What is a Hybrid Solar System? Is Hybrid Solar Power the Future of Power Backup for Commercial and Industrial Use?

From manufacturing units that can’t afford production downtime to commercial complexes managing sensitive data servers, power interruptions can translate into significant operational and financial losses. Traditional backup power, like diesel generators (DG sets), have long been the go-to option. But...

Choosing an Unsecured Business Loan? Avoid These Common Mistakes

For many small and mid-sized businesses in India, unsecured business loans are a lifeline. Whether it’s stocking up for a festive season, bridging cash flow gaps, or funding an expansion, these loans help businesses move forward without pledging property or...

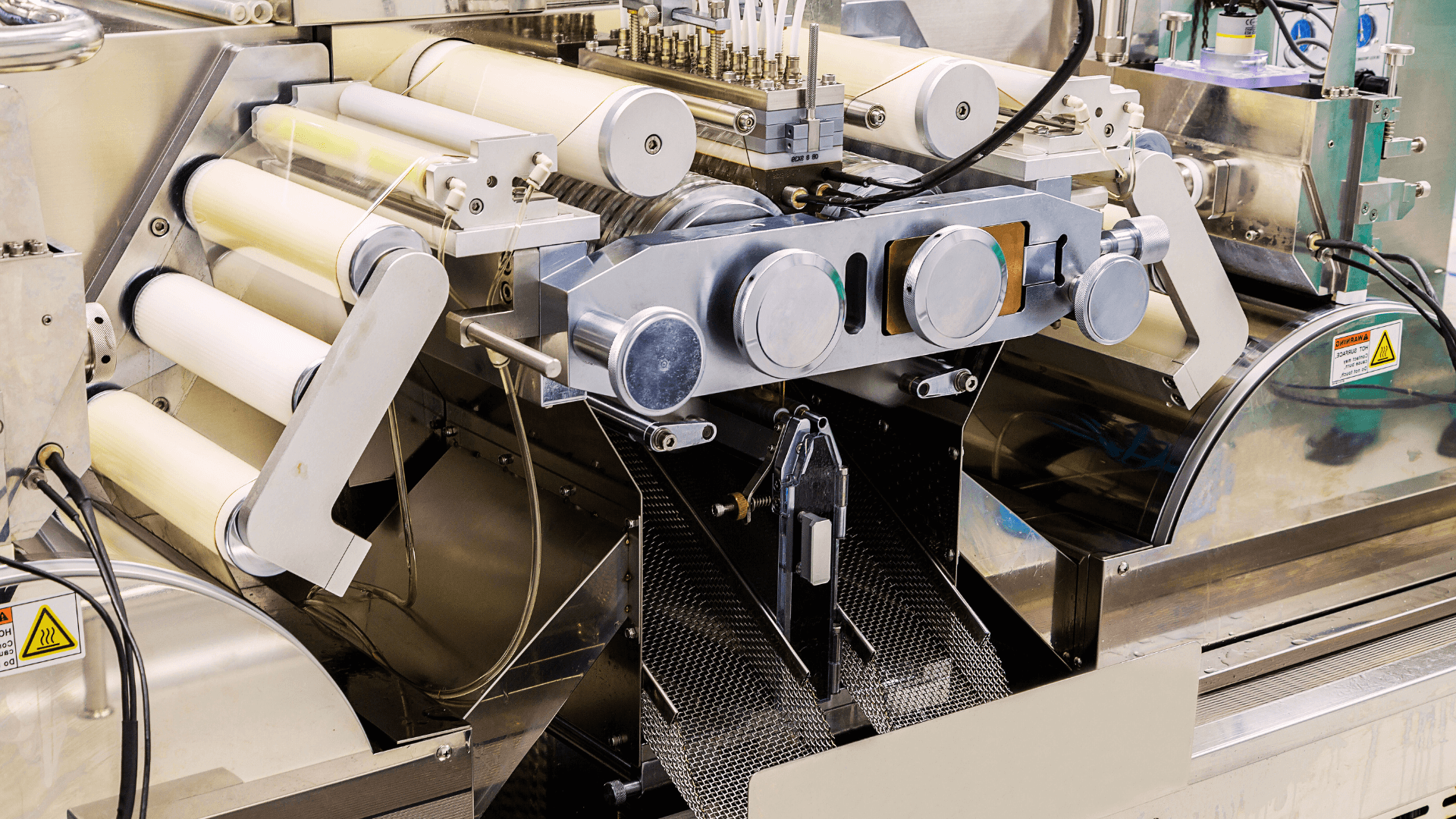

Know All About Fully Automatic Paper Bag Making Machines

The surge in demand for eco-friendly packaging has made paper bag manufacturing a fast-growing sector in India. Entrepreneurs, from small-scale operators to large commercial players, are exploring paper-bag-making as a sustainable business opportunity. And at the centre of it all...

Installation of Rooftop Solar Home Lighting Systems: A Complete Guide

Rooftop solar power solutions are now rapidly becoming common in India. The residential or commercial solar panel system is installed on the roof of a building to generate solar power. This system captures the sun’s energy through solar panels. The solar...

What are the Current Unsecured Business Loan Interest Rates?

Understanding unsecured business loan interest rates is essential for any business owner or entrepreneur looking to secure financing. Whether you’re a small business owner or managing a growing company, knowing what influences business loan interest rates can help you make...

Why Consider a Machinery Loan or an Equipment Loan for Your Business?

When a business grows, it often hits a point where manual processes or ageing equipment can no longer keep up with rising demand. Efficiency depends heavily on the quality of your machines. Yet, buying modern equipment outright is no small...

Why Choose Business Loans Against Property Over Collateral-Free Loans?

If you’re a business owner in India looking for a sizeable loan, you’ve likely come across two primary options: a Business Loan Against Property (BLAP) and an unsecured (collateral-free) business loan. Each serves a purpose, but they are not created...

How to Start a Corrugated Cardboard Box Business: How to Get a Loan for Corrugation Machinery?

Starting a corrugated cardboard box business is a lucrative venture due to the growing demand for packaging solutions across various industries. However, setting up a manufacturing unit requires significant investment, particularly for the machinery needed to produce quality corrugated boxes. ...

Pros and Cons of Unsecured Business Loans – Are They a Good Bet?

Access to finance is one of the biggest hurdles faced by small and medium-sized enterprises (SMEs) in India today. If you are looking to launch a new business or just trying to keep up with a growing order book, capital...

Rooftop Solar Loans for Small and Medium Enterprises: Challenges and Drivers

India’s rooftop solar segment is expanding rapidly, with government incentives, subsidies, and growing emphasis on sustainability. Small and medium enterprises (SMEs) benefit significantly from this shift. Rising energy costs and an unreliable grid power are pushing MSMEs to seek alternatives that offer...