Business loans are a great way to finance entrepreneurial ventures. But starting a new business is not the only reason you need business loans. As business loans are gaining popularity and becoming more accessible to everyone, more people are applying for them, with the reasons to get a business loan varying from starting a business, expanding business operations, or capitalising on the market. However, a business loan can serve many more purposes, and every borrower may need a business loan for different reasons.

Seven of the most common reasons to get a business loan are:

To Start a Business

The most common reason to get a business loan is to start a new business. Acquiring funding for a new business venture has been a throe on the side of entrepreneurs. More accessible business loans, however, have made it possible for them to realise their business dreams. And with the help of a solid business plan, the right team, determination and a lot of hard work, you can turn a business loan from a liability to an asset and fulfil your business vision.

To Expand a Business

Another common purpose of a business loan is business expansion. This can include expanding your existing space, branching out into a new location, diversifying your service offerings or venturing into a new market. A business loan can help you finance your expansion plans and make them a reality. Lenders offer different types of loans when it comes to business expansion, with competitive interest rates and flexible repayment terms. So, make sure you research all business expansion loan offerings well and choose the one that makes the most sense for your business.

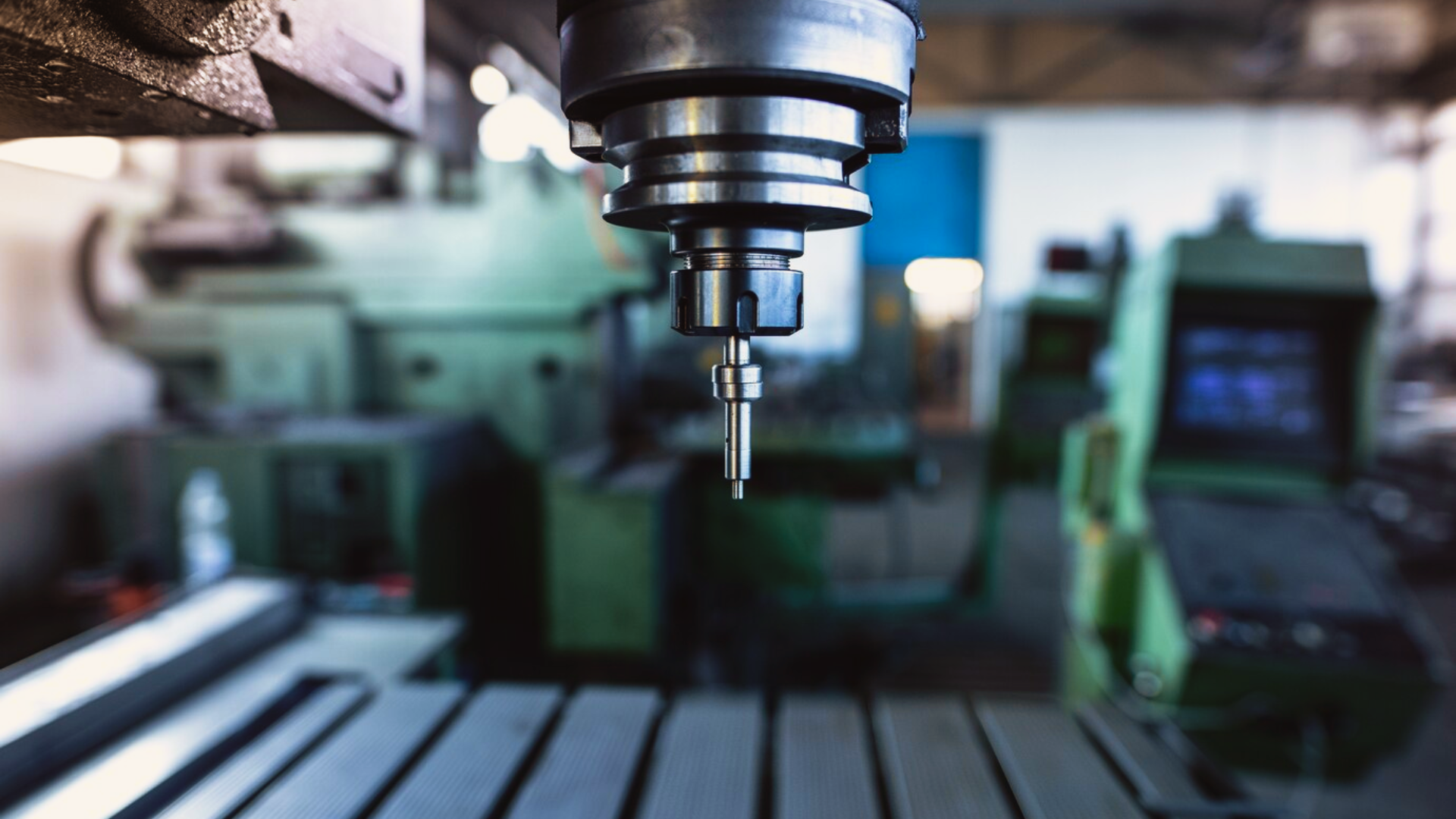

To Upgrade and Replace Equipment and Buy Inventory

Upkeep of the equipment and keeping sufficient inventory are two of the major business expenses and one of the common reasons companies take out business loans. This can include anything from replacing faulty equipment, upgrading outdated machinery, buying furniture and electronics for the office or keeping inventory to sell. You can structure this loan in a couple of ways. First is an asset-based loan, where the lender will hold the asset’s title until you pay back the loan in full. Second is an account receivable loan, where the lender will offer a percentage of the face value of the company’s outstanding invoices as a loan, and you need to pay back the loan as you receive payment for the invoices. Just keep in mind whether the equipment or inventory is worth the loan amount and whether you can afford the monthly payments to make sure you don’t lose money on loan.

To Pay Off Debt

Paying off previous debt is another common reason to get a business loan. With a business loan paying off debt, you can consolidate repayments into a single monthly payment – saving money on interest, getting a cash advance on credit cards or refinancing your mortgage to get lower monthly payments. But no matter what method you choose, you need to research the lenders to find the best interest rates and repayment terms. And be sure to read the fine print to understand all the fees for the loan before you sign.

To Finance a Business Acquisition

You can also use a business loan to leverage a lucrative business opportunity and acquire a business – purchasing equity or assets of another company. Debt financing is the most common way to finance a business acquisition, but you can also go for equity financing and sell shares in the acquired company to raise funds and cover the purchase cost. Business acquisitions are complex, but working with experienced loan officers can help you get favourable terms for your loan.

To Fund a Marketing Campaign

Marketing is an essential but expensive business function, and it can be difficult to find the money to fund marketing campaigns. Different methods of marketing your business have different reach and their own set of costs, which also depends on how you implement them. And choosing to go for a multi-channel marketing campaign can add up costs quickly. A business loan can cover a part – or the entirety – of your marketing budget, giving you the reach and access to customers you need to succeed.

To Cover Unexpected Expenses

As the name suggests, unexpected expenses can crop up at any time. Whether an emergency expense or an unprecedented spike in demand, you need funds to keep your business up and running. But taking a business loan for the entire amount may be unwise; you need to estimate how much funds you will need and how much you can afford to pay back. Also, be sure to research and compare different interest rates and repayment terms of different lenders to find the best deal.

Key Takeaways

There are many reasons you may need a business loan, from starting or expanding a business to covering unexpected expenses or funding a marketing campaign. And a business loan can be a great way to get some extra cash and keep your business running smoothly. If you research lenders to find the best interest and repayment terms and manage to make timely repayments, you can use business loans to finance your business needs, keep it running smoothly and grow.

With Electronica Finance Ltd, you can get easy, convenient and quick business loans with affordable interest rates and flexible repayment options. With options to get unsecured business loans or use your machines as collateral, you can get a business loan of up to INR 50 lakhs to build your business and boost your financial growth. EFL’s MSME business loans are an easy way to get instant cash – without selling your business assets – and keep your business operating smoothly.