Types of Equipment Finance for Used Machinery

Acquiring advanced machinery and equipment can significantly reduce upfront capital expenditure for MSMEs and bring in automation and efficiency. While it is a key ingredient in business growth, limited funds often remain a challenge for many MSMEs. Equipment finance provides...

Why Upgrading to Modern Machinery Can Boost MSME Profits by 30% or More in India

Margins for MSMEs (Micro, Small, and Medium Enterprises) in India’s economic scenario are under constant pressure. Input costs fluctuate, labour availability is uneven, and customers expect faster delivery in every sector without paying more. In this market environment, growth doesn’t usually stall because demand disappears, it...

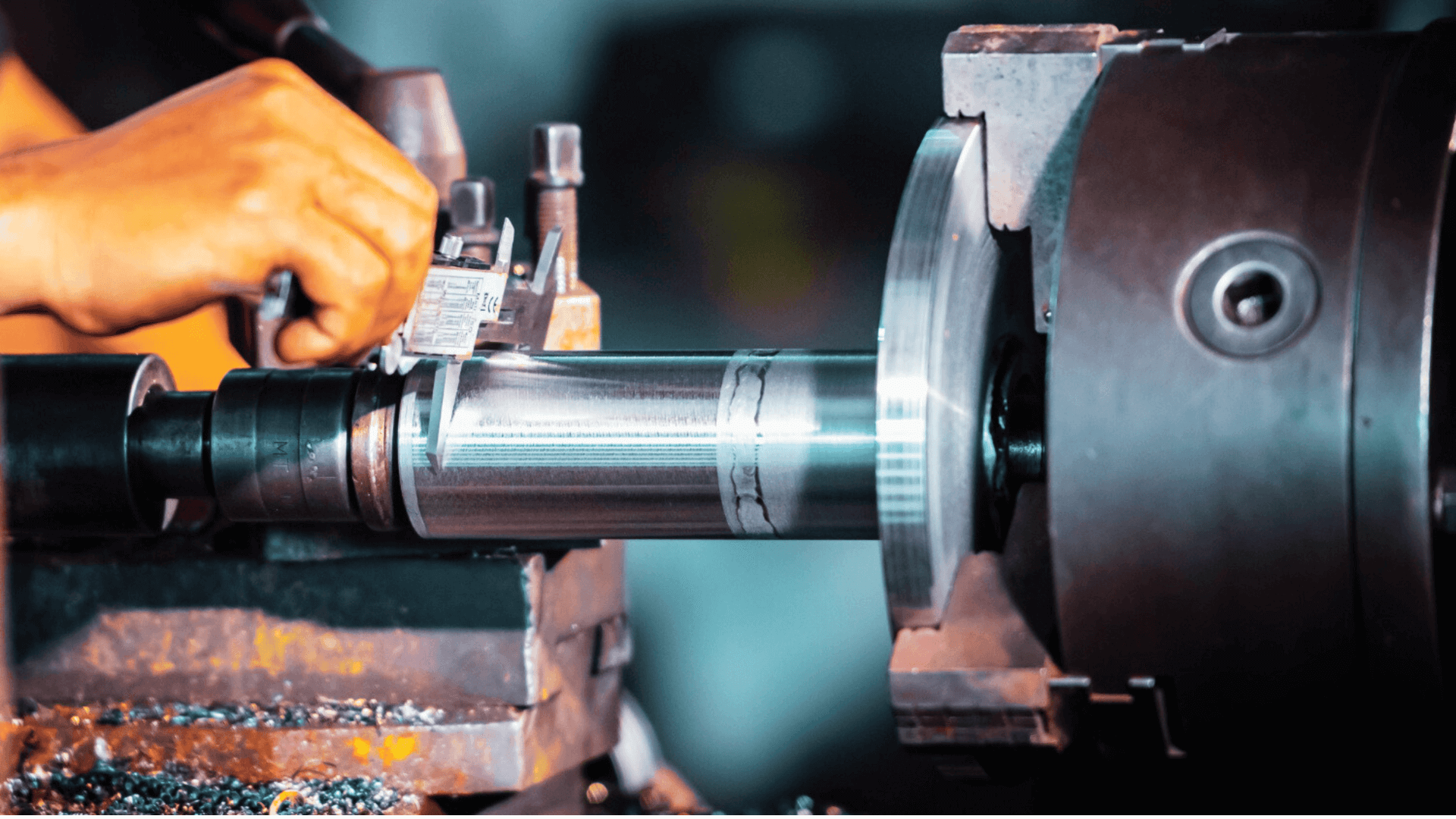

Machinery Loans for Manufacturing MSMEs to Upgrade Productivity

How Machinery Loans Can Boost Manufacturing Efficiency for MSMEs In today’s manufacturing landscape, efficiency is vital. It directly decides margins, delivery timelines, and how competitive a business can remain when input costs are rising and customers expect faster turnaround. Many manufacturers know their productivity...

First-Time Machine Buyer? Discover Loan Options You Can Apply for Today

Key Takeaways First-Time Machine Buyer? Discover Loan Options You Can Apply for Today Purchasing your first machine is a significant investment decision for any business. However, high upfront costs and limited access to funds often make financing essential. A well-structured machinery...

Tired of Heavy Paperwork for Loans? Get Fast Business Loans Without Collateral in India

Securing funding for your business in India can be a time-consuming and frustrating process. Traditional loan applications often need extensive documentation, from proof of income to credit history, which can delay your ability to access much-needed capital. For small businesses, entrepreneurs, or...

Facing a Cash Crunch? A BusinessLoan Against Property Can Help

Business needs are soaring every day, requiring an increased capacity to scale up in a short time and deliver better products and services. However, the financial backing to keep up the continuous business expansion and growth is not always readily available. In...

Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit

Key Takeaways for MSMEs Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit Across the engineering and plastic manufacturing MSME (Micro, Small, and Medium Enterprises) ecosystem, growth often depends on the machinery a business uses....

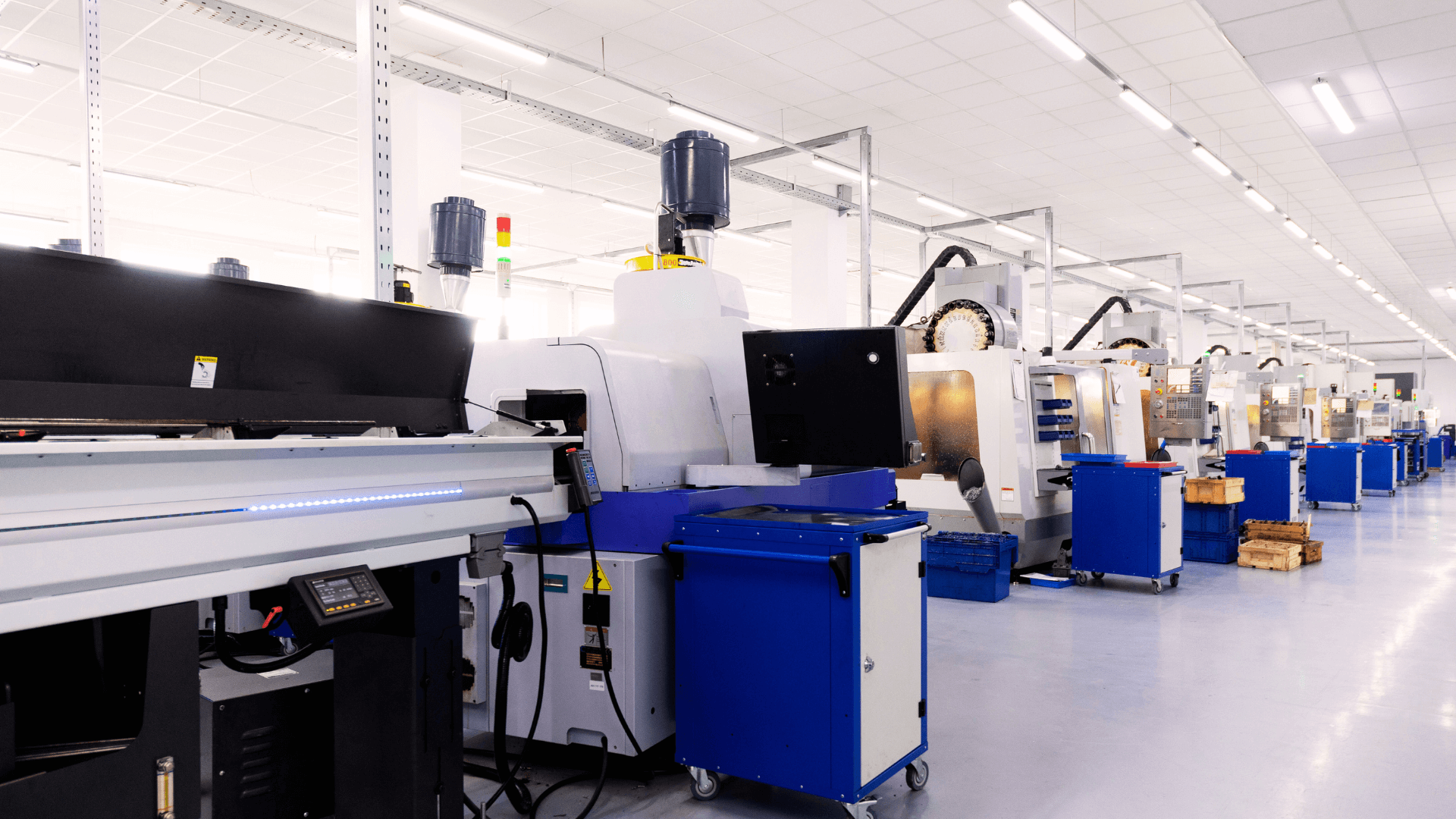

Smart Business Loan Options to Finance a VMC or CNC Machine in India

Key Takeaways No Cash Strain: You don’t have to pay the full cost of an expensive CNC/VMC machine upfront. Use a machinery loan to acquire the equipment and preserve your existing working capital for daily operations. Two Main Paths – Loans vs. Leases: The decision is primarily between two options: a...

Five Signs It’s Time to Upgrade Your Machines and How Machinery Loan Can Help

As a small business in manufacturing, your machinery plays a critical role in your business growth, productivity, safety, and long-term success. Over time, however, older equipment can hinder your operations rather than help them. In this blog, we’ll explore five clear...