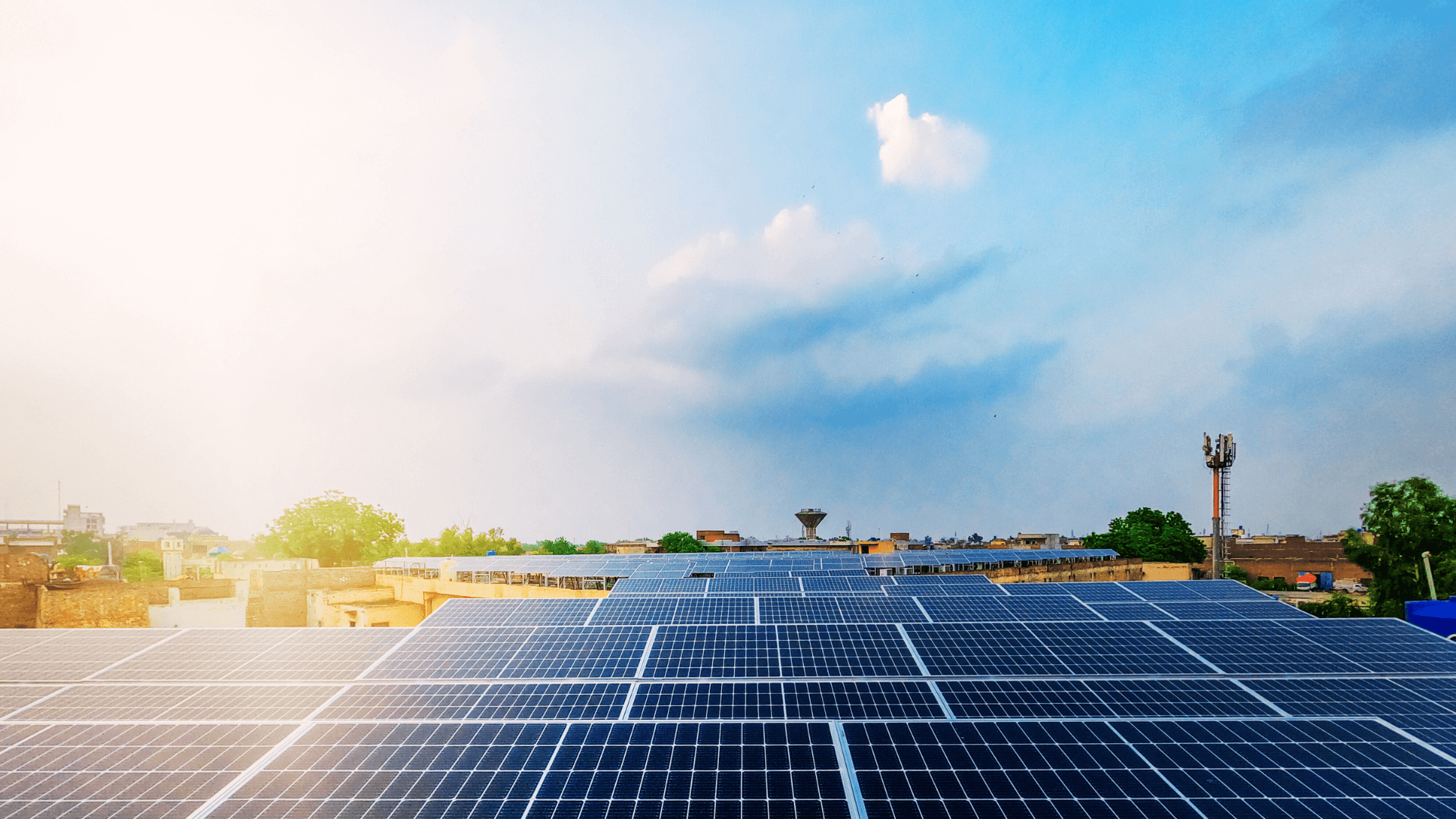

Recently, the concept of “free electricity” from a home solar system has become very popular in India. The idea is simple: install a solar panel and use the sun to power your home.

The reality is that while the solar components themselves aren’t free, substantial government incentives are designed to drastically reduce the upfront cost, making long-term cost savings so significant that your electricity bills can effectively become zero.

In this blog, we will discuss the government schemes you can avail to install rooftop solar power systems, the eligibility criteria, its cost, and some easy ways of using solar energy for your residential and commercial buildings.

Understanding the Government’s Role in Solar Energy Adoption

The Indian government has ambitious climate goals, including achieving 500 GW of renewable energy capacity by 2030. By incentivising rooftop solar panel system adoption in various urban and rural centres, the government reduces the massive burden on the national grid, especially during peak daytime hours. This leads to lower transmission losses and a more stable power supply for everyone.

How Solar Subsidy Schemes Actually Work?

The magic behind “free” solar electricity lies in two mechanisms:

- Capital Subsidy: This is an upfront cost covered by the government that directly reduces solar panel installation cost. It’s a discount backed by the state, favouring its citizens to go solar.

- Net Metering: This is a billing mechanism for on-grid solar power systems. When your system produces more power than your home uses, the excess is fed back to the grid. You earn credits from your solar rooftop system, slashing your bill. You only pay for the “net” energy you use.

Who is Eligible for a Government Solar Panel Subsidy?

Eligibility is broad and designed to be inclusive. The flagship PM Surya Ghar: Muft Bijli Yojana is primarily for:

- Individuals or housing societies with a suitable roof (residential or commercial properties)

- Individuals possessing a valid electricity connection and a consumer number

- Those who have not availed any other central or state government subsidy for solar energy previously

The rooftop solar scheme is available to a wide range of homeowners across India, from those in independent houses to residents of cooperative group housing societies.

How Much of the Solar Installation Cost Does the Government Cover?

Through a suite of strategic initiatives, the central government has established distinct frameworks of financial and regulatory support for the adoption of solar, addressing the unique needs of both the residential and commercial sectors.

Residential Rooftop Solar Subsidies

The government has launched PM-Surya Ghar: Muft Bijli Yojana, which is exclusively a residential rooftop solar program for consumers. It is a direct capital subsidy meant to reduce the upfront cost, making solar energy a viable option for Indian homes.

You can learn how to avail the benefits of the scheme here.

The subsidies offered under the scheme are as such:

- For systems up to 2 kW: ₹30,000 per kW

- For systems between 2 to 3 kW: ₹30,000 per kW for the first 2 kW, and ₹18,000 per kW for the remaining capacity.

- The maximum subsidy is for 3 kW systems. For any system capacity beyond 3 kW, the subsidy is capped at ₹78,000.

Example: If you install a 3 kW system costing approximately ₹1.5 lakhs, the subsidy would be (2 kW x ₹30,000) + (1 kW x ₹18,000) = ₹78,000. This means the government covers over half the cost!

The remaining expense can be financed through EFL Rooftop Solar Loans.

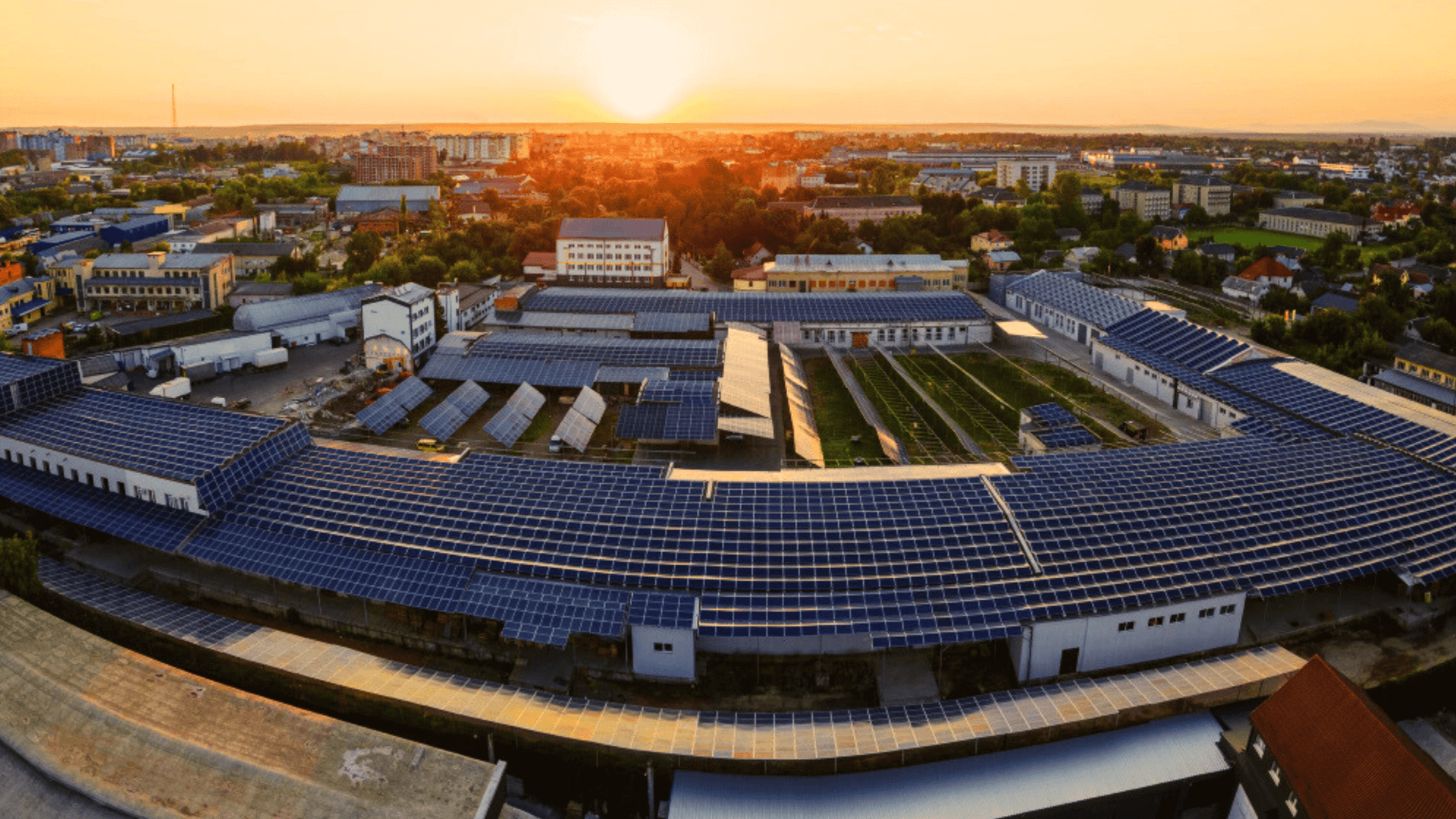

Commercial Rooftop Solar Subsidies

Commercial, industrial, and institutional entities do not receive this direct capital subsidy. For them, the government provides a completely different set of incentives that are often more financially attractive and better suited for their scale and purpose.

For commercial players, the focus is on policy-driven frameworks that improve the Return on Investment (ROI).

1. Accelerated Depreciation (AD)

This is the most significant financial benefit for profitable companies.

- What it is: Companies can deduct a much higher percentage of the project cost from their taxable income in the first few years.

- Current Rate: 40% per year on a Written Down Value (WDV) basis. This means a company can write off nearly 64% of the project’s value for tax purposes within the first two years.

- Impact: Drastically reduces the company’s tax liability, effectively lowering the net cost of the solar project.

2. Renewable Energy Certificate (REC) Mechanism

- What it is: This is primarily beneficial for large-scale power generators (like solar plants on vacant land) that generate and sell electricity to meet Renewable Purchase Obligations (RPO), not typically for residential rooftop systems. For every Megawatt-hour (MWh) of solar power generated, the project owner earns one REC. These RECs can be sold on an exchange.

- Who it’s for: This is particularly beneficial for projects that are not using the net metering mechanism (e.g., solar plants built on vacant land to export power).

- Impact: Provides an additional, tradable revenue stream on top of the savings from the power generated.

3. Custom Duty and GST Benefits

- Custom Duty: There is a 40% customs duty on imported solar modules and a 25% duty on imported cells. This protects and incentivises the use of domestically manufactured solar equipment.

- GST: The GST for solar power systems is currently 12% (devices and components), which is lower than the standard rate for many industrial goods. Businesses can often claim this input tax credit.

4. Grid-Connected Solar Schemes (No Direct Subsidy)

The government promotes large-scale adoption through policy frameworks rather than subsidies:

- PM-KUSUM (Component A): A scheme formulated by the government to help farmers. Component A aims to set up 10,000 MW of decentralised solar power plants on barren land. These can be developed by commercial entities that then sell the power to the distribution companies (DISCOMs).

- Solar Park Scheme: The government facilitates the development of ultra-mega solar parks by providing infrastructure (land, transmission), making it easier for commercial developers to set up large-scale projects.

Steps to Apply for a Subsidy through Government Solar Programs

The process has been simplified through a centralised online portal:

- Register: Visit the national portal for rooftop solar and register using your electricity consumer number.

- Get Technical Feasibility Approval: Your local DISCOM (electricity distribution company) will approve the application based on the feasibility of your roof for a solar rooftop system.

- Select a Vendor: Choose an installer from the portal’s list of enlisted vendors and get the system installed.

- Apply for a Subsidy: The installer will help you apply for the subsidy after installation.

- Inspection and Disbursal: After a final inspection by the DISCOM, the subsidy amount is transferred to your bank account.

Common Myths About “Free” Solar Installations

Let’s clear the air:

- Myth 1: The government pays 100% of the home solar panel installation cost.

- Reality: The subsidy is significant, but you are responsible for the remaining cost, often facilitated through financing options provided by banks and Non-Banking Financial Companies (NBFCs) like Electronica Finance Limited.

- Myth 2: It’s a scam or a marketing gimmick.

- Reality: It is a legitimate government scheme with a transparent process on a national portal. The benefits are real and verifiable.

- Myth 3: Maintenance is a huge hassle.

- Reality: Modern solar panels require minimal maintenance — occasional cleaning is usually sufficient, making solar a low-maintenance energy source.

Benefits of Solar Panel Installation Under Government Support

The subsidy benefits of solar power generation offered by the Indian government result in a substantial reduction in electricity bills.

Consider an example of a typical family in a 3BHK apartment, facing a consistent and rising monthly electricity bill of around ₹2,500. This adds up to a significant annual expense of ₹30,000, a cost that is guaranteed to increase over time due to rising electricity tariffs.

The perfect solution for them is to install a 3 kW rooftop solar system. While the initial price of such a system is approximately ₹1,50,000, the government’s subsidy program makes it remarkably affordable. Under the PM Surya Ghar scheme, they are eligible for a substantial subsidy of ₹78,000. This direct financial support dramatically reduces their upfront investment, bringing the net cost down to just ₹72,000. This remaining amount can be paid up front or conveniently financed through a solar loan.

Moreover, applying for solar loans and subsidy schemes is now a streamlined, transparent process, making solar energy accessible to everyone.

Conclusion: Government Subsidies Make Solar Energy Affordable

The government subsidy for solar energy has significantly reduced the cost of installing solar panels, whether it’s commercial solar or residential solar installations. Your decision to switch to solar helps build a sustainable future for all, which is enthusiastically backed by the Government of India.

Ready to see exactly how much you can save? Don’t navigate the process alone. Download the EFL Click App now for a simple and streamlined loan.

FAQs

1. Does the government provide rooftop solar panels for free in India?

No, the government does not provide solar panels for free. However, through schemes like the PM Surya Ghar Muft Bijli Yojana, the Indian government offers subsidies for solar panels for residential use, which significantly reduce the initial cost of solar panel installation.

2. How much subsidy can I get for switching to solar at home?

The subsidy for solar depends on the capacity of your home solar energy system:

- Up to 2 kW: ₹30,000 per kW

- Above 2 kW and up to 3 kW: ₹78,000 (fixed)

- For systems above 3 kW: ₹78,000 fixed

Additional benefits like net metering and bank loans further reduce the cost of installations in India.

3. Who is eligible to apply for a solar subsidy through government programs?

Most residential solar installations are eligible. Key criteria include:

- Owning a suitable roof for rooftop solar

- Having a valid electricity connection

The combined solar capacity applied for should match your average electricity consumption.

4. Are there different subsidies for residential and commercial installations?

Yes. The subsidies and government incentives are primarily designed for home solar systems. Commercial solar installations typically have different schemes, such as accelerated depreciation, and are not eligible for the same solar panel subsidy as residential properties.

5. How can I verify if a solar installation company is authorised under the government scheme?

To ensure a smooth process for registering for solar subsidies, always choose a government-approved vendor. You can verify the authenticity of the solar company on the official National Portal for Rooftop Solar. Using an authorised installer is crucial for availing government subsidies by reducing the overall solar price and ensuring a quality solar panel system.