Key Takeaways

- The Growing Role of Solar Loans in India: Solar loans are becoming an essential tool to help businesses and homeowners adopt solar power.

- Government and Private Sector Support: The Indian government and private financial institutions are introducing schemes and loans to promote rooftop solar installations.

- Challenges in Solar Financing: High initial installation costs and complex loan processes remain significant barriers to solar adoption.

- Benefits of Solar Investment: Solar power leads to lower operating costs, energy independence, increased property value, environmental benefits, and government incentives.

- Improved Loan Options: Cheaper solar loans, flexible repayment terms, and simplified processes could accelerate solar adoption.

- Solar Loan Amounts: Loans up to ₹3 crore are available for solar installations, with collateral-free loans up to ₹50 lakh.

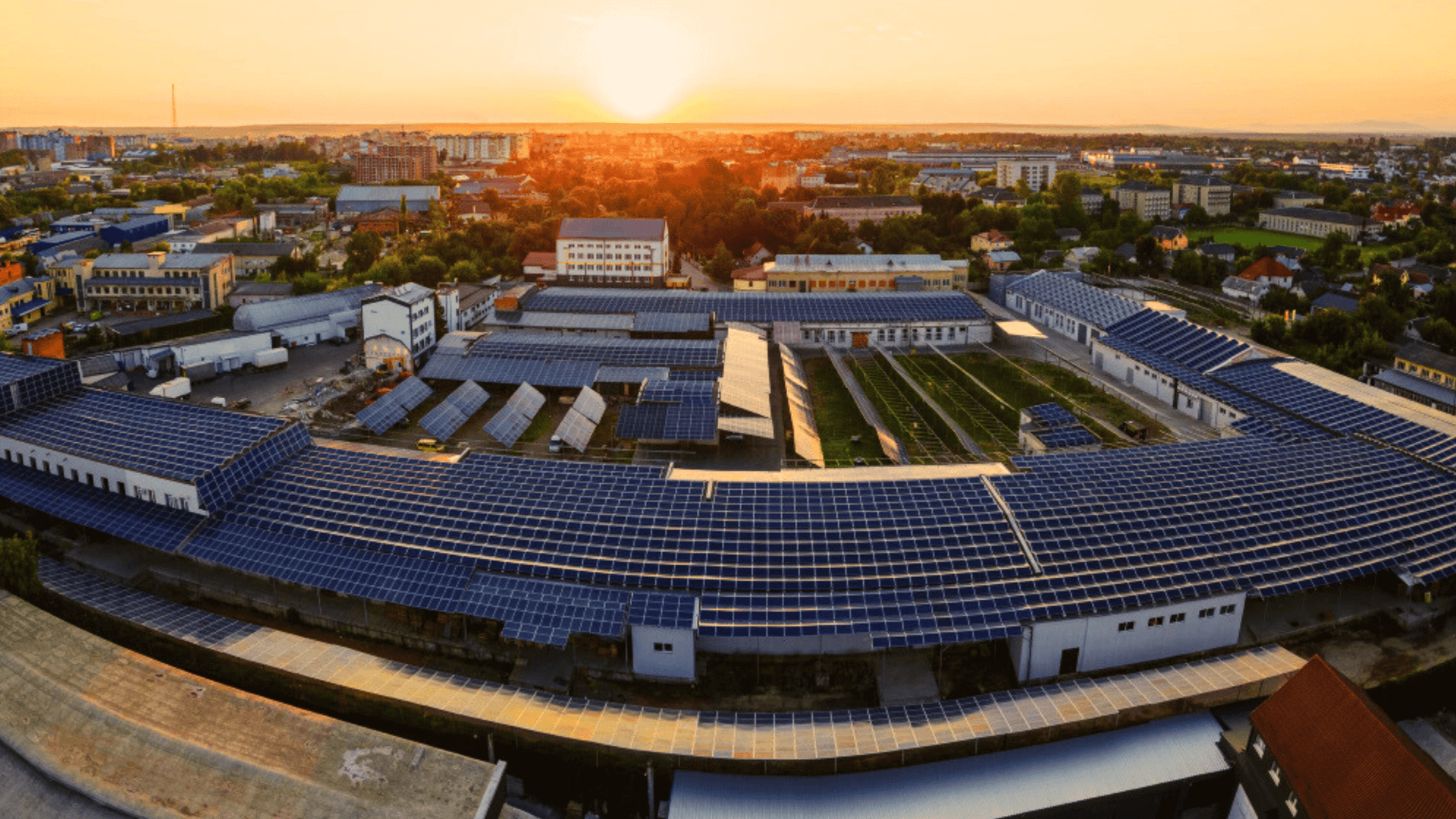

Cheaper Loans Could Take Solar Power to More Rooftops in India

As India accelerates its switch to renewable energy, solar installation loans have become a crucial tool for empowering businesses and homeowners to go solar. The landscape of solar financing in India is evolving with more accessible options. These loans not only make solar adoption financially viable but also promote sustainability and cost savings for commercial, industrial, and residential properties across the country.

India’s commitment to sustainable energy is reflected in its ambitious goals for renewable energy generation. With an aim to reach 500 GW of renewable energy by 2030, the government is pushing for a massive expansion of solar power across the country.

Solar financing in India plays a pivotal role in this transition. By tapping into unused rooftop spaces, properties can contribute to the country’s green energy goals while benefiting from lower energy costs and tax incentives.

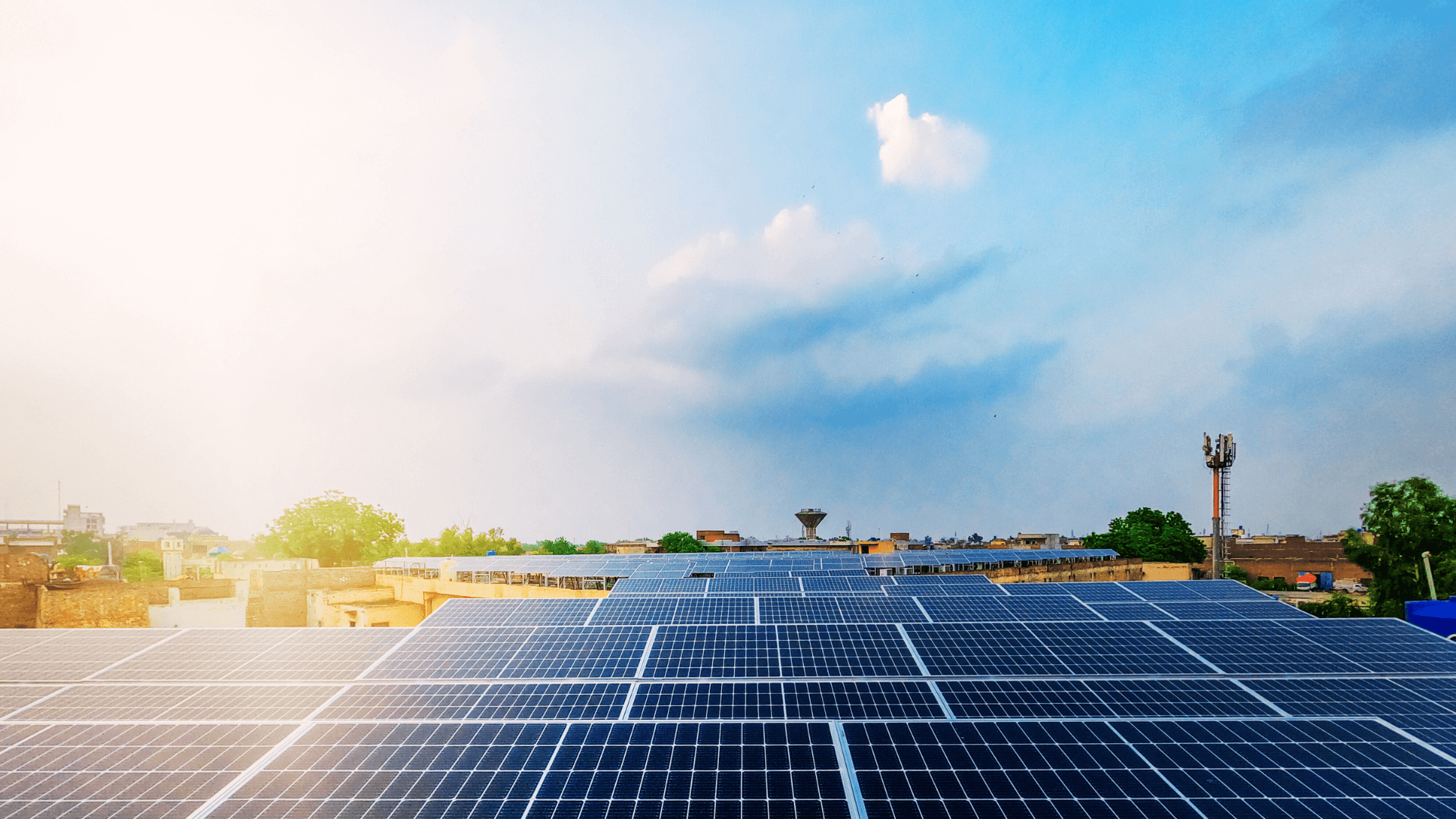

Despite these benefits, the adoption of solar power rooftop systems faces reluctance due to the high upfront installation costs.

The Rise of Rooftop Solar in India

Over the past few years, solar power systems have gained popularity in India, especially for commercial and industrial uses. As energy costs rise and the demand for sustainable solutions grows, businesses are increasingly turning to solar projects as a smart, long-term investment in energy efficiency.

One of the key drivers of this rise is the flexibility in getting a solar loan. These loans cover a significant portion of the installation cost and make it easier for businesses to invest in renewable energy projects without worrying about hefty initial expenses. Solar rooftop power systems offer cost savings on electricity bills, improved energy efficiency, and a reliable power source, which are attractive features for organisations looking to get rid of high operational costs.

Why Solar Financing is Still a Major Barrier

Although the potential for rooftop solar energy is immense, many still face challenges when it comes to financing. The high initial cost of solar installation remains a significant hurdle, as small businesses often do not have the financial bandwidth to make upfront investments in solar energy systems.

While the Indian government offers subsidies and financial support through various schemes, the traditional loan application process can be cumbersome and lacks clarity. Many enterprises are unaware of these options or find the process difficult to navigate.

How Cheaper Solar Loans Can Accelerate Adoption

Cheaper loans for solar can be a game-changer for accelerating solar adoption in India. By lowering interest rates and offering flexible repayment terms, lenders can make solar energy more accessible.

- Reduced interest rates

- Longer repayment periods

- Simplified loan processes

These measures would not only increase solar adoption but also align with India’s broader energy goals by creating a sustainable ecosystem for renewable energy.

Government and Private Sector Initiatives Supporting Solar Loans

The Ministry of New and Renewable Energy (MNRE) has introduced various initiatives to support the adoption of rooftop solar. The PM Surya Ghar Muft Bijli Yojana, which succeeds the National Solar Mission, offers subsidies for the installation of solar panels, particularly for residential buildings and businesses.

Private sector players, including banks and financial institutions, are also stepping up their efforts to offer tailored financing for solar adoption. These options often come with lower interest rates, longer repayment terms, and quicker approval processes.

Benefits Beyond Affordability: Why Solar Energy is a Smart Investment

While loans make solar more affordable, its long-term benefits extend far beyond cost savings. Here’s why investing in solar is a smart decision for all:

- Lower Operating Costs: By switching to solar energy, you can significantly reduce electricity bills, which is a large operating expense for most businesses.

- Energy Independence: Solar panels generate their own power and reduce reliance on the grid. This is particularly beneficial in areas with unstable power supply or frequent power cuts.

- Increased Property Value: Installing solar panels can increase the value of a property. Businesses or residential buildings that invest in solar energy can benefit from higher resale or rental value.

- Environmental Impact: Solar energy is a clean, renewable energy source that helps businesses reduce their carbon footprint. Adopting it allows you to contribute to India’s goal of reducing greenhouse gas emissions.

- Government Incentives: Through various schemes for MSMEs, you can receive financial incentives and tax rebates. These subsidies reduce the cost of initial investments and make it even more attractive to adopt solar.

What’s Needed to Make Financing More Accessible

Despite the growing availability of financing for rooftop solar power systems, there are still several challenges that need to be addressed to make financing more accessible:

- Awareness Campaigns: Many are unaware of available solar loan schemes. Awareness programs can highlight the benefits of solar loans and government schemes to boost renewable energy adoption.

- Simplified Loan Process: The application process for solar installation loans should be simplified to reduce complexity and encourage energy adoption.

- Flexible Loan Products: Financial institutions should offer loans with flexible terms and conditions that cater to the small and medium sectors.

- Digital Platforms: Digital platforms can streamline loan applications and make the process quicker, more transparent, and more accessible.

Conclusion: Financing the Future of Clean Energy

As India continues to focus on sustainability and clean energy, the role of solar loans will only increase. By offering affordable financing options and streamlining the loan application process, the central government and private sectors can encourage enterprises to adopt solar energy. Financing for solar in India is not just about saving costs; it’s about contributing to a greener, more sustainable future.

With initiatives like the solar scheme for MSMEs and the rise of digital platforms like the EFL Clik App, financing solar projects has never been more convenient. By lowering barriers to financing, India can take significant strides toward a cleaner, more energy-efficient future.

FAQs

How much loan can I get for a solar power plant?

You can avail a loan of up to ₹3 crore for solar. For amounts up to ₹50 lakh, the loan is collateral-free. Loans exceeding ₹50 lakh may require collateral, such as land, property, or machinery, depending on the lender’s discretion.

Which bank is best for solar loans in India?

When choosing the best bank for a solar loan, it depends on your preferences, loan requirements, and the specific terms you’re looking for. While many banks offer financing for solar, Non-Banking Financial Companies (NBFCs) are often a great option for businesses looking to install a solar system.

What is the maximum loan amount for financing rooftop solar for corporates?

Corporates can secure rooftop solar loans of up to ₹3 crore. For amounts up to ₹50 lakh, these loans are typically collateral-free. However, for loans exceeding ₹50 lakh, collateral may be required, depending on the specific lender’s terms.

What is the PM solar rooftop scheme?

The PM Surya Ghar Yojana, launched on February 13, 2024, aims to provide free electricity to 1 crore households through rooftop solar panel installations. The scheme offers subsidies of up to 60% for systems up to 2 kW capacity and 40% for systems between 2–3 kW, with a maximum subsidy of ₹78,000.

How to apply for a loan for a solar energy system?

To apply for a solar panel loan, you can use:

- Online Application: Visit the lender’s website and fill out the application form.

- EFL Clik App: Use the EFL Clik App for a seamless digital application process.

Documentation: Prepare necessary documents, such as:

- KYC documents (Aadhaar, PAN)

- 3 years of financial statements and ITR

- 12 months’ bank statements

- GST returns

- Electricity bills for the last 6 months

- Property ownership proof

- Eligibility Criteria: Ensure a credit score above 700 and ownership of at least one property.