Choosing a suitable and beneficial financing option is crucial for business owners aiming to fuel their ventures, optimise cash flow, or fund business expansion. With a variety of loans available from banks and Non-Banking Financial Companies (NBFCs), deciding between secured and unsecured loans can be challenging.

This guide explores the differences, advantages, and use cases of these two main types of business loans to help business owners make sound financial decisions for their businesses.

What is a Secured Business Loan?

The simple definition of a secured loan is that it is secured by collateral. The borrower pledges collateral in the form of property or any other valuable possession to avail the loan. Collateral includes assets like property, equipment, or inventory, which can be used to cover the loan amount if the borrower defaults.

This type of loan reduces the lender’s risk if the borrower does not repay the loan, allowing banks and NBFCs to offer lower interest rates and higher borrowing limits, which can be beneficial for business owners with substantial assets.

Examples of Secured Loans

Common secured loans include:

- Loans against property or mortgages

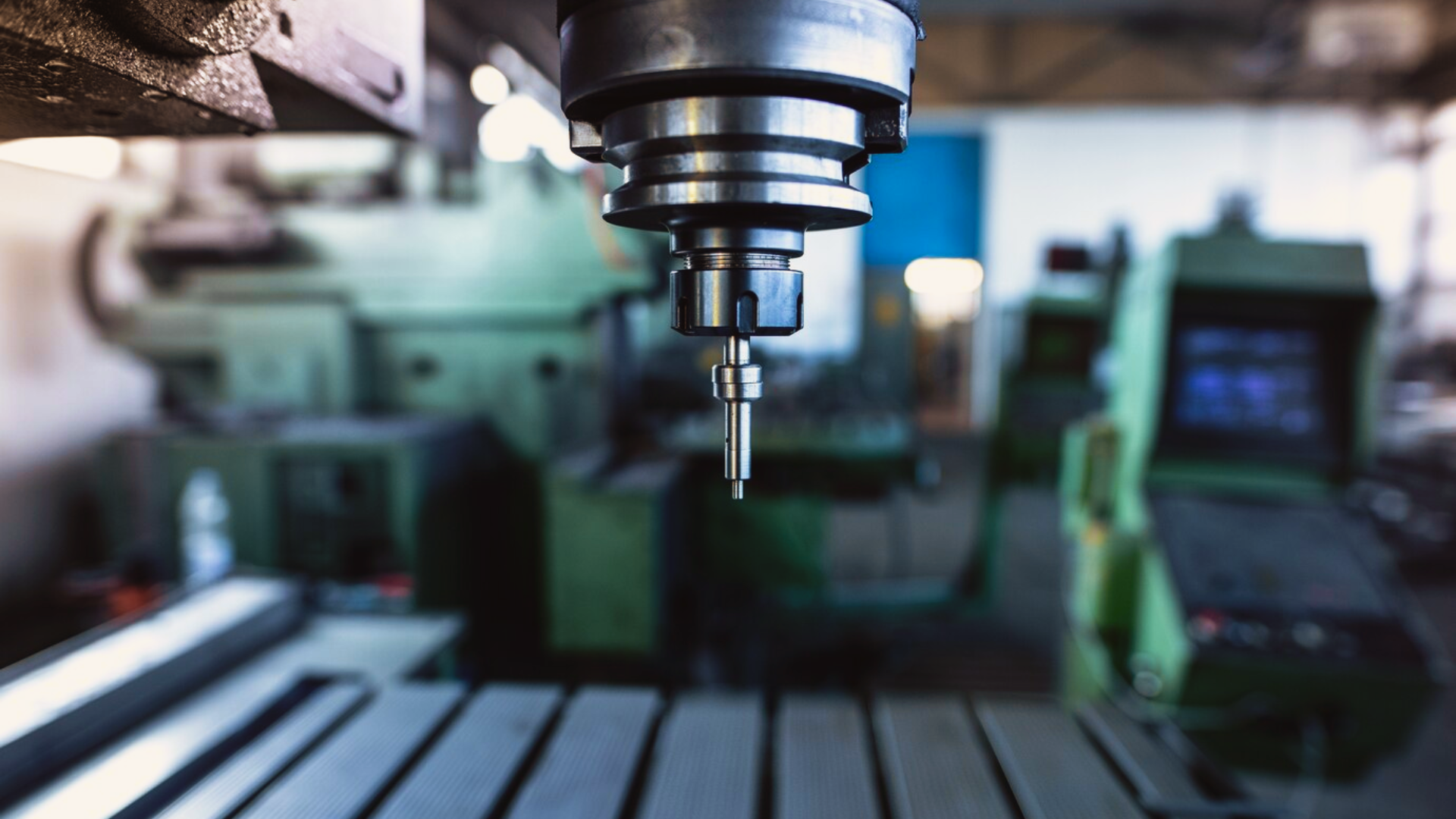

- Machinery loans

- Gold loans

- Home loans

- Vehicle loans

- Term loans (equipment or other high-value assets are pledged)

What is an Unsecured Business Loan?

Unlike secured loans, unsecured business loans are offered without collateral. The lender relies on the borrower’s creditworthiness, financial history, and business performance to receive the loan amount. Since no assets are pledged, unsecured loans come with a higher risk for the lender, resulting in higher interest rates and smaller loan amounts than secured loans.

Examples of Unsecured Loans

There are fewer types of unsecured loans. Some unsecured loans are:

- Business credit cards or personal credit cards

- Lines of credit

- Personal loans

- Student loans

What is Collateral?

Collateral is any asset that a borrower pledges to the lender in exchange for a loan. Collateral reduces risk for the lender, allowing them to offer more favourable loan terms. Should the borrower default on their loan, the lender can seize the collateral to cover any outstanding debt.

Examples of Collateral

Examples of collateral include

- Real estate

- Machinery

- Inventory

For secured loans, the value of these assets is critical, as they help determine the borrowing limits and loan terms. Business owners need to understand the implications of pledging assets, especially when dealing with high-value collateral.

The Difference Between Secured and Unsecured Loans

| Feature | Secured Loans | Unsecured Loans |

| Collateral Requirement | YES Property or equipment | NO Not required |

| Risk for Lender | LOW Lower risk due to pledged assets | HIGH Higher risk for lenders due to no collateral |

| Interest Rates | LOWER | HIGHER |

| Loan Amounts | HIGH | LOW |

| Eligibility Criteria | Lenient criteria Accessible even with lower credit scores | Strict criteria Requires a strong credit score |

| Approval Process | May take longer due to asset valuation and verification | Generally faster due to fewer requirements |

| Risk for Borrower | Risk of losing pledged assets in case of default | No asset loss risk. Higher repayments in case of default |

| Ideal For | Businesses with substantial assets needing long-term financing | Businesses without significant assets needing quick funds |

| Best Use Cases | Large capital expenses, business expansion | Covering operational expenses, short-term cash flow needs |

Choosing Between Secured and Unsecured Business Loans

Choosing between a secured and unsecured loan is primarily a question of the availability of assets and the ROI of the business. However, several factors influence the decision. One must consider:

- The business’s financial health

- The purpose of the loan

- Risk tolerance

A secured loan may be best for a business with sufficient assets, as it offers low interest rates and better loan amounts.

Conversely, an unsecured loan is suitable for businesses that lack assets or need faster access to funds without risking their property. This type of loan may be preferable for managing operational expenses or bridging cash flow gaps. For some, unsecured options provide a practical way to support business growth without the collateral requirement.

Steps to Avail a Secured or Unsecured Loan

Applying for any of the two loans could be complex, considering the stringent criteria, documentation requirements, etc. We’ve simplified the steps for you here:

Assess the type of loan that suits your business needs and research various lenders. For secured loans, ensure you have collateral that meets the lender’s requirements. Next, gather the necessary documents. You might need:

- Business financials

- Tax returns

- Credit history details

- Proof of business vintage

For convenient unsecured loans from Electronica Finance Limited, you will need:

- Three years balance sheet and ITR reports

- Twelve months’ bank statements of all banks

- GST returns for the current year

- KYC – Aadhar and PAN

- Residence and factory ownership proof

- Twelve months’ electricity bills

Once the loan is approved, review the loan terms, including repayment terms and interest rates, to ensure they fit your cash flow and repayment capacity.

Selecting the right loan type can significantly impact a business’s financial health and growth potential. By understanding the distinctions between secured and unsecured loans, business owners can make financial decisions that align with their goals and optimise their chances of business success.

FAQs

What is the difference between a secured and unsecured business loan?

A secured business loan requires collateral, offers lower interest rates and provides higher loan amounts. An unsecured loan does not require collateral, leading to higher interest rates due to increased risk for the lender.

Which loan is better, secured or unsecured?

The choice depends on your business’s needs and risk tolerance. A secured loan offers better terms but involves asset risk, while an unsecured loan provides faster access to funds without collateral.

Is an unsecured loan better than a secured one?

An unsecured loan may be better for businesses needing quick access to funds or lacking significant assets. However, it generally comes with higher interest rates, which can impact cash flow.