Introduction

The global industrial landscape is undergoing profound changes due to a growing reliance on machinery across diverse sectors. Automation and cutting-edge technologies are now at the forefront of productivity, accuracy, and safety across various industries. This transition not only leads to cost savings and heightened competitiveness but also requires the development of new workforce skills and promotes the use of data to make informed decisions.

As industries increasingly integrate machinery into their operations, they are poised to meet the challenges of a rapidly changing world while reaping the benefits of enhanced productivity and sustainability.

Definition and Types of Machine Insurance

- Machine insurance is a type of coverage that protects individuals or businesses against financial losses resulting from damage, breakdown, or loss of machinery. It helps make sure that the cost of repairing or replacing valuable machines is covered, minimising disruptions to business operations and preventing significant financial setbacks.

- Machinery Breakdown Insurance: Similar to equipment breakdown insurance, this policy specifically focuses on covering the breakdown of industrial machinery used in manufacturing and production processes.

- Electronics Equipment Insurance: This insurance protects electronic equipment such as computers, servers, and communication systems from damage due to accidents, power surges, or other covered events.

Importance of Machine Loans

In an era dominated by cutting-edge technology and automation, the significance of machine insurance has never been more pronounced. The intricate interplay between humans and machinery has revolutionized industries across the globe, bringing unprecedented efficiency and productivity. However, it has also ushered in a new realm of risks and challenges. Machine insurance is the safeguard that ensures businesses and individuals can harness the full potential of their automated assets while mitigating potential financial and operational setbacks. Let’s explore the compelling reasons why machine insurance is a vital component in our technologically driven world.

Protection Against Costs

Machine insurance covers the high costs of repairing or replacing machinery by providing financial support in the event of breakdowns, malfunctions, or damage. It ensures businesses have the necessary funds to quickly restore their machinery and operations without depleting their financial resources.

Machine insurance plays a pivotal role in managing the financial aspects of machinery-related challenges. When machinery experiences breakdowns, the costs of repairing or replacing it can be significant, and machine insurance helps reduce these expenses by jointly shouldering the financial responsibility.

Depending on the coverage, it can either fund machinery restoration to operational status or procure equivalent replacements. Furthermore, it minimises disruptions to business operations caused by downtime, production delays, and potential financial losses, ensuring that the necessary funds are promptly accessible for a swift recovery. Machine insurance spares businesses from tapping into reserves or operational funds by helping them plan for unforeseen events while maintaining their competitive edge.

Minimising Downtime

Machinery breakdowns can have far-reaching consequences, from production delays and lost revenue to customer dissatisfaction and supply chain disruptions. However, machine insurance can be a game-changer by including coverage for business interruption. This specialised insurance ensures that businesses receive financial compensation during downtime resulting from machinery breakdowns. It offers crucial support to cover ongoing expenses, aiding in the recovery process and safeguarding the company’s financial stability. By minimising disruptions and preserving customer relationships, machine insurance with business interruption coverage helps businesses not only survive unexpected machinery failures but also continue operating smoothly.

Comprehensive Coverage

Machine insurance offers a versatile range of coverage that can be tailored to meet the diverse needs of various industries. It encompasses an extensive array of machinery and equipment, highlighting the importance of customising coverage to suit specific industry requirements. Here is an overview of a few from the wide range of machinery and equipment that machine insurance can cover:

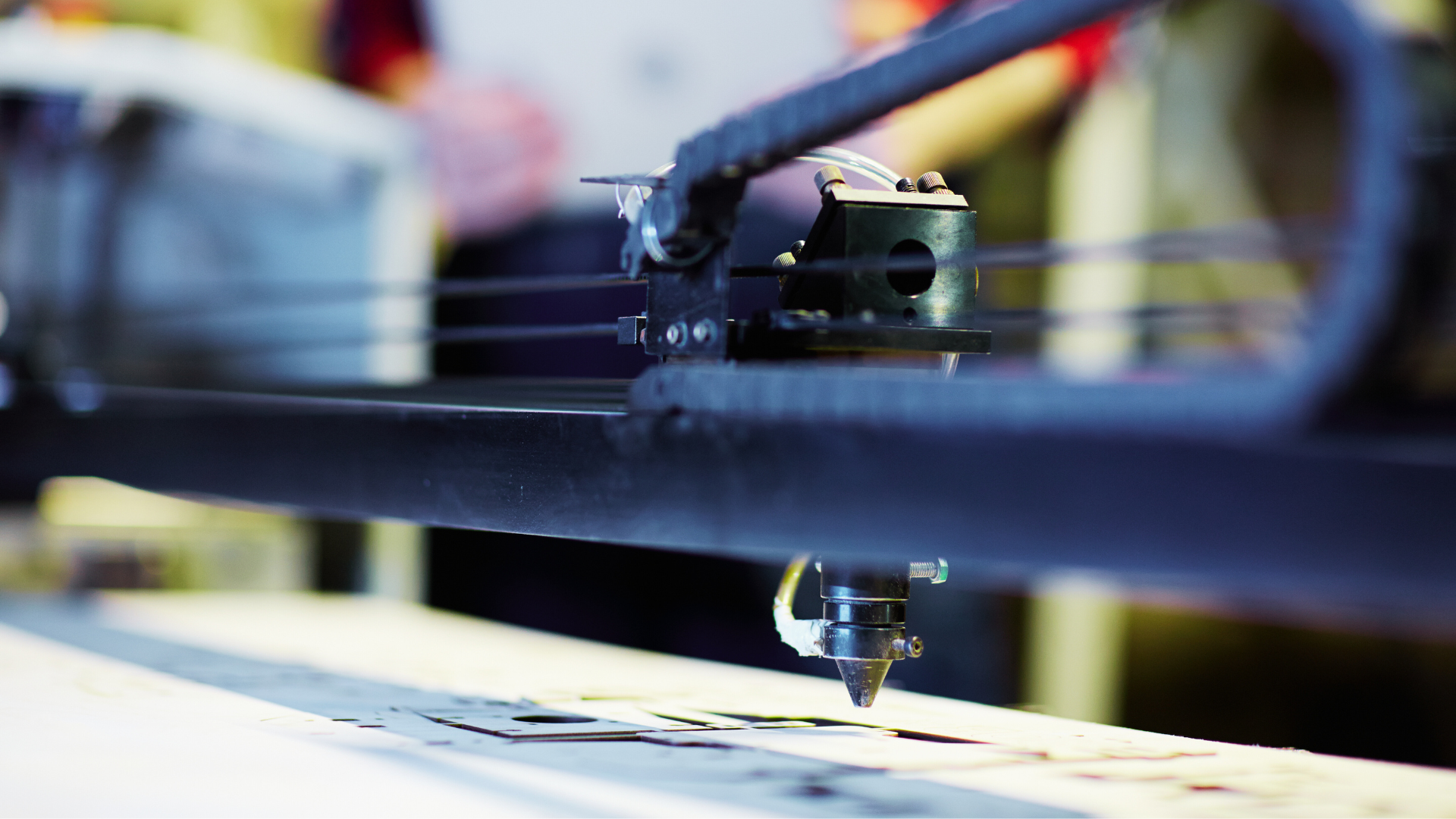

- Industrial Machinery: This includes heavy machinery used in manufacturing and production, such as CNC machines, stamping presses, and industrial robots.

- Commercial Equipment: Machine insurance can extend to various commercial equipment, like commercial ovens, refrigeration systems, and printing presses.

- Construction Equipment: Construction machinery, including excavators, bulldozers, and cranes, can be covered to protect against breakdowns and damage.

- Electronics and IT Equipment: From servers and data centre equipment to computers and communication systems, electronics and IT equipment can be protected against breakdowns and other risks.

- Medical and Healthcare Equipment: This category includes medical imaging machines, diagnostic equipment, and laboratory instruments, ensuring that healthcare facilities can continue providing essential services.

- Transportation Vehicles: Vehicles used for transportation, such as commercial trucks, forklifts, and delivery vans, can also be included in machine insurance policies.

- Elevators and Escalators: Buildings with elevators and escalators can ensure the reliability of these systems.

The importance of tailoring machine insurance coverage to specific industry needs cannot be overstated. Different industries face distinct risks, rely on unique equipment, and have varying levels of operational importance. Customising coverage allows businesses to address their specific vulnerabilities, ensuring that they are adequately protected against the risks most relevant to their operations. It maximises the value of the insurance investment by providing targeted protection.

Safeguarding Investments

Machines and equipment are significant investments for businesses, requiring substantial capital investments and serving as the operational backbone of many industries. These assets are expected to have a long lifespan and often require ongoing maintenance. Machine insurance plays a pivotal role in safeguarding these investments by providing financial protection for unexpected breakdowns, damages, or malfunctions. It preserves capital by covering repair or replacement costs and enhances the longevity and reliability of critical machinery and equipment. With machine insurance, businesses can focus on growth and competitiveness while knowing their valuable assets are financially protected and well-maintained.

Mitigating Risks

Common machinery-related risks, including accidents, fires, and natural disasters, present significant threats to businesses. Accidents may arise from human error, mechanical failures, or unforeseen incidents. Fires, often triggered by electrical faults or overheating machinery, can lead to extensive machinery and facility damage. Natural disasters like earthquakes, floods, hurricanes, and tornadoes can devastate businesses and their vital machinery.

All these machine-related risks incur substantial costs for repair or replacement. Machine insurance policies are designed to address these risks by providing coverage for such incidents, helping businesses mitigate the financial impact and guarantee the uninterrupted functioning of essential machinery and business activities.

Lender and Regulatory Requirements

Lenders and regulatory bodies may require machine insurance in various situations, primarily to mitigate risks associated with financing and to ensure compliance with industry-specific regulations. Here are some scenarios where such requirements may arise:

- Secured Loans: When businesses seek loans to purchase machinery or equipment, lenders may require machine insurance as a condition for financing. This requirement safeguards the lender’s investment by ensuring that the equipment serving as collateral is protected against potential damage or loss.

- Industry Regulations: Certain industries, such as manufacturing, construction, and energy, are subject to specific regulations that mandate the coverage of machinery and equipment through insurance. Compliance with these regulations is essential for legal operation within the industry and can also serve to protect the interests of employees, customers, and the environment.

- Occupational Safety: Regulatory bodies concerned with workplace safety may mandate machine insurance as part of an overall safety and risk management plan. Ensuring compliance with these requirements helps businesses create a safer working environment, reducing the risk of accidents and potential legal liabilities.

- Contractual Agreements: Businesses engaged in contracts or agreements with other parties may be obliged to maintain machine insurance coverage. This can protect both the business and its partners or clients in case of equipment-related issues that could disrupt contractual obligations.

- Government Funding or Grants: Companies seeking government funding or grants for equipment purchases or capital improvements may be required to demonstrate insurance coverage as part of their application. Compliance in this regard can facilitate access to much-needed financial support.

- Lease Agreements: When businesses lease machinery or equipment, lessors often insist on insurance coverage to protect their assets. Compliance with these lease requirements ensures a smooth leasing process and helps maintain a good business relationship with the lessor.

Complying with these lender and regulatory requirements offers several key benefits. It aids in proactively managing and reducing the risks associated with equipment breakdowns, accidents, and unexpected events. In the event of machinery-related incidents, insurance coverage enables swift recovery, preventing prolonged downtime and potential revenue losses. Furthermore, it ensures legal compliance, which is crucial for adhering to industry regulations and fulfilling contractual obligations. Lastly, it fosters a positive reputation by showcasing a commitment to compliance and safety, thereby earning trust from customers, partners, and stakeholders.

Adaptation to Technology

Machine insurance’s adaptability to new and evolving technologies is a necessity for businesses in today’s dynamic landscape. This flexibility protects companies as they upgrade their machinery and integrate cutting-edge technologies. Machine insurance policies can be expanded to cover advanced technologies like automation and artificial intelligence, and risks associated with these innovations are regularly assessed by insurers. Customisation options enable businesses to align coverage with the specific features and capabilities of their upgraded equipment, ensuring that they can replace or repair it in case of damage or breakdown. Moreover, insurance providers offer expert guidance and bundling options and adjust insured values to reflect the changing costs of technologically advanced machinery. This adaptability not only safeguards businesses but also encourages them to embrace innovation confidently.

Conclusion:

Machine insurance ensures compliance with lender and regulatory requirements, offering financial security and a positive reputation. Its adaptability to new technologies further reinforces its value by enabling businesses to stay protected. It minimises disruptions to operations, preserves cash flow and budgets, and proactively mitigates risks associated with machinery breakdowns.

One of our clients had acquired a total of seven machines, with two of them being financed through EFL. Unfortunately, their factory experienced a fire incident, which led to the compromise of all seven machines. However, there was a silver lining for the two machines obtained with an Electronica Finance Limited loan—they were covered by comprehensive insurance.

Electronica Finance Limited loans offer comprehensive coverage. Furthermore, when an insurance claim is made, it covers the entire amount, equivalent to the initial asset purchase value, without factoring in depreciation. It is also important to note that the cost of insurance is a one-time payment, and insurance coverage remains valid until the end of the machine loan tenure.

In conclusion, machine insurance plays a pivotal role in safeguarding businesses against the high costs of repairing or replacing machinery. Electronica Finance Limited provides personal support in insurance claims to ensure the most favourable outcomes for you.