Facing production delays can be a major setback for any business, especially for smaller manufacturers relying on the efficiency of their machinery. Malfunctioning or outdated machines can halt operations, disrupt cash flow, and delay product deliveries. Fortunately, a machinery loan can be the best solution to get your business back on track. By securing the right loan, you can speed up production and prevent further delays.

How Production Delays Hurt Your Business Growth

When machines are down or outdated, your entire operation is at risk of stalling. Every minute spent waiting for repairs or replacement equipment is a minute lost in revenue. They disrupt operations, lead to lost revenue, and damage customer relationships, ultimately slowing your growth and holding you back. Therefore, it is essential for businesses to take swift action.

1. Decreased Efficiency

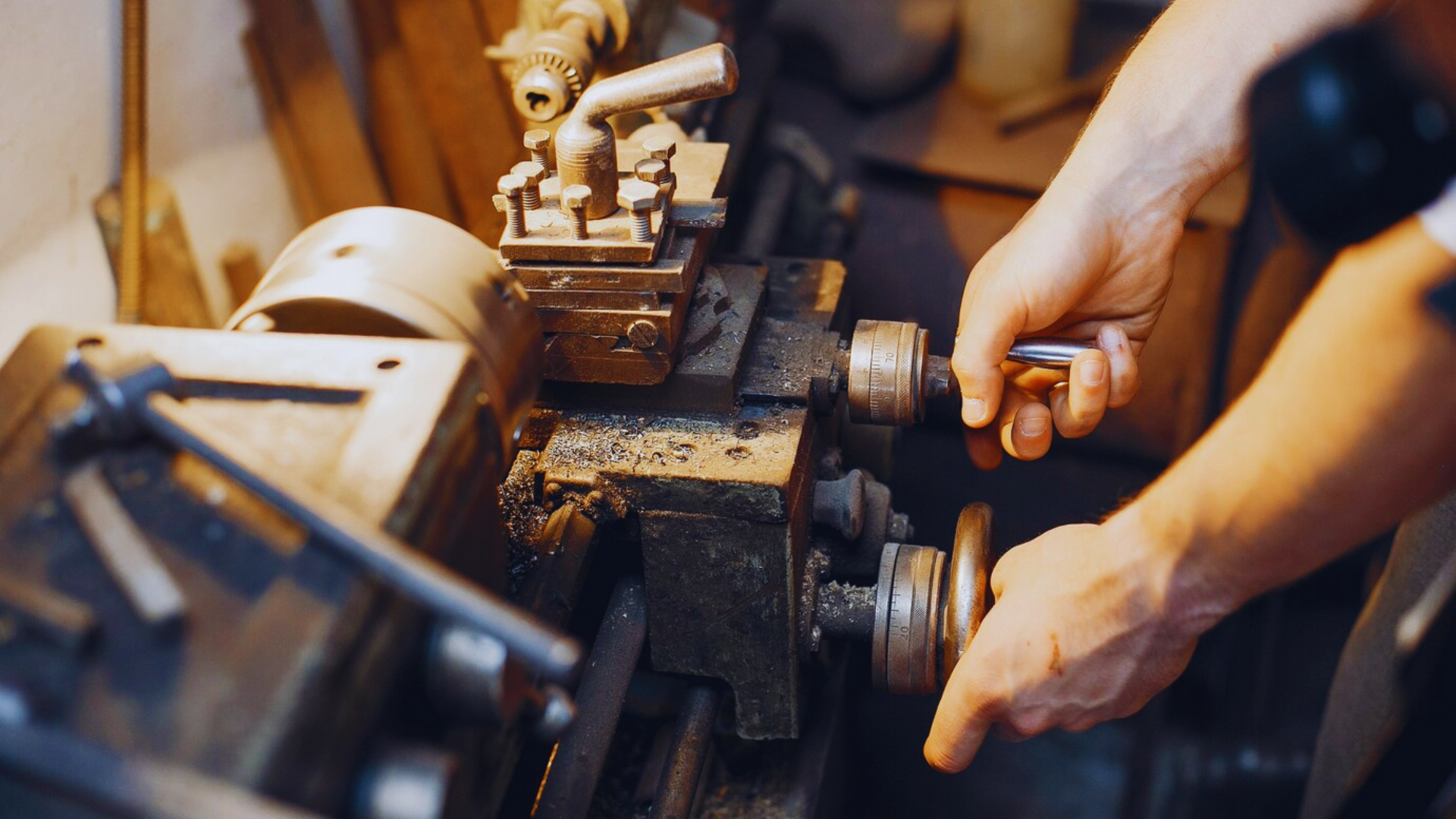

Production delays often stem from the wear and tear of existing machinery, which leads to downtime and a disruption in business operations. Whether due to a machine breakdown or outdated equipment, these disruptions significantly reduce overall output. As production slows, so does the ability to meet demand, leading to lost business opportunities and revenue.

2. Impact on Customer Satisfaction

In an increasingly competitive market, meeting deadlines is critical. If your business struggles with production delays, customers may turn to your competitors. Failure to deliver on time not only damages your reputation but also threatens long-term relationships and customer loyalty.

3. Increased Operational Costs

Every time equipment breaks down, you face unexpected repair costs. Additionally, the longer you wait for a machine to be replaced or fixed, the more you spend on temporary fixes, like overtime pay or expedited shipping fees. These costs, coupled with higher machinery maintenance costs, can quickly escalate, eating into your working capital.

Therefore, businesses need to take swift action.

Why a Machinery Loan is the Fastest Way to Resolve Equipment Shortages

A machinery loan is a type of business loan specifically designed to help businesses purchase new equipment or upgrade existing machinery. With machinery loans, business owners can acquire new machinery or advanced technology that helps increase efficiency, reduce downtime, and improve overall performance.

Key Benefits of a Machinery Loan:

- Quick Access to Funds: Machinery loans offer quick approvals, saving businesses the waiting time for cash flow improvements.

- Increased Productivity: With new equipment, businesses can scale up production, reduce manual labour, and increase efficiency.

- Flexible Repayment Terms: Machinery loans typically come with flexible repayment terms, allowing businesses to tailor payments to their cash flow.

A machinery loan ensures that your operations are equipped to handle increased demand and new business opportunities. It also eliminates the financial burden of draining your working capital.

Common Causes of Production Delays in Manufacturing Units

Understanding the common causes of production delays helps businesses prevent them in the first place. Here are the most frequent culprits:

1. Ageing Equipment and Machinery

Old or worn-out machinery is more prone to breakdowns and maintenance issues. This can result in unexpected downtime and delays. The machinery loan provides businesses with the ability to buy new equipment, improving reliability and reducing the risk of failure.

2. Supply Chain Disruptions

Supply chain issues, such as shortages of raw materials or delayed shipments, can lead to production halts. A machinery loan can help businesses opt for newer equipment that better supports inventory management and enhances supply chain efficiency.

3. Labour Shortages

A lack of skilled workers can also delay production. When paired with outdated machinery, the slowdown in productivity becomes even worse. With a machinery loan, businesses can acquire advanced machinery to automate operations. This minimises the dependency on skilled labour.

Why a Machinery Loan is the Fastest Way to Resolve Equipment Shortages

1. Quick Loan Approval and Funds

The machinery loan application process is simple and often quicker than applying for other types of loans. The loan process itself is streamlined, and many lenders offer flexible terms to help businesses get the equipment they need quickly.

2. Flexible Repayment Terms

Many financial institutions offer flexible repayment terms and competitive interest rates to ensure businesses can repay the loan based on their cash flow. This flexibility in loan tenure helps businesses avoid financial strain while they benefit from improved machinery and operations.

3. Competitive Interest Rates

Machinery loan interest rates can be quite favourable, especially when the loan amount is relatively low. With lower interest rates, businesses can afford to upgrade or replace equipment without worrying about hefty repayments.

4. No Need for Collateral

In many cases, businesses can get an unsecured machinery loan. Business owners do not need to provide any collateral to secure this loan. This makes it easier to get the required funds without risking any assets.

Actionable Steps for SMEs to Avoid Production Delays

For SMEs, avoiding production delays is crucial to maintaining steady growth. By taking proactive steps to optimise equipment, streamline processes, and manage resources, you can minimise disruptions and keep your operations running smoothly.

1. Regular Equipment Maintenance

Preventive maintenance can reduce the risk of machinery breakdowns and minimise downtime. This simple step can go a long way in maintaining unhindered production.

2. Invest in New Equipment

With modern machines, you can boost productivity, reduce wear and tear, and improve efficiency. If your current equipment is outdated, consider using a machinery loan to buy new equipment. Use the EFL Clik App for fast and easy machinery loans.

3. Get Ahead of Your Loan Application Process

If you anticipate equipment shortages, start looking into machinery finance early on. Study the requirements for machinery loans and prepare your loan application in advance to avoid unnecessary delays.

4. Assess Your Business Needs

Before applying for a machinery loan for your business, assess what type of equipment you need and how it will fit into your current production process. Focus on machinery that will enhance productivity and help you meet business goals.

Conclusion: Take Your Business to the Next Level with a Machinery Loan

A machinery loan could be the solution you need to avoid production delays and keep to take your business growth to the next level. With flexible repayment terms, competitive interest rates, and quick access to funds, a machinery loan for your business is the best way to get the new equipment your business needs. Don’t let equipment issues slow you down — apply for a machinery loan today and start operating at full speed!

FAQs

How quickly can I get funds through a machinery loan to fix production delays?

Some lenders provide machinery loan approvals in as little as 24 to 48 hours, allowing you to address production delays swiftly.

What types of machinery loans are available for small manufacturers facing delays?

Small manufacturers can apply for equipment loans, unsecured machinery loans, or term loans, depending on their business needs, loan amount, and repayment terms.

Do I need to provide collateral for a fast machinery loan?

Many lenders offer unsecured loans for machinery purchases, meaning you don’t need to provide collateral to secure the loan.

What documents and eligibility criteria should I prepare for quick loan approval?

To ensure fast approval, prepare the required documents, like the balance sheet, credit score, tax returns, and proof of ownership, along with a clear loan application.

Can a machinery loan also cover the repair or replacement of existing equipment causing delays?

Yes, machinery loans can be used for the repair or replacement of existing equipment, depending on the lender’s terms and the loan product offered.