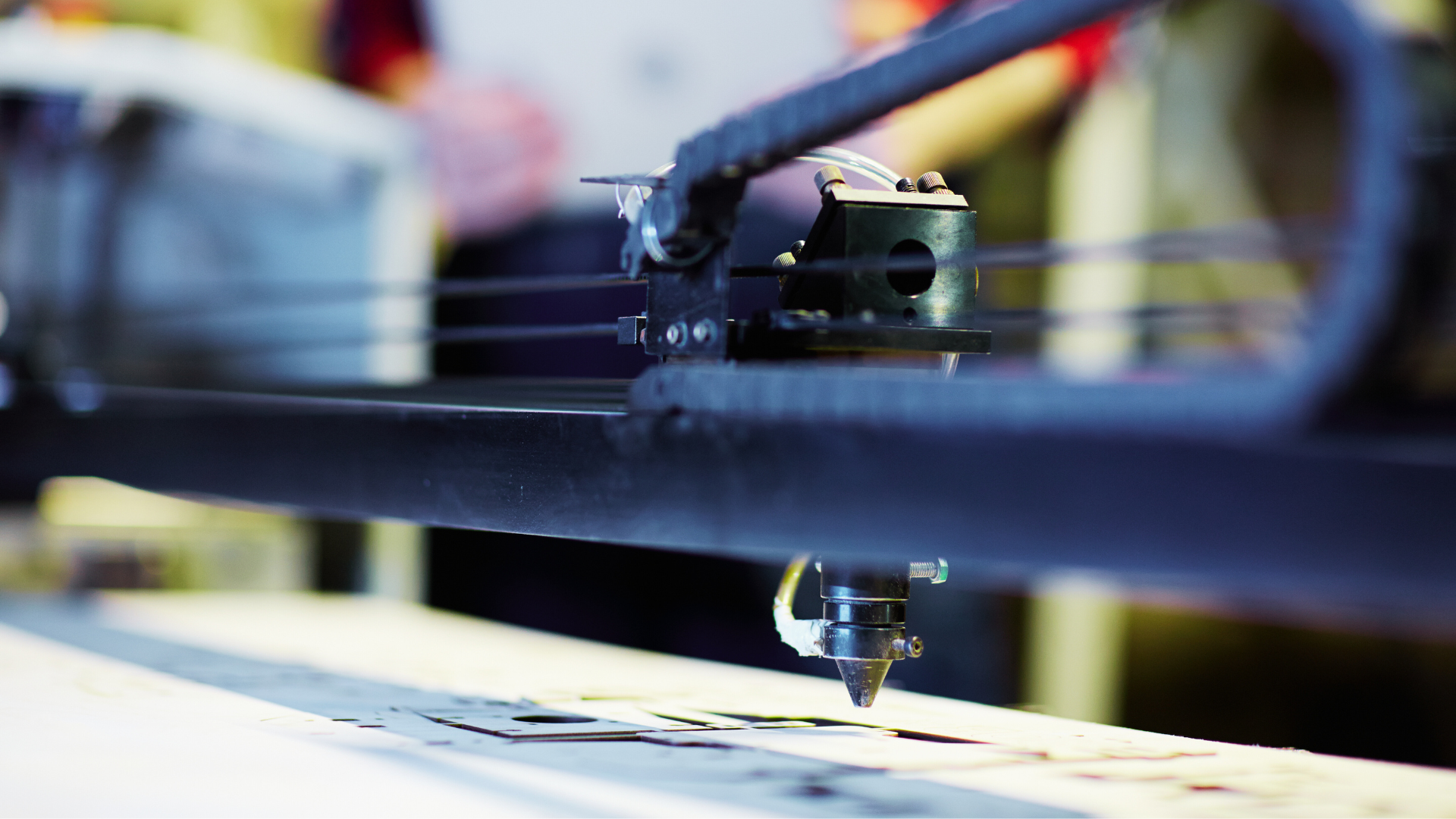

In the world of business financing, there is often a need for innovative solutions to secure loans and meet your financial goals. One such innovative approach is using machinery as collateral for loans. If you are a business owner in India, this option might be more accessible than you think. In this blog, we will explore the possibilities of using machinery and equipment as collateral and how Electronica Finance Limited can help you leverage this option for your business.

Understanding Loan Types

Electronica Finance Limited, a pioneering name in the financial industry, offers a range of loan products tailored to the specific needs of businesses. Their offerings include machine and equipment loans, loans against property, rooftop solar loans, MSME loans, working capital loans, and business loans. But can your machinery serve as collateral for these loans?

Benefits of Using Machinery as Collateral

The answer is a resounding yes. The ability to use machinery as collateral for loans brings several benefits to the table. Electronica Finance Limited understands the unique needs of businesses, and its approach reflects it. Here is a quick overview of the advantages:

1. Maximum Loan Amount Up to Rs. 3 Crores

When you are in need of substantial financial support, Electronica Finance Limited can provide loans of up to Rs. 3 Crores, helping you meet significant business expenses.

2. Loan Disbursal Within Three Working Days

In the fast-paced world of business, time is often of the essence. Electronica Finance Limited ensures that funds will be disbursed and processed within three working days, ensuring that your financial needs are met promptly.

3. No Collateral Required

What is unique is that you do not necessarily need additional collateral; your machinery can serve as collateral for the loan, making the loan accessible to a wider range of businesses.

4. Easy and Transparent Application Process

The application process is streamlined and transparent, simplifying the way you secure financing for your business.

5. Customised Nationwide Services

Electronica Finance Limited’s services are customised to suit the specific needs and locations of businesses across India.

6. Unbeatable After-sales Support

Electronica Finance Limited’s unwavering commitment to after-sales support ensures you have peace of mind throughout your financial journey.

7. Documents Required

The documentation for the machinery loan process is hassle-free, ensuring that you can secure a loan without any complications.

8. 30+ Years of Experience

With over three decades of experience, Electronica Finance Limited’s expertise is unmatched in the industry.

9. Serving More than 35,000 Customers

The company’s track record speaks for itself, having successfully served over 35,000 customers.

Loan Application and Approval Process

The application and approval processes are designed to be user-friendly and transparent. You can rely on Electronica Finance Limited to guide you through the process seamlessly.

Machinery Valuation and Assessment

Curious about how your machinery’s value is determined? Electronica Finance Limited has a team of experts to assess the worth of your machinery, ensuring a fair and accurate valuation.

The Role of Machinery in Loan Security

Machinery serves as a reliable form of loan security. It provides a strong foundation for securing loans, and Electronica Finance Limited recognises its importance in the lending process.

Expertise and Trust

When you choose Electronica Finance Limited for your financial needs, you are opting for a company that not only offers loans but also demonstrates expertise, authority, and trust in the niche. Your business’s financial well-being is in experienced hands.

Legal Aspects and Considerations

While machinery as collateral is an innovative approach, it is essential to understand the legal aspects and considerations involved. Electronica Finance Limited ensures that your financial transactions are within legal boundaries.

Conclusion

In conclusion, using machinery as collateral for a machinery loan is not only possible but also a smart financial move for your business. It opens avenues for securing loans without additional collateral, and Electronica Finance Limited’s offerings are tailored to make this process seamless.

Frequently Asked Questions

Is machinery a common form of collateral for business loans?

Yes, machinery is a relatively common form of collateral for business loans, especially in industries where equipment and machinery are essential for operations. Using machinery as collateral allows businesses to secure financing while leveraging their existing assets.

What are the advantages of using machinery as collateral for a loan?

The advantages of using machinery as collateral for a loan include:

- Access to financing without the additional collateral

- Higher loan amounts, as machinery values can be significant

- Faster loan processing due to the tangible nature of collateral

- Simplified documentation and a streamlined application process

- No personal assets required as collateral

How is the value of machinery assessed when used as collateral?

The value of used equipment as collateral is assessed by expert appraisers who consider factors such as the machines’ brand, age, condition, market value, and potential resale value. The assessment aims to determine the fair market value of the machinery.

Can I use older machinery as collateral, or does it have to be new?

You can use older machinery as collateral, as the value of machinery is not solely dependent on its age. The condition, functionality, and market demand for the machinery are more critical factors in determining its suitability as collateral.

What types of loans accept machinery as collateral?

Several types of loans accept machinery as collateral, including Equipment Loans, Machinery Loans, Working Capital Loans, and Business Expansion Loans. Electronica Finance Limited, for instance, offers a range of loan products that accept machinery as collateral.

Are there any risks involved in using machinery as collateral for loans?

While using machinery as collateral offers several advantages, there are some risks, such as the potential loss of machinery if loan repayments are not made. However, responsible fiscal management can mitigate these risks.

How does Electronica Finance Limited facilitate machinery-based loans?

Electronica Finance Limited simplifies the process by offering a streamlined application and approval process, conducting expert machinery assessments, and providing a transparent, hassle-free experience for borrowers.

In industries like machine tools, plastic, printing, wood working, textile, and food packaging, businesses can borrow against their used machines also.

What happens if one cannot repay the loan when machinery is used as collateral?

If one cannot repay the loan, the lender may take possession of the machinery used as collateral to recover the outstanding amount. It is essential to communicate with the lender to explore alternative solutions before defaulting.

Do I retain ownership of the machinery when it is used as collateral?

You typically retain ownership of the machinery when it is used as collateral, but the lender holds a lien on it until the loan is fully repaid. Once the loan is paid off, the lien is released, and you regain full ownership.

Are there tax benefits associated with using machinery as collateral for business loans?

There can be tax benefits, such as potential deductions on the interest rates paid on the loan. It is advisable to consult a tax professional to fully understand the tax implications based on your specific situation.

What is acceptable collateral for a loan?

Acceptable collateral for a loan can vary based on the lender, but it often includes assets like real estate, vehicles, machinery, equipment, inventory, and accounts receivable. The suitability of collateral depends on the lender’s policies and the nature of the loan.