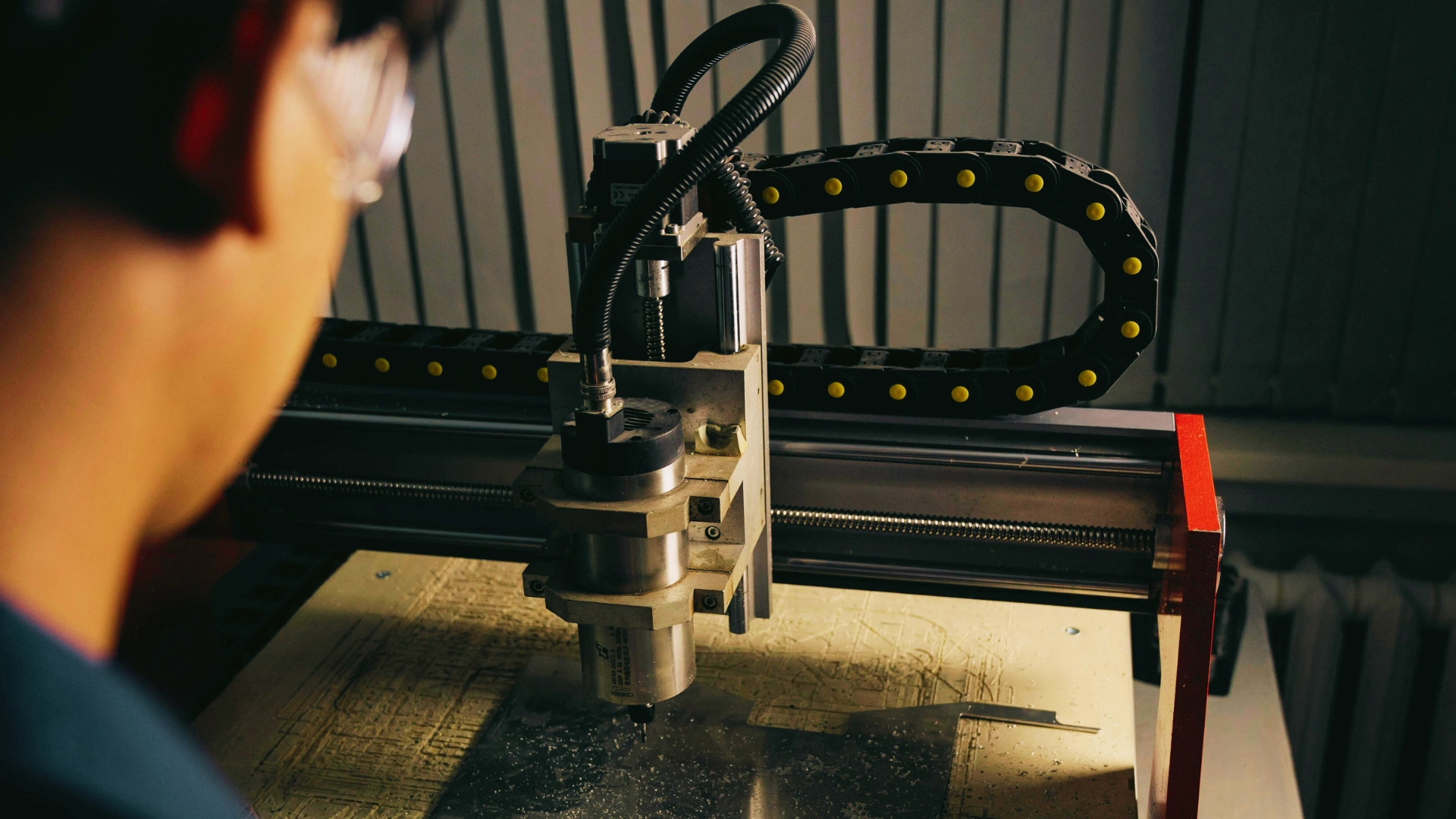

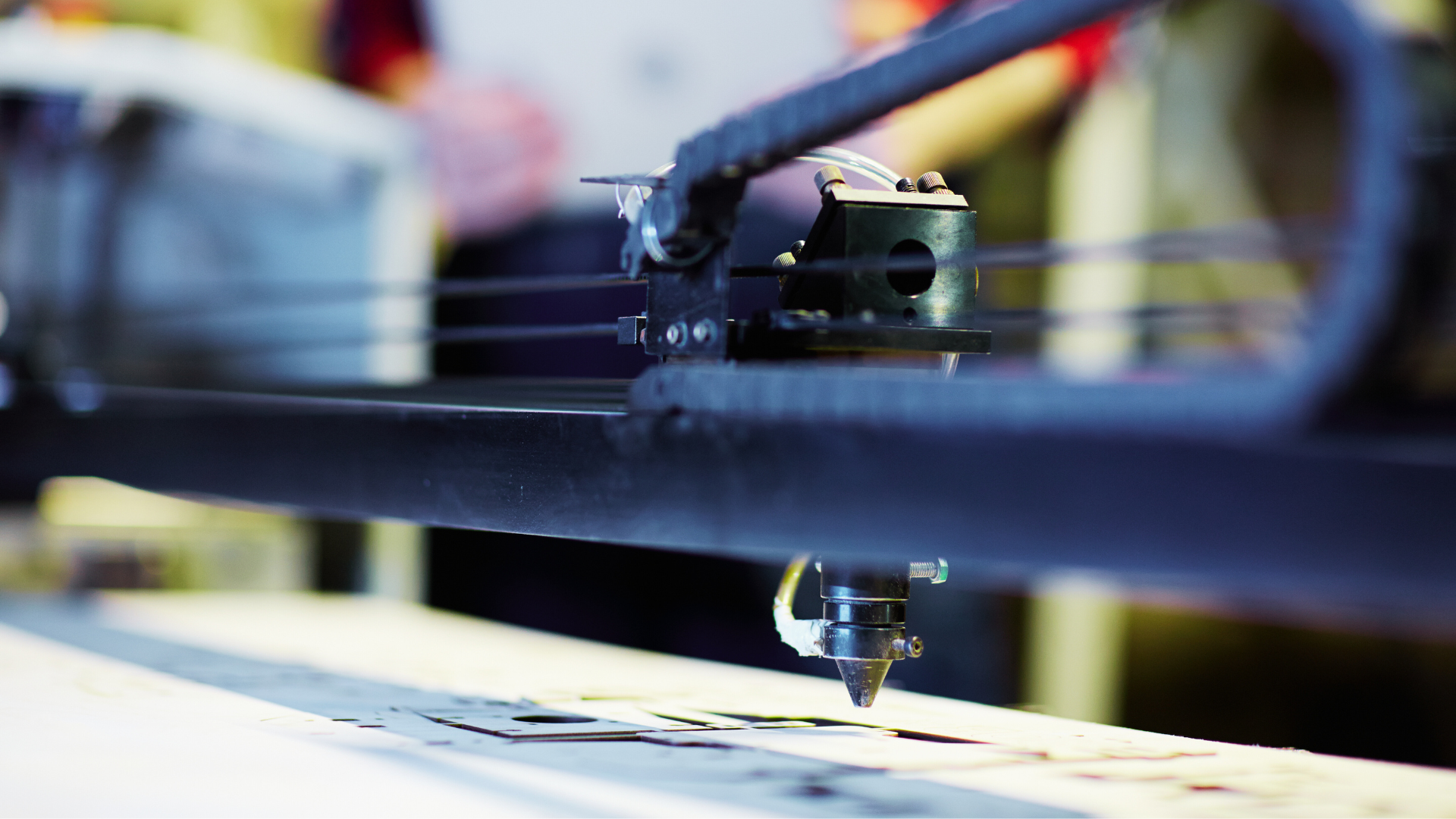

As far as small businesses are concerned, acquiring the right machinery is often a crucial part of the survival of the business. Small Machine Loans play a pivotal role in helping businesses secure the necessary equipment without significant upfront costs. This guide outlines the six essential steps to successfully apply for a Small Machine Loan, ensuring a smooth and informed process for aspiring business owners.

What is a small machine loan?

Small machine loans or small equipment loans help small and medium-sized businesses secure the necessary funding to get the machinery or equipment required to upscale their business processes and production.

The Six Essential Steps to Secure a Small Machine Loan:

- Qualifying for a Small Equipment Loan

To kickstart your journey, understanding the eligibility criteria is paramount. Most lenders will assess factors such as business stability, creditworthiness, and the purpose of the loan. Ensuring your business aligns with these requirements sets the foundation for a successful application.

- Choosing the Right Lender: Aligning Financing with Business Needs

Not all lenders are the same. Research and choose a lender whose terms align with your business goals. Consider interest rates, repayment terms, and additional services offered. Electronica Finance Limited stands out in this regard, providing customised nationwide services, hassle-free documentation, and unbeatable after-sales support.

- Crafting a Winning Business Plan for Equipment Financing

Presenting a compelling business plan enhances your credibility and increases the likelihood of loan approval. Outline your business goals, the purpose of the machine loan, and how the new equipment will contribute to your overall success.

- Financial Documentation: Strengthening Your Loan Application

Prepare and organise your financial documents meticulously. This may include income statements, balance sheets, and tax returns. Clear and transparent documentation reinforces your financial stability and instils confidence in the lender.

- Credit Score Matters

A healthy credit score is instrumental in securing favourable loan terms. Regularly monitor your credit score and take steps to improve it if necessary. A good credit score not only facilitates loan approval but also contributes to lower interest rates.

- Maximising Your Chances: Tips for a Successful Small Machine Loan Application

Fine-tune your application with these tips:

- Clearly articulate the purpose of the loan

- Provide accurate and up-to-date financial information

- Be prepared to explain any past financial challenges and how they have been addressed

- Show a strong business strategy and growth prospects

Availing Electronica Finance Limited’s Small Machine Loan: Unique Features for Business Growth

Electronica Finance Limited stands out in the market with unique features, including faster disbursal, no collateral requirements, and dedicated after-sales support. Our committed service to over 35,000 customers is a testament to our expertise in the field.

To improve your chances of getting equipment financing, ensure that you have a satisfactory track record, a business vintage of over 3 years, adequate monthly cash flow to serve EMI, and at least one self-owned property.

Apply for a small machine loan through EFL and avail our unique features, such as:

- Maximum loan amounts up to 75% of the price of equipment or Rs. 3cr (whichever is lower).

- Loan term up to 5 years.

- Flexible interest rate based on customer profile.

- Loan disbursement within 7 days.

- No additional collateral required.

Thus, small machine loans are an effective way to not only increase your performance but also stay up to date with trends in your respective industry.

Conclusion: Empowering Small Businesses Through Small Machine Loans

In conclusion, a small machine loan can be a vital investment for the growth of your small business. Follow these six steps, leverage Electronica Finance Limited’s expertise, and embark on a journey of business expansion with the right machinery.

For more information on small machine loans and how Electronica Finance Limited can support your business, contact us.