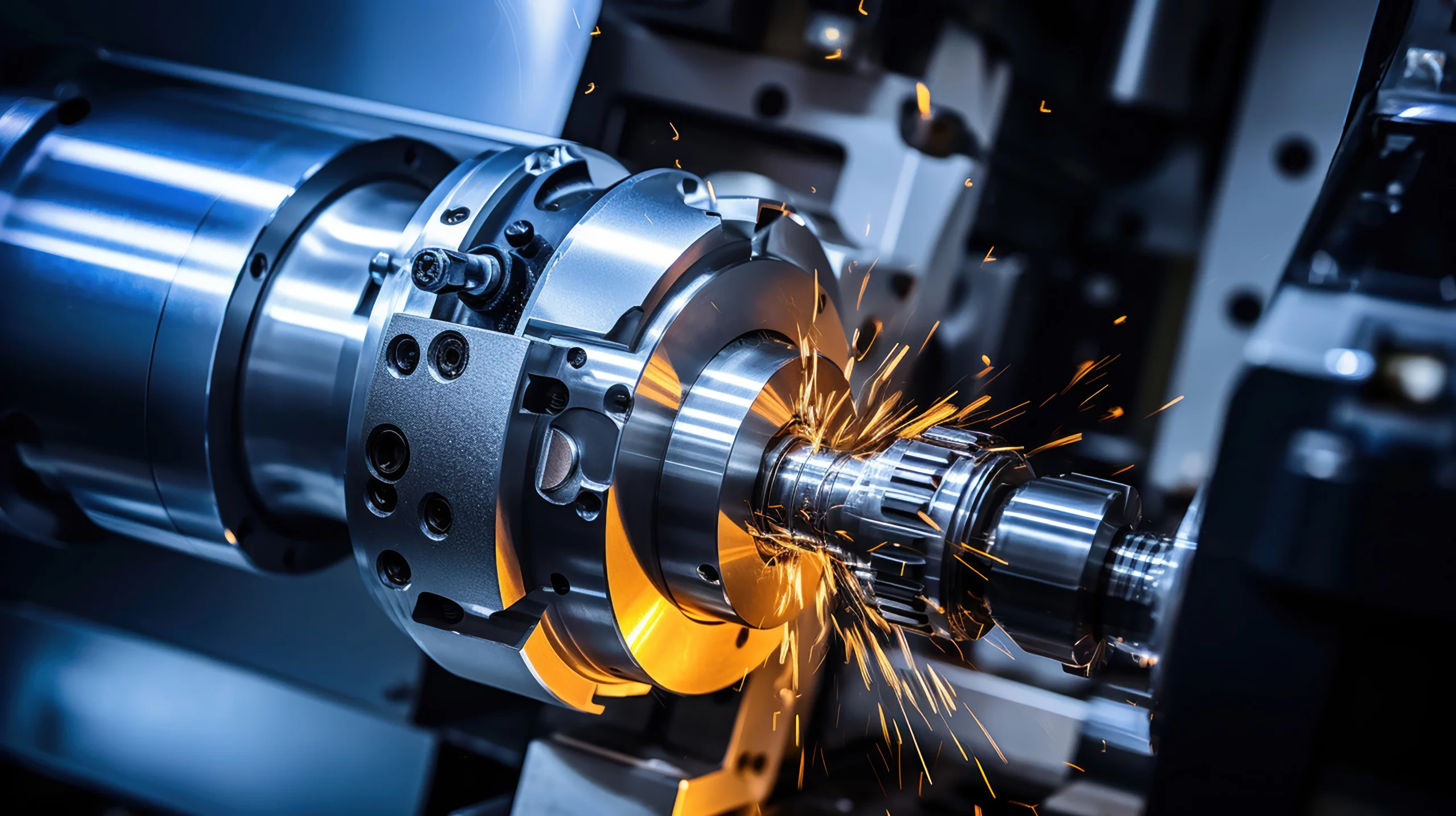

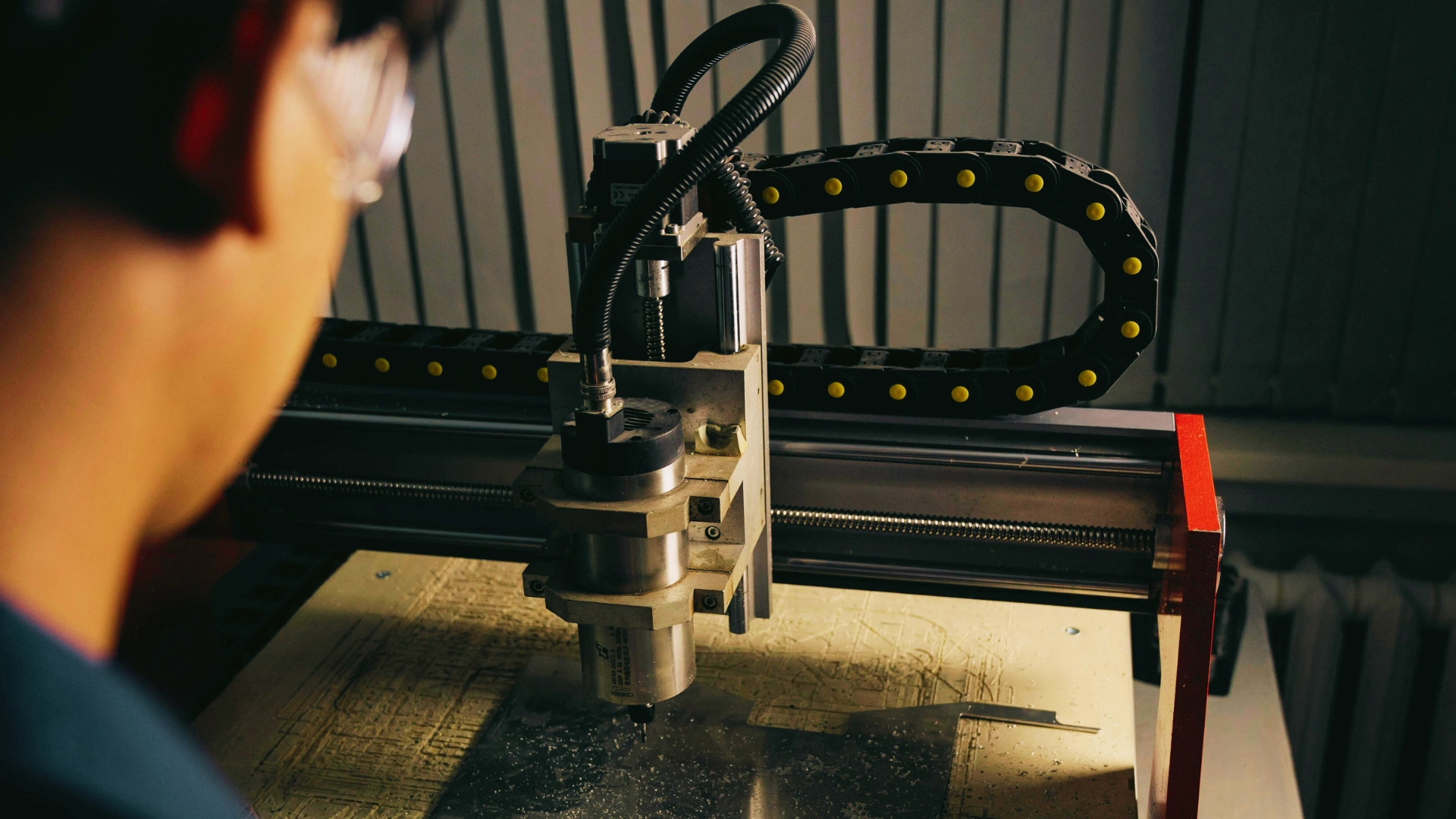

In the manufacturing business, precision and efficiency are paramount, and CNC machines epitomise these qualities. For startups navigating this competitive landscape, investing in a CNC machine signifies a strategic step towards success. This article aims to shed light on the intricate process of securing a customised loan for startups aiming to acquire a CNC machine, offering guidance through the financing complexities in the manufacturing sector.

Eligibility Criteria

Typically, to acquire a CNC machine loan for startups, lenders require a minimum business history, often a record of at least two years. Additionally, applicants aged between 21 and 65 years at loan maturity are preferred. A spotless credit score and impeccable repayment history stand as crucial determinants for approval. These stringent yet pivotal criteria set the stage for startups aspiring to procure a CNC machine through financial aid.

Benefits of Obtaining a CNC Machine Loan for Startups

Beyond the high precision and efficiency, these machines serve as catalysts for exponential growth. Leveraging CNC technology allows startups to elevate production quality, enhancing their position in the market. Furthermore, the scalability offered by CNC machines opens avenues for potential cost-savings. Improved efficiency and superior product quality empower startups to not only compete but to flourish in today’s demanding manufacturing landscape. The loan becomes more than financial support; it becomes a strategic tool for sustainable growth and success.

Steps to Apply for a CNC Machine Loan

Below are the online and offline procedures for getting a loan for purchasing a CNC machine.

Online Application Process

Initiating an online application for a CNC machine loan involves a simple procedure:

- Visit the lender’s official website

- Complete and submit the online application form

- Upload necessary documents and proofs

- Await contact from the lender’s representative

- Upon discussion and approval, the sanctioned amount is disbursed to the provided account

Offline Application Process

Alternatively, startups preferring an offline approach can visit the lender personally:

- Visit the bank or financial institution

- Submit the filled application form and required documents

- Engage with the lender’s representative for further processing

- Upon approval, the sanctioned loan amount is disbursed

Documents Required

To support the loan application, some documents are essential:

- KYC documents of the applicant(s)

- Proof of business vintage and existence

- Financial statements: ITR, bank statements

- Details and quotations of the intended CNC machine

- Additional documents, as requested by the lender

Conclusion

Securing a loan for a CNC machine holds the promise of transformation for startups. The efficiency, precision, and scalability offered by these machines can significantly boost a startup’s growth trajectory. Understanding the procedures and fulfilling eligibility criteria can unlock this pathway to success, enabling startups to thrive in a competitive market.

By adhering to these guidelines and comprehending the intricacies of securing a CNC machine loan, startups can leverage technology to revolutionise their manufacturing capabilities, paving the way towards prosperity.

FAQs:

What is the procedure for a machinery loan?

First, potential borrowers need to research and select a lending institution that offers machinery loans. Once chosen, applicants are required to fill out an application form provided by the lender. This form usually asks for personal, business, and financial details. Alongside the application, applicants need to submit supporting documents such as KYC (Know Your Customer) documents, proof of business vintage, income statements, and details about the machinery to be purchased. After the submission, the lender evaluates the application, verifies the provided information, and assesses the applicant’s creditworthiness. Upon approval, the loan amount is sanctioned and gets disbursed.

Who is eligible for a machinery loan?

Eligibility for a machinery loan generally depends on various factors. Typically, lending institutions consider several criteria when determining eligibility. These may include the applicant’s age, business vintage, credit score, repayment history, and the specific requirements of the lender. Generally, individuals or entities within a certain age bracket, having a minimum business vintage, a good credit score, and a clean repayment history, stand a better chance of qualifying for a machinery loan. However, the specific eligibility criteria can vary between different lenders and may require specific documentation or financial credentials.

What is the best option for the purchase of new CNC machinery to drive business growth?

The acquisition of new CNC machinery stands as the best option for businesses aiming for substantial growth. Investing in state-of-the-art equipment bolsters operational efficiency, fostering precision and productivity essential for business expansion. Incorporating new CNC machinery optimises manufacturing processes, ensuring superior quality outputs and faster turnaround times. This modernisation leads to increased competitiveness in the market, attracting more clients and opportunities. In essence, leveraging new CNC machinery isn’t just an investment; it’s a strategic move propelling continuous business growth.