditional solutions like using a personal loan or dipping into...

Choosing an Unsecured Business Loan? Avoid These Common Mistakes

For many small and mid-sized businesses in India, unsecured business loans are a lifeline. Whether it’s stocking up for a festive season, bridging cash flow gaps, or funding an expansion, these loans help businesses move forward without pledging property or...

Know All About Fully Automatic Paper Bag Making Machines

The surge in demand for eco-friendly packaging has made paper bag manufacturing a fast-growing sector in India. Entrepreneurs, from small-scale operators to large commercial players, are exploring paper-bag-making as a sustainable business opportunity. And at the centre of it all...

What are the Current Unsecured Business Loan Interest Rates?

Understanding unsecured business loan interest rates is essential for any business owner or entrepreneur looking to secure financing. Whether you’re a small business owner or managing a growing company, knowing what influences business loan interest rates can help you make...

Why Consider a Machinery Loan or an Equipment Loan for Your Business?

When a business grows, it often hits a point where manual processes or ageing equipment can no longer keep up with rising demand. Efficiency depends heavily on the quality of your machines. Yet, buying modern equipment outright is no small...