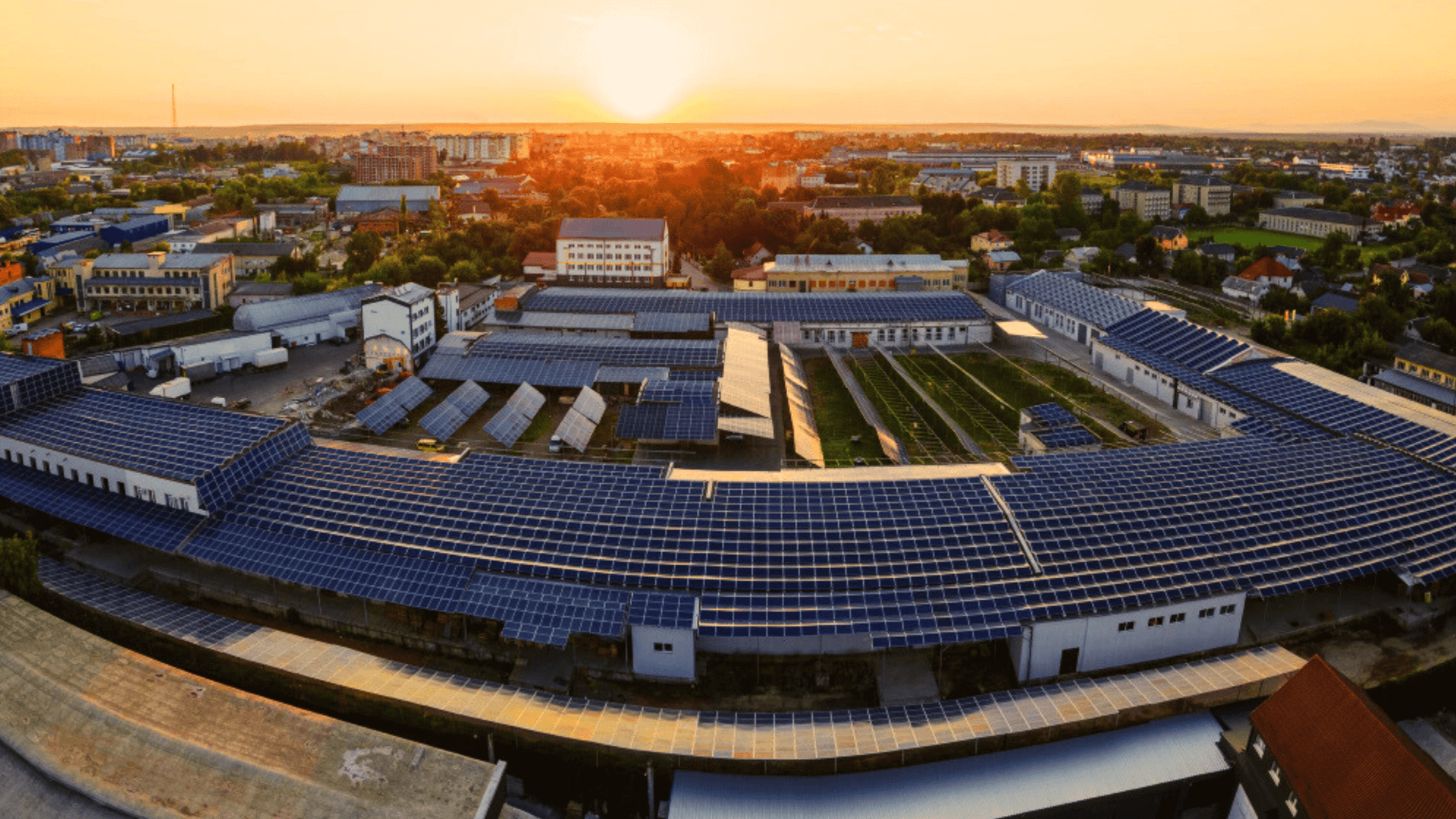

India’s rooftop solar segment is expanding rapidly, with government incentives, subsidies, and growing emphasis on sustainability. Small and medium enterprises (SMEs) benefit significantly from this shift. Rising energy costs and an unreliable grid power are pushing MSMEs to seek alternatives that offer both savings and independence. Rooftop solar power plants provide an effective solution, but adoption remains inconsistent due to financing barriers.

This article outlines the key drivers and challenges behind rooftop solar loans for MSMEs and how financing can help small businesses adopt clean energy.

Why Are MSMEs Choosing Solar Energy?

MSMEs have recognised rooftop solar energy systems as a strategic investment. Below are the core reasons why this shift is gaining momentum across sectors:

Rising Operating Costs

MSMEs across India spend up to 20% of their operational budgets on electricity. Adopting solar energy helps reduce the financial burden by 30 to 60%, depending on usage patterns and local policies.

Long-Term Savings and Stability

With rooftop installations, MSMEs gain predictable energy expenses for 20+ years and considerable cost savings over the years. Simultaneously, net metering enhances savings by allowing businesses to export surplus power back to the grid.

Tax Benefits and Subsidies

The Indian government supports MSME solar projects through incentives like accelerated depreciation (up to 40% in year one), capital subsidies, and schemes under the PM Surya Ghar Yojana. These reduce the upfront cost of solar energy and improve financial viability.

Common Challenges in Solar Loan Adoption

While notably cost-effective, installing rooftop solar panels is not without its challenges. Here are the challenges businesses can expect with the decision to go green.

Credit Access and Upfront Costs

Many MSMEs have limited credit histories or stretched balance sheets. This affects their ability to secure loans. Even with lower costs, upfront investment can still be challenging.

Limited Awareness

Many business owners are unaware of the benefits of rooftop solar panels or financing options. Doubts around subsidies, ROI, and system performance create hesitation.

Regulatory Complexity

Complicated documentation, DISCOM approvals, and net metering processes slow down adoption. Delays in subsidy disbursal can further impact timelines.

Reluctance to Invest in Non-Core Assets

Some MSMEs avoid investing in assets like rooftop solar, viewing them as non-critical. The longer payback period adds to this reluctance.

Key Drivers for Solar Adoption Among MSMEs

Several factors are accelerating the shift toward renewable energy adoption in the MSME sector. Here are some of the most crucial factors driving the adoption.

Financing for Solar Solutions

Various financing options from banks and NBFCs (Non-Banking Financial Companies) have become the most important tools for clearing financial obstacles. Easy loan approvals, flexible repayment terms, and loans tailored to rooftop solar panel installation are the key highlights of the financing solutions.

Energy Independence

Adopting solar reduces exposure to power outages and gives MSMEs more energy control. This is especially helpful in rural or semi-urban areas where power cuts are common.

Government Support

The Ministry of New and Renewable Energy (MNRE) has introduced several schemes for commercial and industrial sectors. These include rooftop solar guarantees, interest support, and grid integration help. Several state governments also provide benefits and incentives over and above the central government schemes.

Greener Brand Positioning

Adopting solar improves sustainability scores and corporate responsibility. Many buyers prefer environmentally responsible suppliers. Solar power use enhances competitiveness and brand trust.

Financing Options for Rooftop Solar Installations

Access to the right financing options is often what enables an MSME to move ahead with rooftop solar plants. NBFCs like Electronica Finance Limited (EFL) offer rooftop solar loans specifically for MSMEs. Loans of up to ₹3 crores with minimal paperwork, a 3-day disbursal, and the EFL Clik App allow for quick project rollout. Loans up to ₹50 lakhs can be availed without collateral. The required documentation includes KYC, three years’ ITR, 12 months’ bank statements, GST returns and electricity bills. The eligibility for these loans includes a credit score above 700 and at least one owned premise.

The Road Ahead: Making Solar Viable for MSMEs

To increase rooftop solar adoption, MSMEs need the right mix of policy support, financing access, and education. The rooftop solar loans, supported by government subsidies, offer a viable path.

With falling solar costs and better financing options, small and medium enterprises are well-positioned to lead India’s green energy transition.

Explore how transition to solar energy can cut your energy costs. Explore financing tailored for MSMEs with EFL’s rooftop solar loans.

FAQs–

What are the drivers for rooftop solar loans for SMEs in India?

SMEs are increasingly adopting rooftop solar systems to reduce escalating energy costs and ensure uninterrupted power supply, particularly in regions with frequent power cuts. Financial institutions are providing tailored financing options, such as collateral-free loans and flexible repayment terms, to support SMEs in switching to solar energy.

What challenges do SMEs face when applying for rooftop solar loans in India?

SMEs encounter several challenges, including stringent collateral requirements, lengthy documentation processes. Many SMEs lack the necessary credit ratings or financial track records, making them less attractive to lenders.