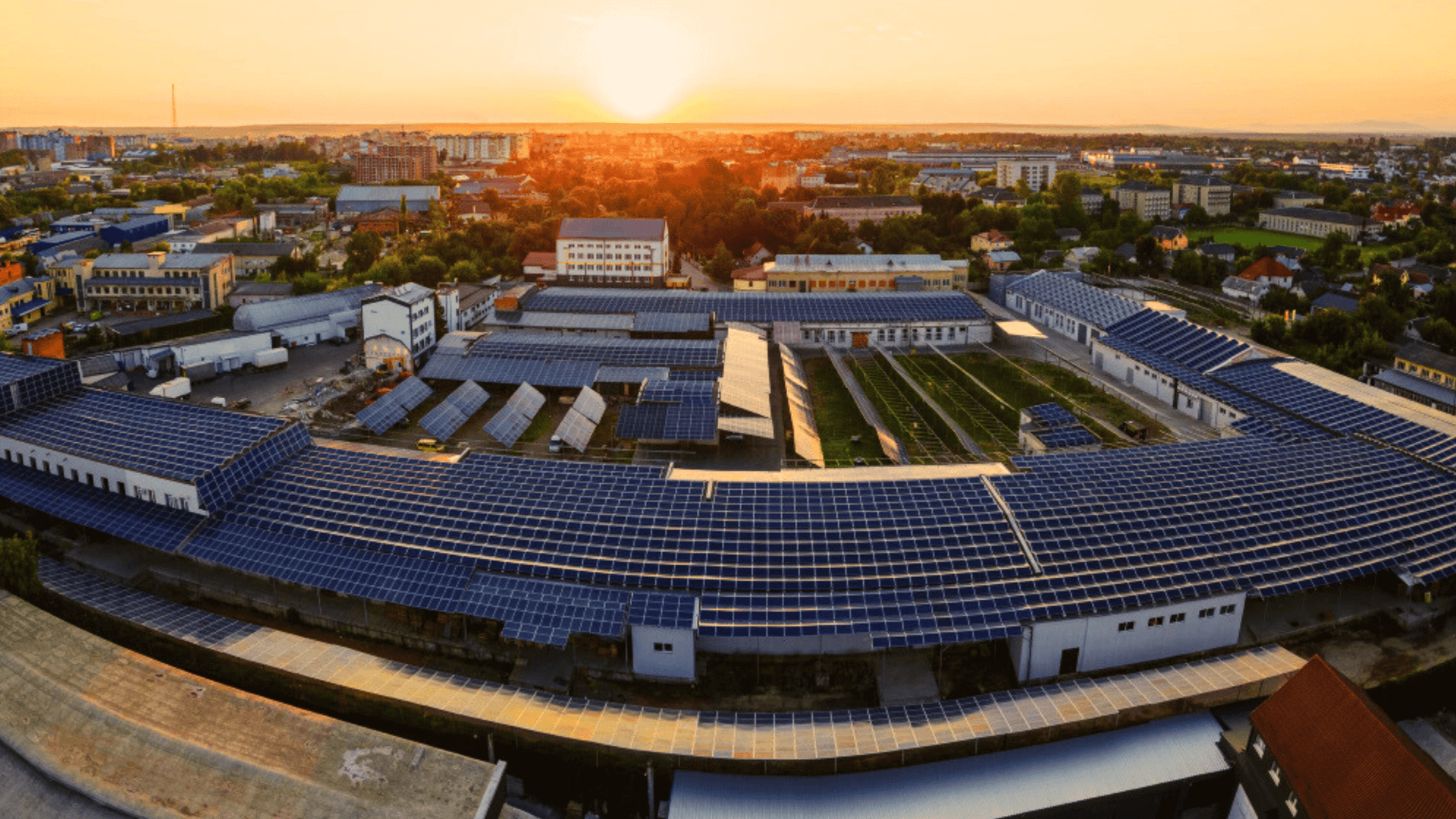

How East-Facing Roofs Impact Solar Returns and Rooftop Solar Financing

For many Indian homeowners and businesses, the decision to invest in rooftop solar begins with a simple question: “Will my roof actually generate enough returns to justify the cost?” Roof orientation ends up being the cause of hesitation, especially if...

Working Capital Funding Gap: How to Calculate and Address It

If your business is profitable on paper but constantly short of cash, you might not be in the wrong. This happens often. Many Indian businesses, especially growing MSMEs, find themselves stuck in a cycle where sales are increasing, orders are...

Why Upgrading to Modern Machinery Can Boost MSME Profits by 30% or More in India

Margins for MSMEs (Micro, Small, and Medium Enterprises) in India’s economic scenario are under constant pressure. Input costs fluctuate, labour availability is uneven, and customers expect faster delivery in every sector without paying more. In this market environment, growth doesn’t usually stall because demand disappears, it...

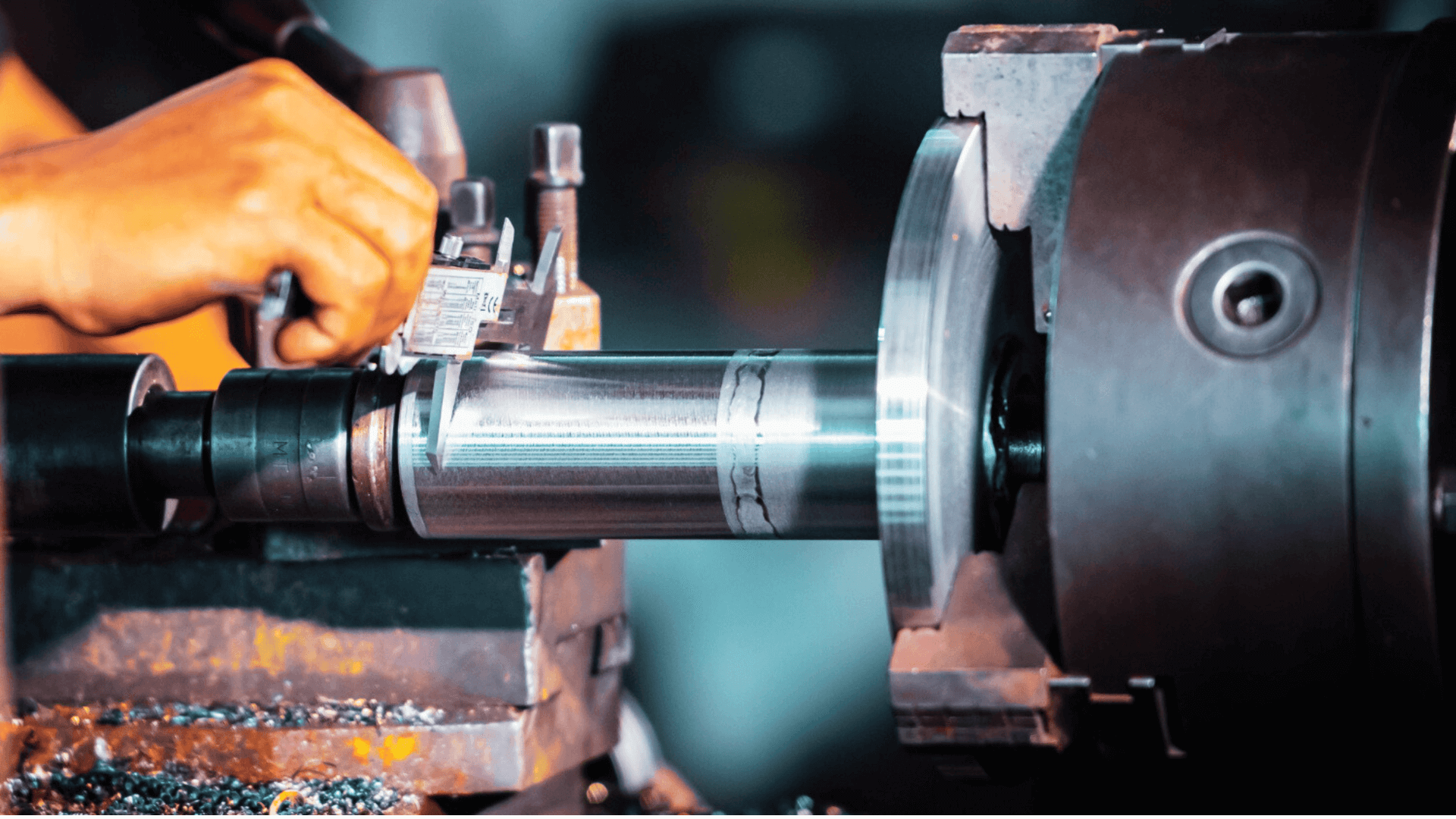

Machinery Loans for Manufacturing MSMEs to Upgrade Productivity

How Machinery Loans Can Boost Manufacturing Efficiency for MSMEs In today’s manufacturing landscape, efficiency is vital. It directly decides margins, delivery timelines, and how competitive a business can remain when input costs are rising and customers expect faster turnaround. Many manufacturers know their productivity...

First-Time Machine Buyer? Discover Loan Options You Can Apply for Today

Key Takeaways First-Time Machine Buyer? Discover Loan Options You Can Apply for Today Purchasing your first machine is a significant investment decision for any business. However, high upfront costs and limited access to funds often make financing essential. A well-structured machinery...

From Payroll to Inventory: Top Uses of Working Capital Loans for Small Businesses

Key Takeaways From Payroll to Inventory: Top Uses of Working Capital Loans for Small Businesses For many small businesses, a working capital loan plays a critical role in managing everyday cash flow challenges. Delayed customer payments, unpaid invoices, seasonal sales...

Clean Energy With National Portal for Rooftop Solar in India: Features, Benefits and How it Works

India’s shift towards clean energy has become a common discussion. With rising electricity bills, increasing awareness of renewable energy, and government-backed incentives for rooftop solar, more families and businesses are actively looking for ways to adopt solar power. But until recently,...

Tired of Heavy Paperwork for Loans? Get Fast Business Loans Without Collateral in India

Securing funding for your business in India can be a time-consuming and frustrating process. Traditional loan applications often need extensive documentation, from proof of income to credit history, which can delay your ability to access much-needed capital. For small businesses, entrepreneurs, or...

Facing a Cash Crunch? A BusinessLoan Against Property Can Help

Business needs are soaring every day, requiring an increased capacity to scale up in a short time and deliver better products and services. However, the financial backing to keep up the continuous business expansion and growth is not always readily available. In...