Everything You Need to Know Before Financing and Installing Solar Panels at Home

Adopting solar energy for your home is a long-term investment in a greener, more sustainable future. As electricity costs continue to rise and the environmental impact of fossil fuels becomes more evident, homeowners are increasingly making the switch to solar....

Unlocking Value: All the Benefits of Taking Business Loans Against Used Machines

If you’re running a small business in India, you already know that growth hinges on cash flow to a large extent. You know that every asset holds a value that can be leveraged for cash flow. Besides the shiny new...

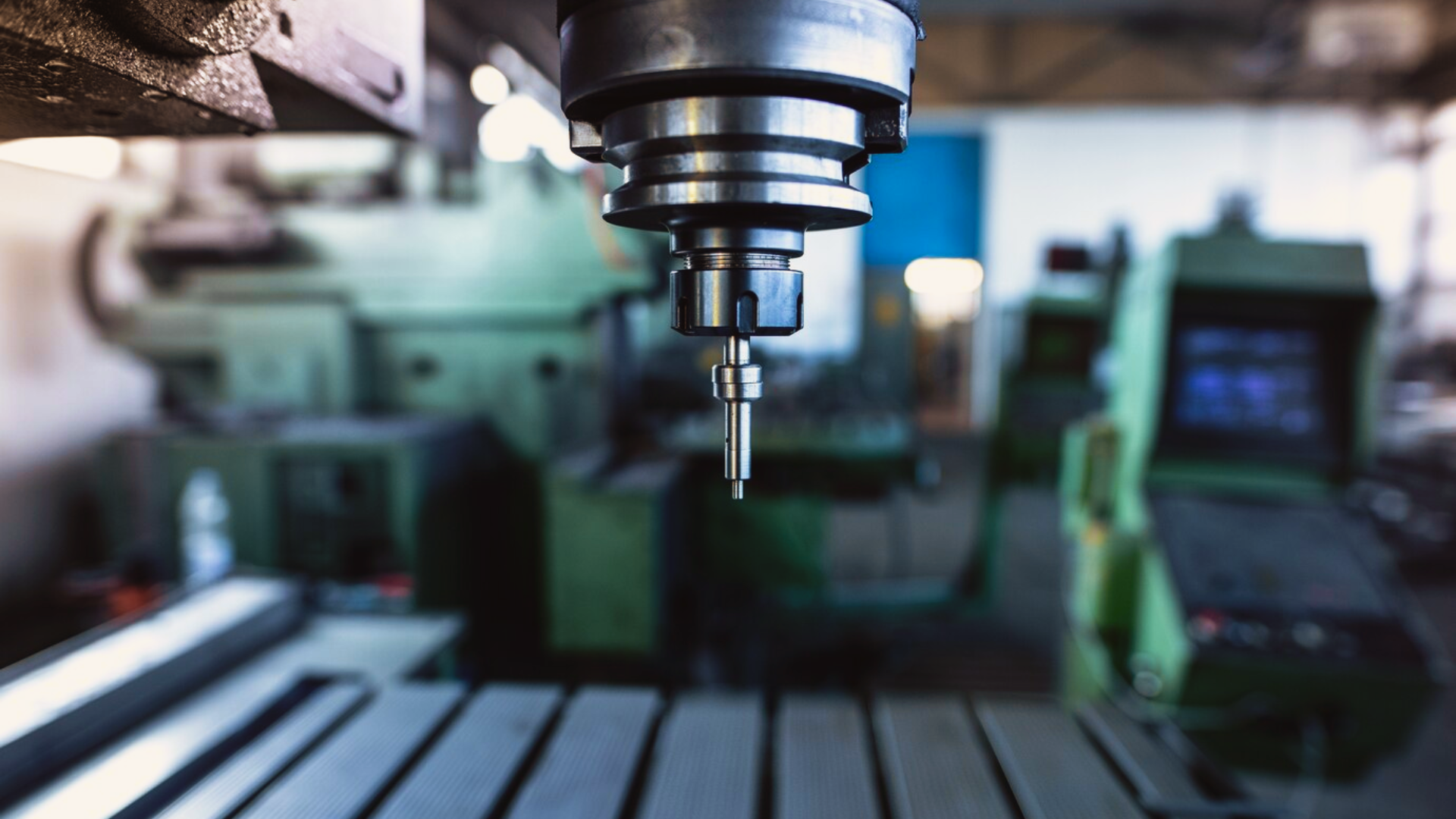

Is Investing in a CNC Business Profitable? Know the Benefits and Interest Rates for Loans for Machinery

The CNC (Computer Numerical Control) machining industry in India is experiencing rapid growth, driven by increasing demand for precision, automation, and efficiency across multiple sectors. Entrepreneurs looking to invest in this field can find many avenues to grow. However, starting...

Smart Solar Finance Options For Your Solar Energy Project in India

India has been witnessing a quiet but powerful energy revolution. As solar panels pop up across rooftops and farmlands alike, renewable energy has become an essential part of our power ecosystem. Whether you’re a homeowner looking to cut electricity bills,...

How Using a Business Loan Against Property Can Help You Expand Your Business

Expanding a business requires capital — whether it’s for upgrading infrastructure, purchasing new equipment, hiring staff, or expanding operations to new locations. While there are multiple financing options available, a Business Loan Against Property (BLAP) is a viable solution for business...

6 Common Mistakes Consumers Make When Installing Solar Panels for Solar Power

Investing in solar panels for your home is a smart move — both financially and environmentally. But before you start your rooftop solar journey and install a system, it’s crucial to understand some common mistakes that buyers often make. Overlooking...

How to Get a Higher Business Loan Against Property in India?

When you’re looking to secure a Business Loan Against Property (BLAP) in India, the loan amount you receive often depends on several factors. Many of these can be actively improved with some smart moves over a period. Are you planning to...

Frequently Asked Questions About Machinery Loans and Equipment Financing in India

When investing in your business, purchasing machinery is often a crucial step. Whether you run a manufacturing unit, a construction firm, or a small workshop, the right equipment can improve efficiency and boost output. However, machinery can be costly, and...

The Pros and Cons of a Machinery Loan: Availing a Business Loan Against Used Machinery

Having the right equipment can be the difference between smooth operations, profits, growth and missed opportunities. For many small business owners and startups in India, buying brand-new machinery isn’t always financially feasible — especially with increasing working capital and other...

How CNC Machine Financing Can Help Your Small Business

Computer Numerical Control (CNC) machinery enables precise and efficient automation of manufacturing operations. Purchasing CNC equipment can be a financial burden, particularly for small businesses with limited capital. CNC machine financing offers tailored solutions to facilitate the acquisition of high-quality machinery without...